We continue on from yesterday’s letter on why I believe gold has a bright future.

In yesterday’s letter, we detailed what real interest rates are, and how falling and negative real interest rates push the gold price up like a seesaw.

Here in the UK, we are already living with negative real interest rates, but I believe they have much further to fall. This is not an especially happy future; it is one of gross financial repression, where savers are no longer simply flogged by the financial system as they are today, but keelhauled.

As mentioned yesterday, for real interest rates to fall, either 1) inflation can rise 2) interest rates can fall, or 3) both.

In today’s letter I’d like to focus on the interest rate side.

Lower for longer

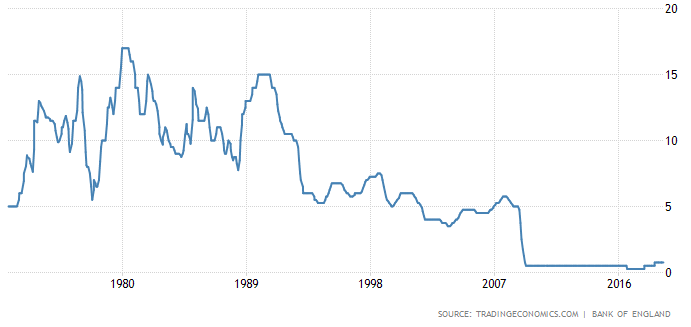

As you will have realised, interest rates at your local bank are still nowhere near they used to be. More than a decade after the financial crisis, central bankers are still scraping the interest-rate barrel. Here in the UK…

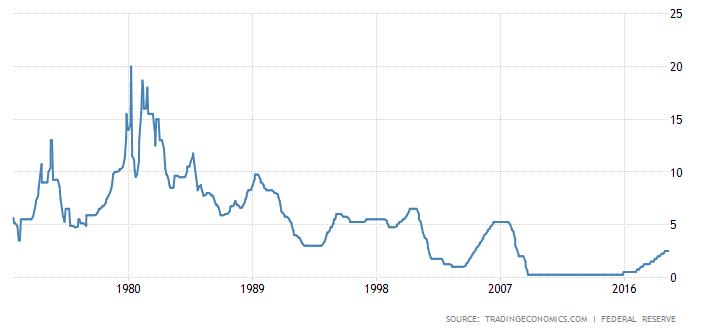

Across the pond…

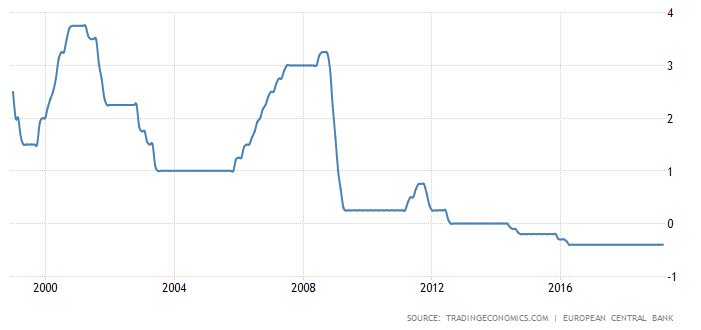

And even more farcical in Europe, where the European Central Bank (ECB) still has interest rates negative…

What is being illustrated here is the short-term interest rate offered at central banks. Inflation collapsed following the crisis, but central banks cut rates so low that real interest rates went negative. This caused gold to jump even higher, having already been kicked upward by the fear of total collapse.

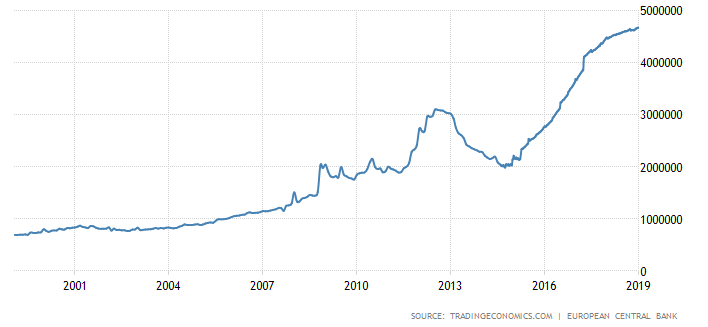

But that wasn’t enough in their attempt to “stimulate” growth. Central banks did not only attempt to influence short-term rates, but long-term interest rates as well through policies of “quantitative easing”, or QE.

By printing money to buy assets (mostly government debt) by the billion, they crowded out the returns that could be earned from such assets, in an attempt to force investors to take more risk. By lowering the returns on government debt, they lowered real interest rates. Inflation didn’t move nearly high enough to offset their largesse, and so real interest rates went ever more deeply downward.

The ECB only stopped buying assets in December 2018. Super Mario Draghi was already speaking about resuming printing more money less than three months later. It hiked rates once after the credit crisis, in 2011, before Greece showed up and Mario rammed them negative.

The ECB’s balance sheet, in millions of euros

The ECB’s balance sheet, in millions of euros

The UK is little better. The Bank of England has hiked rates twice since the crisis, and one of those was just to undo the rate-cut straight after Brexit.

The US is the best of the bunch, having hiked rates several times since Jerome Powell became chair. But as the chart before shows, rates are anything but “normalised”.

And time until the next downturn is ticking. It is waiting in the wings, and will inevitably arrive at some point. The growing weight of debt grows ever heavier on the shoulders of developed and emerging economies, and threatens deflation.

If deflation arrives, central bankers, mandated to keep inflation away and with little in the way of interest rates to cut, will need to get imaginative.

They could take the ECB’s lead and start pulling rates ever more deeply negative. This would no doubt be good for gold, as real interest rates would fall sharply, and if banks start charging people for holding their money, gold will become an ever more obvious option for the public to preserve their money.

What is likely is that we see an ever larger QE programme, where central banks buy trillions more in assets to force investors further into risk. It’s more than ten years since QE began, and with deflation still a threat, it’s hard to say that QE has been at all successful in doing anything other than bleeding savers to benefit asset holders. But that certainly doesn’t mean they won’t double down and just try it again: “the beatings will continue, until morale improves”.

What will be different this time is that central banks are changing their targets to allow more inflation. One such example is the potential adoption of “nominal GDP targeting”. What this means is that central banks no longer focus on maintaining low inflation (at 2%, for example) and instead target a certain amount of economic growth without adjusting for price increases caused by their stimulus.

They could keep their foot on the accelerator for as long as it takes for economic growth to be generated, even if that means inflation rides higher. In theory, all of that economic growth could be a product of inflation, and the central bank would still be meeting its target.

Another “trial balloon” being floated by central bankers (especially at the Federal Reserve) at the moment is a “make-up” strategy. This has nothing to do with cosmetics, and is instead more to do with inspiring a feeling of impending inflation to the public.

The way it works is the bank keeps its inflation target but tries to “make up” for previous years where it has not been able to create 2% inflation. This is done by ramming more stimulus down the throat of financial markets in the form of low rates and QE, in order to make up for inflation that “should have” occurred in previous years.

One of the intended effects of this is to make the public and companies believe a large wave of inflation is coming during periods of low inflation. They would then behave as though there was higher inflation currently, and create a higher inflationary environment – “fake it until you make it”.

Should these policies be successful, they would be very positive for gold, as interest rates would be pinned down by QE and low rates, while inflation would increase – the very definition of negative real interest rates. The purchasing power of cash in the bank? Not so much.

We’ll be back with part III of this series later in the week. Nick O’Connor will be in touch tomorrow.

Until then,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates