So here we are, at the end of another wild week. Another weekend in lockdown beckons… though according to Spotify ($SPOT), it’s earning money like it’s the weekend every day of the week. More than 30% more folks are turning to the app to make “still life” more interesting.

All through lockdown, the weather here in London has been incredibly pleasant, with sunshine and blue skies arriving almost every day. But yesterday, we got some thunder and lightning, and it poured for hours. I welcome the change – anything to break the monotony. Thankfully, we also have plenty of numbers going up and down in the market to keep us entertained.

At the beginning of this week I mentioned the bumper array of earnings announcements from major companies – contaminated with WuFlu lockdown, that would be the star of the show this week. They didn’t disappoint – the stockmarket was split like a log between the winners and losers, with some downright grim consequences for investors, as we’ll come to.

Global conglomerate 3M($MMM), which has gained plenty of publicity due to its manufacture of safety equipment, cleaned house, beating earnings estimates, and the tech giants did relatively well out of it too. Google, the advertising agency disguised as a search engine on steroids, surprised the Street with how much money it’s making now that we’re gorging even more time in front of the ruddy glow of our screens.

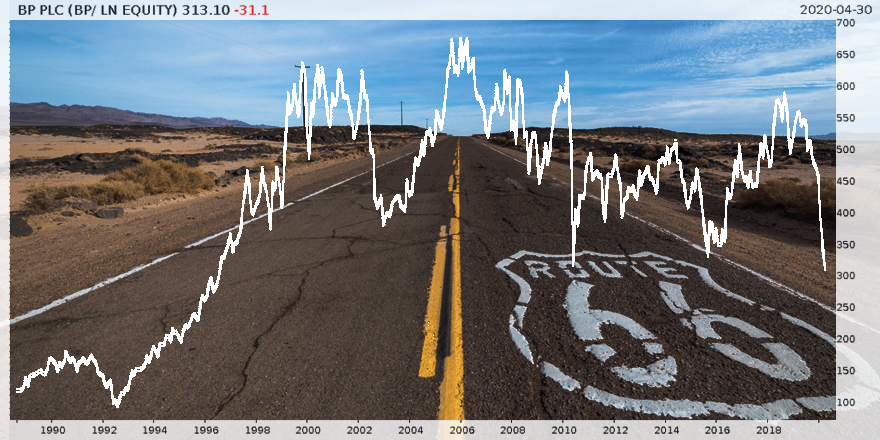

The oil sector was simply carnage. I’m writing this before Exxon ($XOM) reports, but just looking at companies closer to home it was a total bloodbath. $BP has just taken an incredible 66% drop in its earnings. The share last traded at this price back in the mid-90s…

BP dines on roadkill with a 66% earnings drop

BP dines on roadkill with a 66% earnings drop

Source: me, on Twitter

The chart for Shell doesn’t look much happier. While the hit to Shell’s earnings are not quite so severe, to give some context as to the gravity of the situation facing the company, it’s cutting its dividend for the first time since the Second World War. The oil business, previously so enduringly lucrative, is facing a reckoning. As the CEO said on the day the company announced earnings, “We do not expect a recovery in oil prices or demand for our products in the medium term”.

The International Energy Agency reckons global energy consumption for 2020 will be down by 6%. That may not sound like all that much, but it’s the equivalent of India’s energy demand, the world’s third largest, being abruptly deleted.

Big Oil getting whacked in this way is a big deal for the pension industry, where Shell has been the “old reliable” for decades, constantly providing cash to allow schemes to keep paying those in retirement, while income from the bond market dried up.

Pension funds will need to get creative. But bear in mind that getting creative generally means taking more risk. One such strategy to earn income, “volatility selling”, whereby a pension fund sells insurance against volatility in an asset market and pockets the premiums as income, has come violently unwound in March. The Alberta government pension fund, already drained of contributions by the WuFlu lockdown, and then by the brutal collapse of its oil sector (a possibly existential blow), then went and lost $4 billion of its $110 billion it manages following this strategy just in March…

We’ll explore how the lockdown is cooking the pension industry more next week. For now, a reader working in the oil and gas industry wrote in a very interesting email to myself and my colleagues James Allen and Kit Winder regarding the future of the industry, which I thought I would share with you. He also sent in a chart, which I’ve taken the liberty of altering somewhat:

I’ve recently enjoyed listening to your broadcasts and especially the current End of Oil series. I’ve been involved with the O & G industry (mainly downstream) for over 30 years and so have a keen interest into where it’s going.

I’d like to pick up on your views today regarding oil services companies and their demise in parallel with the oil industry. In my opinion not all the service companies will just pack up and retire. Many of these are forward looking companies with the skills and technology that can be (and are) migrating to the alternative energy boom. We will need companies that can design, construct, erect and maintain facilities such as: Hydrogen, biomass, wind farms etc. These same companies are currently involved with Oil & Gas – I am contracted to one such company whose main income is from refining projects. We are actively looking for opportunities for where we can fit within the Hydrogen distribution and storage in the UK. The chemical sector is also going to benefit from the Green technology boom – such as Johnson Matthey with their new battery storage technology. Again this and industry we can easily migrate to – Pipes, vessels, tanks, pumps etc.

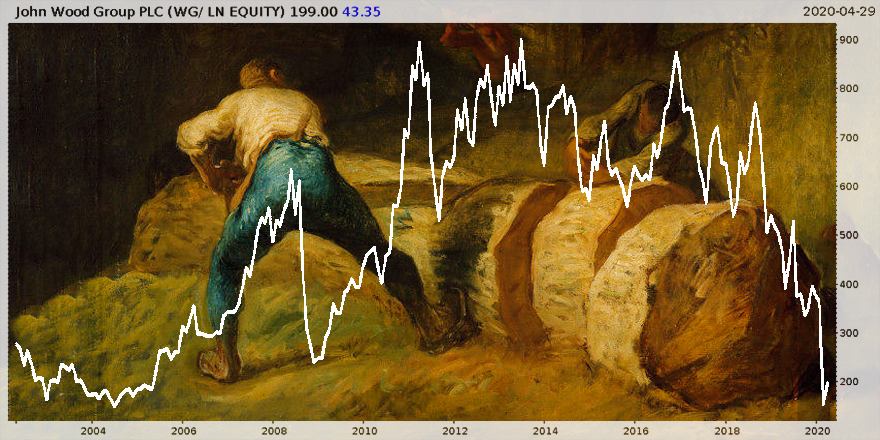

As with most FTSE companies many large O & G service companies nose dived one March 20th. Take Wood Group for instance, the Aberdeen company Boaz will be familiar with, they had been riding above 500p per share for the last 10 years at times over 800p. They dived to a low of around 100p on ‘Black Swan day’ and have managed to drag themselves to the current 170ish. This is a company that has their eye, and is actively involved with the whole energy industry -conventional and alternative. As with other large O & G service providers these are companies the renewable utilities will turn to for the EPCM of their greener projects. The temporary share price of Wood Group will return – probably not to the levels of 2013 but I’d bet next year they’ll be around 300 or so (which is why I’ve added them to my portfolio!).

I’m one of the hundreds of thousands in the engineering and construction industry that have a personal, professional and financial stake in the O & G industry. Our skills and experience can migrate to the green energy revolution and we are more than keen to be part of it. In my view the numbers in terms of workforce to build the green energy plants won’t match the ones required to create the O & G industry, I do however think many of the current O & G providers and people with them will form a big part of it, so don’t write us off yet!

I am indeed familiar with Wood Group – an organisation very thickly entwined within the Aberdonian economy. Though looking at the share right now, it’d probably be better calling it “Timber”:

Chopping Wood. The share hit an all-time low earlier this year, though it’s obscured on the chart as I’ve zoomed out to show the monthly pricing.

Chopping Wood. The share hit an all-time low earlier this year, though it’s obscured on the chart as I’ve zoomed out to show the monthly pricing.

Source: me, on Twitter

A bold move to buy it now, but you make a strong argument and I applaud your conviction. Personally, I don’t think the oil industry is completely finished by any stretch – the world’s need for hydrocarbons is anything but extinguished – there’s just a gigantic supply glut of them right now.

This will be a very trying time, especially in areas like Aberdeen, until there is something of a recovery. I wonder if the shutdowns and bankruptcies we’re witnessing now are going to lead to sudden and massive price rises in the future for the likes of oil, when demand comes roaring back online, but all of the supply chain has gone to rot.

Perhaps in the meantime we will see a migration to the green infrastructure by the “supermajors” like Shell. And of course, there’ll be plenty of activity around the young renewables companies, which are seeing huge support from politicos, not just investors

I remember an oilman at my favourite pub in Aberdeen telling me he thought the city would become a capital of sorts for renewable energy in the future as all of the corporate infrastructure has already been built there, and all of the same oil companies will end up in the renewables business anyway. I was pretty sceptical of the idea at the time, but let’s see. After all, negative oil prices would have seemed pretty ridiculous just a few weeks ago…

Now, off to find something, anything, to do. Back on Monday!

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised