State seizure of private wealth in the UK is something I expect we’ll see a lot more of in coming years. The recently launched unexplained wealth orders (UWOs), which permits the National Crime Agency to seize your assets if it’s not satisfied with your explanation for how you got them, are the thin end of a very large wedge.

And it’s not just here in Blighty. Only this morning, Nickolai Hubble turned from his desk, a massive grin on his face, to tell me how the Italian government is proposing a tax on the contents of safety deposit boxes, be there cash or valuables inside. Wealth that is “substantially hidden” is the target of Italian Deputy PM Matteo Salvini (substantially hidden, mind – perhaps the deeper Italians bury their safes underground, the higher the tax rate they’ll pay if they’re discovered).

But the threat of wealth confiscation hasn’t trickled broadly into Western public consciousness yet. Only the very vigilant in this country among us – those our American cousins might call “wingnuts” – are actively preparing for such a scenario.

To see what it looks like when financial authoritarianism is more overt, you need to look further east. As Eoin Treacy told me recently, “When we think of buying and selling assets, we know that we don’t really have the money until it’s in our bank account… but for Chinese people, you don’t really have the money until you’ve got it out of the country.”

The threat that the government may confiscate your wealth at a moment’s notice creates interesting changes in behaviour that lead to even more interesting news stories.

From The Toronto Sun:

The majority owner of a Point Grey mansion that was sold earlier this year by Canaccord founder Peter Brown for a record $31.1 million is a “student,” property records show.

Land title documents list Tian Yu Zhou as having a 99-per-cent interest in the five-bedroom, eight-bathroom, 14,600 square-foot mansion on a 1.7-acre lot at 4833 Belmont Avenue…

Capital flight from China has been a hell of a drug for developed property markets, especially in Australia and Canada, where an estimated £4.16 billion flow of Chinese cash hit Vancouver alone last year, raising property prices at least 5%.

But it’s not just property that gains from this wealth outflow, but rare gems, art and supercars and bitcoin. What suffers is the Chinese yuan, and as the yuan depreciates in value, it spurs ever more capital flight from Chinese citizens looking to protect their wealth in a vicious loop.

This pressure comes on top of the pressure for the Chinese government to devalue its currency, and remain competitive in the face of US tariffs. The yuan, or CNY, is now close to “cracking 7”, or being valued at 7 yuan per dollar, a key psychological level last seen in 2008. While the yuan is pegged to a basket of different currencies (a quasi-USD standard), it’s allowed to move within a certain range set by the People’s Bank of China (PBoC) each morning – a range which now allows the yuan to crack 7 without intervention.

The yuan is allowed to trade in Hong Kong without being bound within the daily range – this is known as “offshore yuan”, or CNH. A difference in value between onshore and offshore yuan generally illustrates friction between the agenda of the central planners at the PBoC and the opinion of market participants on the underlying value of the currency.

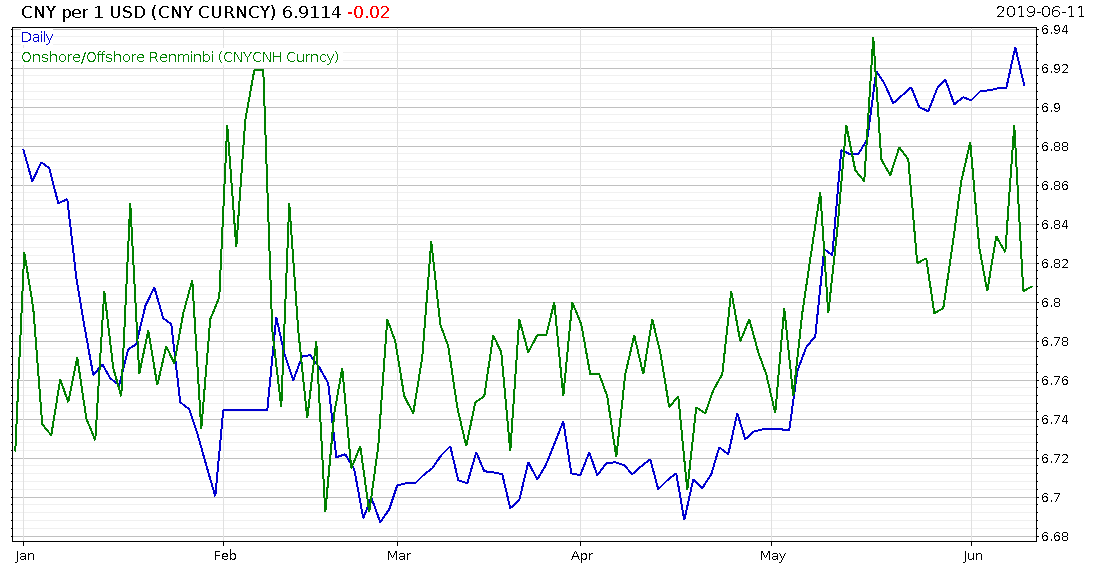

Since the beginning of the year, as the yuan has devalued, that difference has spiked up:

Onshore yuan close to “cracking 7” in blue. A rising difference between onshore and offshore yuan in green

Onshore yuan close to “cracking 7” in blue. A rising difference between onshore and offshore yuan in green

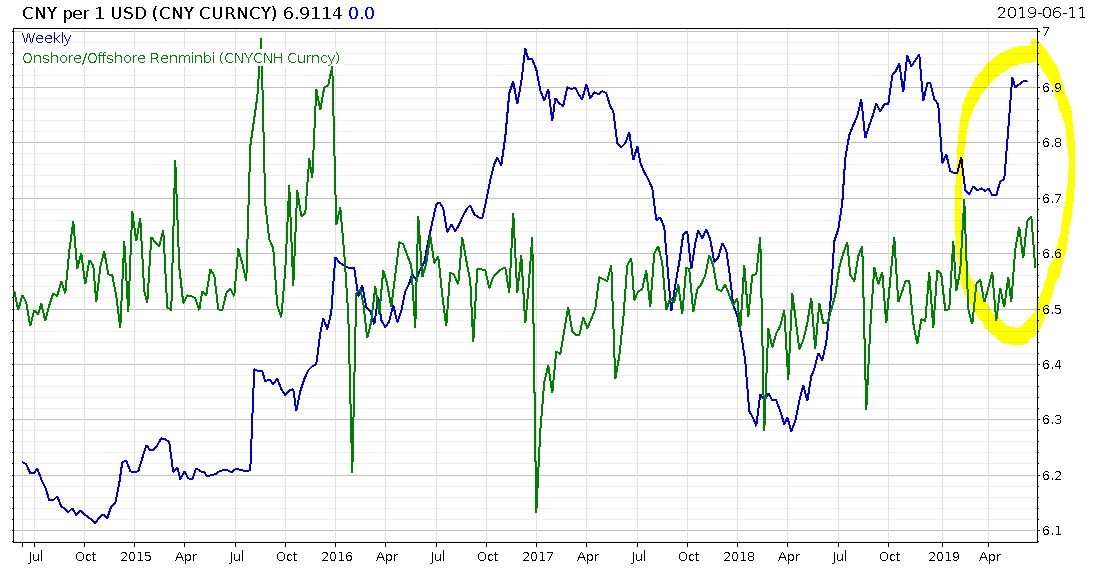

Zoom out a few years, and this looks a little insignificant:

But if the yuan does indeed crack 7, it will signal further devaluations to come (which means China will begin exporting deflation, a scenario beyond the scope of today’s letter), and will spur even more capital flight; more wealth “falling though the cracks” into foreign assets.

A tried and tested pipeline for wealthy Chinese to transfer their wealth out of the country (a “crack pipe”, if you will) is bitcoin. And while I expect the next crypto boom may need to wait until central banks start cutting rates and expanding their balance sheets again, Chinese capital flight may well get it started earlier. And the consequences are not to be underestimated – just ask first-time buyers in Vancouver.

Until next time,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates