Cats and dogs litter the pavement. Their small fluffy bodies are contorted into unnatural positions, limp and lifeless.

A rumour went around that pets might be carriers for the coronavirus, and their owners threw them from their apartment windows high above the street.

Mistrusting the government to the point that you kill your own pets seems alien and repulsive here in Britain.

But mistrusting the government is an altogether different exercise in China.

It’s a land where everybody knows that everybody knows, that what the government says can’t always be relied upon – especially in a crisis. For the Chinese Communist Party (CCP), maintaining stability comes before safety, and by “stability”, I mean control.

When you add in a diabolical level of censorship that crushes any contrarian discussion or speculation on current events (forcing citizens to use Teletubbies and Winnie the Pooh characters in place of politicians’ names to avoid keyword filters online), the room for mistrust grows exponentially. Rumours spread like bushfires.

And that mistrust goes both ways. As Xi Jinping goes through the motions of being inspected for the virus in a propaganda video, the doctor in charge opts not to take his temperature from his forehead. The thermometer, a small gun shaped device, is pointed only at The Great Leader’s wrist instead – for security reasons, of course.

When you hear calls for increased government control over what you say and do on the internet, remember that strange spell of weather in China when it rained cats and dogs for real.

But enough of such grimness – how about some good news!

I’m delighted to tell you that the CCP has changed the rules as to what a “confirmed” case of the coronavirus is.

If you display no symptoms, you’re not confirmed on the official numbers as having the virus – even if you test positive for it. Or should I say, especially if you test positive for it.

So I’m happy to announce: the number of confirmed coronavirus cases in China has been going down!

Feel better yet? Just let that wave of relief wash over you…

The triumph of optimism?

The stock market has been rising continuously recently. This is quite strange.

– Transcript (translated) from a recent conference call at a Chinese securities firm

I anticipated a melt-up this year, but even I’m marvelling at how little the market has reacted to the coronavirus.

Just like the Chinese authorities, the market appears similarly reluctant to “confirm” its existence.

Even when articles like this are on the front page of Bloomberg. This is Mohamed El-Erian who accurately predicted the “new normal” we’ve grown accustomed to in the investment world (low rates, low growth) was here to stay as early as 2009 (he was also ranked world number 1 “influencer” on LinkedIn in 2016, if you’re into that kind of thing):

[the outbreak] involves critical interruptions to both demand and supply; it impacts both manufacturing and services; and it disrupts both internal and external trade…

… there is growing evidence of the cascading impact in the rest of the world. Here are just a few examples: Apple, Ikea and many others are shutting stores in China; Burberry reported a drop in sales of three-quarters or more there; Fiat-Chrysler warned that it may be forced to stop production at one of its European factories because of supply chain issues; many countries are halting flights to China and placing restrictions on people arriving from there; passengers are being quarantined on ships, including in Japan. The list goes on.

This type of cascading sudden-stop dynamics was last experienced on a large scale in 2008 during the global financial crisis…

We explored yesterday that the global equity market has barely stirred in reaction to the outbreak.

The market just doesn’t seem to care – or at least, not yet. But before we speculate why that might be, let’s see what has responded to the virus.

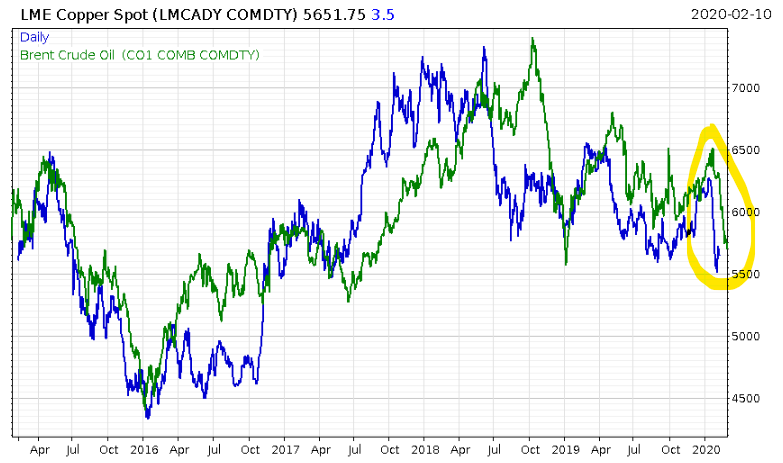

China is the emperor of commodities, guzzling more oil and copper than anybody else. The arrival of the virus and the anticipated slowdown has hit both…

Copper in blue, oil in green

Copper in blue, oil in green

Source: FullerTreacyMoney

… but as you can see, with a long time frame, the movement so far hasn’t been all that extreme.

What has been extreme is some of the activity that’s taken place in the real world.

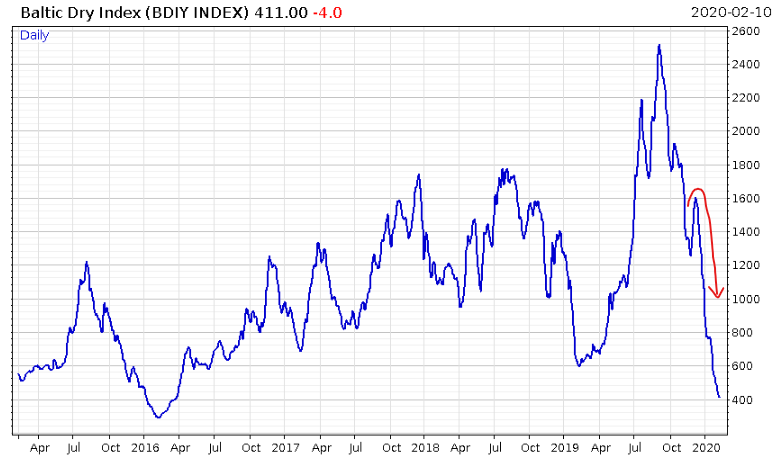

The seas have fallen silent:

That’s the Baltic Dry Index, which is representative of how much dry bulk goods – like metals and grains – are being transported across the ocean.

The lockdown in China, which is such a major importer and exporter, has significantly quietened the oceans. The index has only been lower than this once in recent memory, during the growth scare in 2015:

But this indicator that globalisation is effectively going in reverse still causes no stirring from the global stockmarket.

Why?

Let’s examine the options.

- The market is correctly pricing the risks posed by the virus. I am wrong to question why the virus has not had a larger effect on the market and market sentiment, for the market is efficient.

- The market believes the Chinese government stats on the virus, the same way the market believes Chinese government stats on the Chinese economy. Believing the latter has rewarded investors in the past – so why not the former?

- The market is no longer “conscious”. It lacks enough active managers to care about risks, for it is ruled by passive investment funds who simply buy everything when they receive cash (from those saving for retirement for example), and sell everything when they are asked for it (from pensioners in retirement, for example). These “price insensitive” actors have become large enough that they can make the entire market go up on their own, and have turned it into a cash machine for retiring baby boomers

- There market is still conscious – there are still enough active participants who will hold cash and sell overvalued stocks – but they have been conditioned to treat every fall in the stock and bond market as a buying opportunity (in some cases going even further and treating every volatile event as an opportunity to bet against volatility continuing).

- Bad news = more stimulus from central banks. Stimulus from central banks = more share buybacks and higher share prices generally. All bad news will be responded to with money printing, and the market is simply discounting this reality.

- Separate from #5, the mother of all stimulus is coming, to celebrate a certain 100-year birthday. Markets stay elevated in anticipation.

The truth is unlikely to be as simple as just one of these – it may well be a little of all of these (or perhaps I’m wrong and it’s something completely different). But it’s #6 in particular that I think is worth paying attention to, that few are looking at.

23 July 2021 will mark the 100-year anniversary of the CCP. This event will be heralded with a colossal fanfare, on a scale that only China can achieve, and will be used to reinforce the CCP’s control and approval from China’s citizens.

Mario Draghi’s “whatever it takes” moment for the euro pales in comparison to the CCP’s “whatever it takes” moment now. While the European Central Bank’s intervention was through the creation of electronic cash out of thin air using a keyboard, the CCP will be forced to create actual economic activity, of any variety, to keep growth going at any cost. Economic stagnation leading to domestic unrest is the CCP’s nightmare.

To overcome the coronavirus, and have a booming economy in time for that anniversary, is going to require a hell of a lot of stimulus: money printing, concrete pouring, infrastructure building, military strengthening, belt and road extending… the lot. And to have completed it by July 2021… we’ll likely start hearing about it soon.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates