When you’re stuck indoors all day, the imagination wanders more than usual. We rerun old memories like a cabinet of dusty video cassettes, taking respite in reveries of better times.

Come with me, and remember back to this, four years ago…

Déjà vu

It’s 4 July 2016.

In Aberdeen, it’s a sunny Tuesday with only a sprinkle of rain. The golden rays make the silver granite buildings glitter.

The word “corona” still refers to lager. Nobody can tell you what a “Covid” is. And the thought of our country in lockdown resides only in the imaginations of those who refuse to accept the result of the Brexit referendum less than a fortnight ago. Fittingly, it’s the 240th anniversary of when some independent-minded colonists in the Americas decided to crash out of the British Empire without a deal…

After seven years of delays, the Chilcot report is finally on the eve of publication. Over the pond, Hillary Clinton, running for president, is about to be chastised but let off the hook by the FBI for letting anyone and their dog access her emails while she was secretary of state.

And “The Halvening” is almost upon us.

In five days’ time, the supply of freshly minted bitcoin will be cut in half, an automated process built into its programming to make it automatically harder to obtain as time goes on. The quantity of bitcoin which miners are rewarded with for processing a block of transactions will be permanently cut from 25 BTC, to 12.5 BTC. There’s never been more awareness for bitcoin than there is now, and the event, totally unique to this asset, is hotly anticipated by ever more observers.

The bitcoin price is £540.

What do you do?

Back to the future

We break our reverie, and return to the present, faced with a repeat of the same scenario.

Once again, in five days’ time, the supply of bitcoin will be permanently halved, this time from 12.5 BTC to 6.25 BTC. Once again, there has never been more awareness for this event, which is totally unique to the digital asset space. Our own Sam Volkering is hosting a special event for it, celebrating all things crypto and the digital revolution it promises, early next week – keep an eye out for your invite.

With bitcoin now over seven grand a coin, it was of course a great time to buy right before the last halvening.

… but the last halvening didn’t occur in the middle of a pandemic panic and vast swathes of the global economy being shut down. What happens on Tuesday is a real trial by fire for how bitcoin will behave under pressure.

Let’s take a look under the bonnet at what’s been going on within the network, the digital ecosystem referred to as the blockchain.

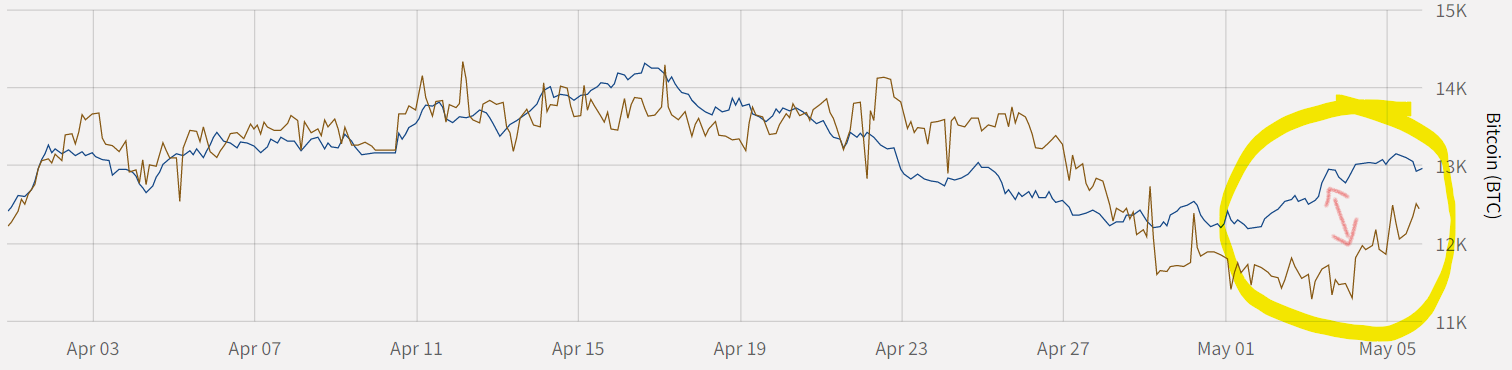

The price has ramped up significantly this week, very likely in anticipation to the news. There was a very large series of transactions totalling over a billion pounds that took place a week ago at 8pm:

BTC price in dollars in green and red. Blue bars coming up from the bottom are bitcoin transactions taking place within the bitcoin network, measured in dollars at the prevailing exchange rate.

BTC price in dollars in green and red. Blue bars coming up from the bottom are bitcoin transactions taking place within the bitcoin network, measured in dollars at the prevailing exchange rate.

Source: ByteTree

The miners have interestingly begun hoarding more of their bitcoin, also likely in anticipation the halvening coming up. You can see this in the difference between the amount of bitcoin that has been mined (blue line) and the amount of bitcoin that they have then spent (tan line).

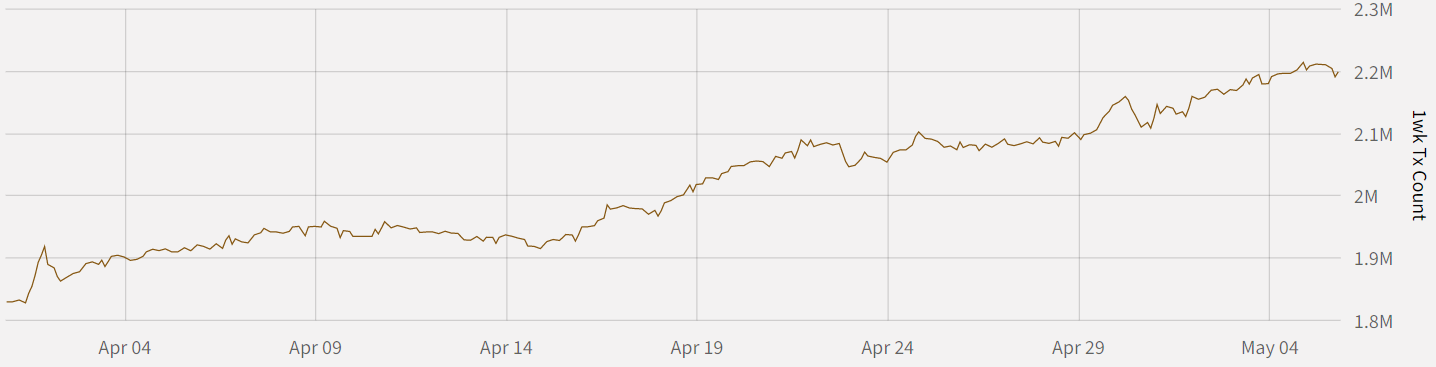

While the miners have been distributing less of the BTC they earn, the amount of traffic on the network has increased. More bitcoin transactions are taking place – over 2.2 million on a rolling weekly basis:

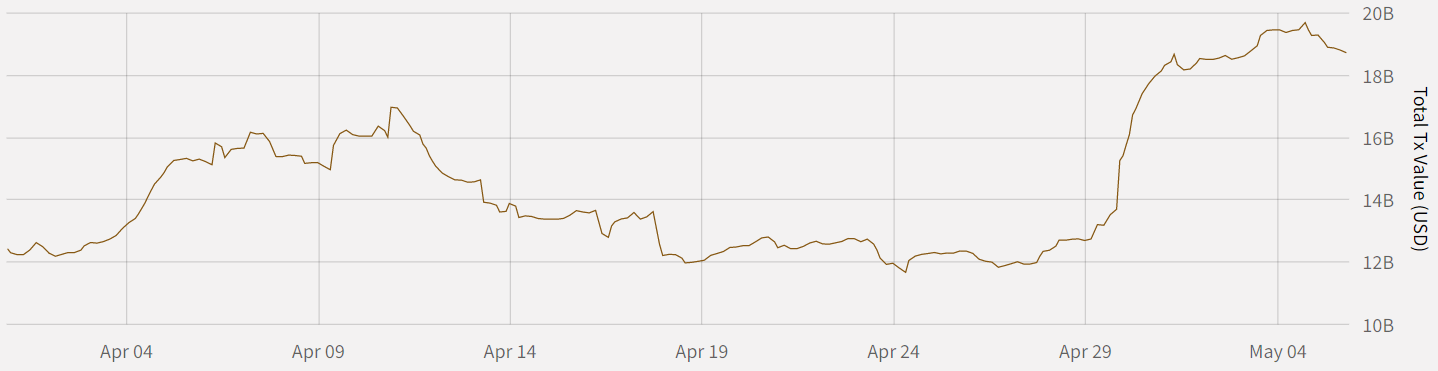

And the average value in fiat terms is also on the up. It’s possible that bitcoiners transacting only in BTC between themselves are not paying attention to its fiat value and this is just a result of the fiat price of BTC going up, but this is somewhat unlikely.

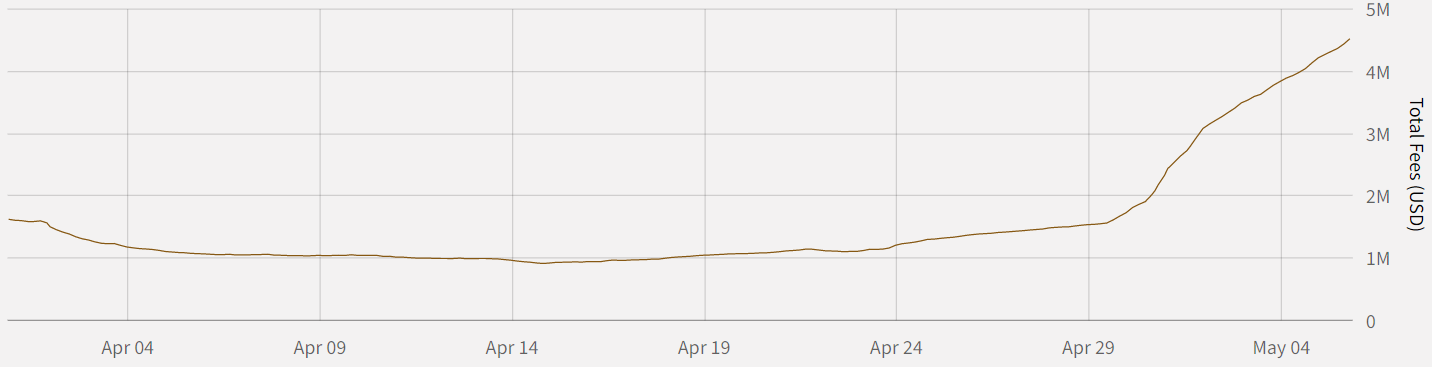

As a result, miners are earning more fees for processing all these transactions. On a rolling weekly basis, we’re looking at almost £3.7 million worth in fees earned by the miners, not counting the newly minted bitcoin they take as a reward:

Eventually, once the entire supply of 21 million BTC has been mined, it’s these fees that are supposed to become the entire incentive for mining. But at the current rate, that’ll occur in over a century, so it’s not something anybody is worrying about.

The thing about bitcoin, as we’ll explore tomorrow, is that while the true believers want it to behave as an antifragile asset which behaves completely independently to traditional investment assets… it doesn’t. Or at least, it hasn’t so far.

Perhaps that shall change. Perhaps soon. But until now, it’s traded very tightly in line with a certain niche of the stockmarket. I believe we’re in the middle of a bear market rally here at the moment, which if the correlation holds, would mean a bad day to be a bitcoin holder, or “hodler” as the saying goes. But to add more confusion to the situation, the sector of the stockmarket bitcoin is closely correlated to… is the sector that’s poised to do very well out of the WuFlu lockdown..!

I’ll explain it all tomorrow, and let you make up your own mind on whether we’re due for the reverie of 2016 to repeat.

Until then,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised