Well here we are dear xXreaderXx,

We’re one week into 2020. And what a year it’s turning out to be so far.

The US embassy in Baghdad being stormed by militia… an IRGC general getting droned by the Americans in response…

But you wouldn’t know it looking at the FTSE or the S&P, which are both positive on the month. While I strongly believe the US will not invade Iran (the logistical preparations required for an invasion of such scale are so vast that they take months and are highly visible), it’s fair to wonder why nothing in the stockmarket has stirred considering all the “WWIII” hysteria.

I attended a investment risk conference last year, in which a geopolitical investment adviser made the argument that provided a geopolitical event does not affect the price of oil, then markets can generally shrug them off.

With that in mind, you’d think that the US’s continuing pressure on Iran – a major oil producer – would produce the fear required to cause a market sell-off.

But Iran’s status within the oil market is not anywhere near what it once was, at only 2 million barrels a day, or about 2% of daily oil production:

Source: Holger Zschaepitz, on Twitter

Source: Holger Zschaepitz, on Twitter

As you can see, the Saudis picked up Iran’s slack in the 1970s, and didn’t stop. While Saudi production hovers near 10 million barrels a day, Iran is in the doldrums at 2 million.

It’s worth bearing in mind that Iranian oil production is likely higher than officially stated due to the black market sale of oil, escaping US sanctions not appearing in the official figures. But unless this hidden production is huge in scale, Iran simply does not have the grip on the world’s economic jugular that it used to.

Iraq, historically the lesser oil producer has surpassed Iran producer than Iran, exceeding its oil production by over 2 million barrels a day. But the real elephant in the room of course is the US. Formerly the world’s largest consumer of oil, the US is now its largest producer: if the Energy Information Administration is correct, then our cousins over the pond are on track to churn out an incredible 13 million barrels a day this year.

By removing the threat of an oil price spike, the booming stockmarket rally is even further insulated from external shocks. Our melt-up thesis for 2020 remains on the cards…

But stress has appeared, when you look outside the stockmarket. The gold price in dollars has just blown through $1,500 for the first time since 2013…

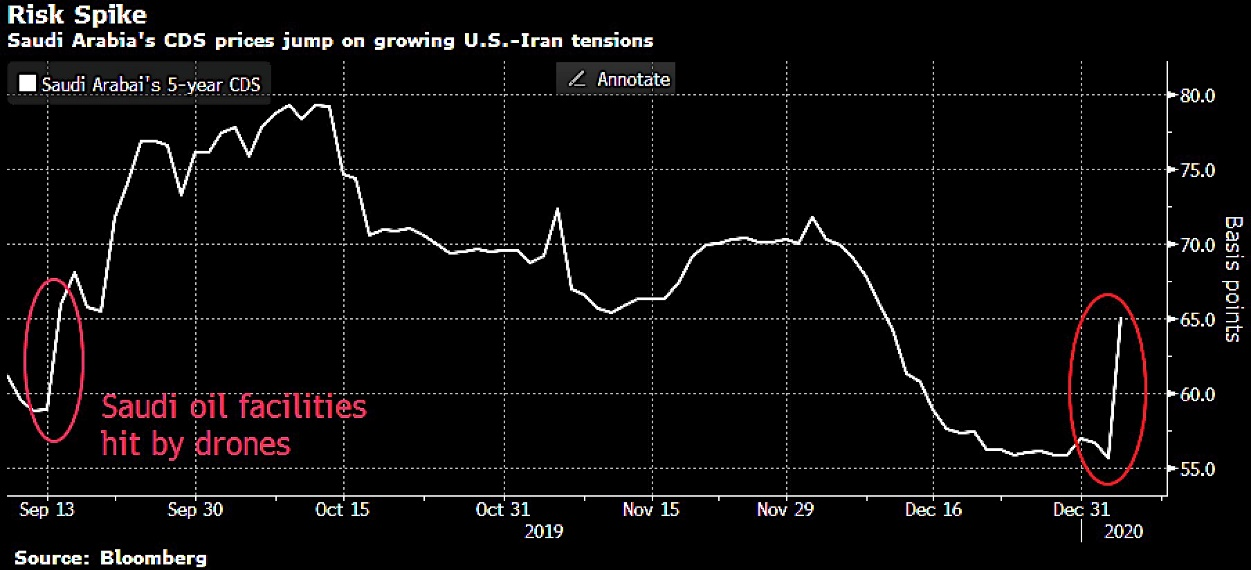

And interestingly, the drone strike on the IRGC general (who every journalist now knows everything about) has caused investors to fear a Saudi Arabian default more strongly than when their oil production was hit by Iranian developed drones last year:

The price of insurance against a default on Saudi Arabian debt

The price of insurance against a default on Saudi Arabian debt

Source: Holger Zschaepitz

Whatever the fallout from the drone strike on an Iranian general in Iraq, any contagion has not broken out yet. The key threat that I see is if Iranian forces try to shut down the Strait of Hormuz in their “Way to Jerusalem” plan… but that’s for another letter.

What geopolitical crisis would cause a markets melt-down, oil price change or not? Nickolai Hubble and I have an idea, and it’s going in this month’s issue of The Fleet Street Letter Monthly Alert.

That’s all from me for now – before I leave you for today, I’ll leave you with what Wall Street thinks is going to happen in the markets next year from two of its oldest and most respected investment banks – just in case you were unsure. Courtesy of Grant’s:

Two brokerage houses, two diametrically opposed outlooks for the new year:

[Bank of America:]

“We enter the next decade with interest rates at 5,000-year lows, the largest asset bubble in history, a planet that is heating up, and a deflationary profile of debt, disruption, and demographics” – Michael Hartnett

[Goldman Sachs:]

“Overall, the changes underlying the Great Moderation appear intact, and we see the economy as structurally less recession-prone today,” “While new risks could emerge, none of the main sources of recent recessions — oil shocks, inflationary overheating, and financial imbalances — seem too concerning for now. As a result, the prospects for a soft landing look better than widely thought,” – Jan Hatzius and David Mericle

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates