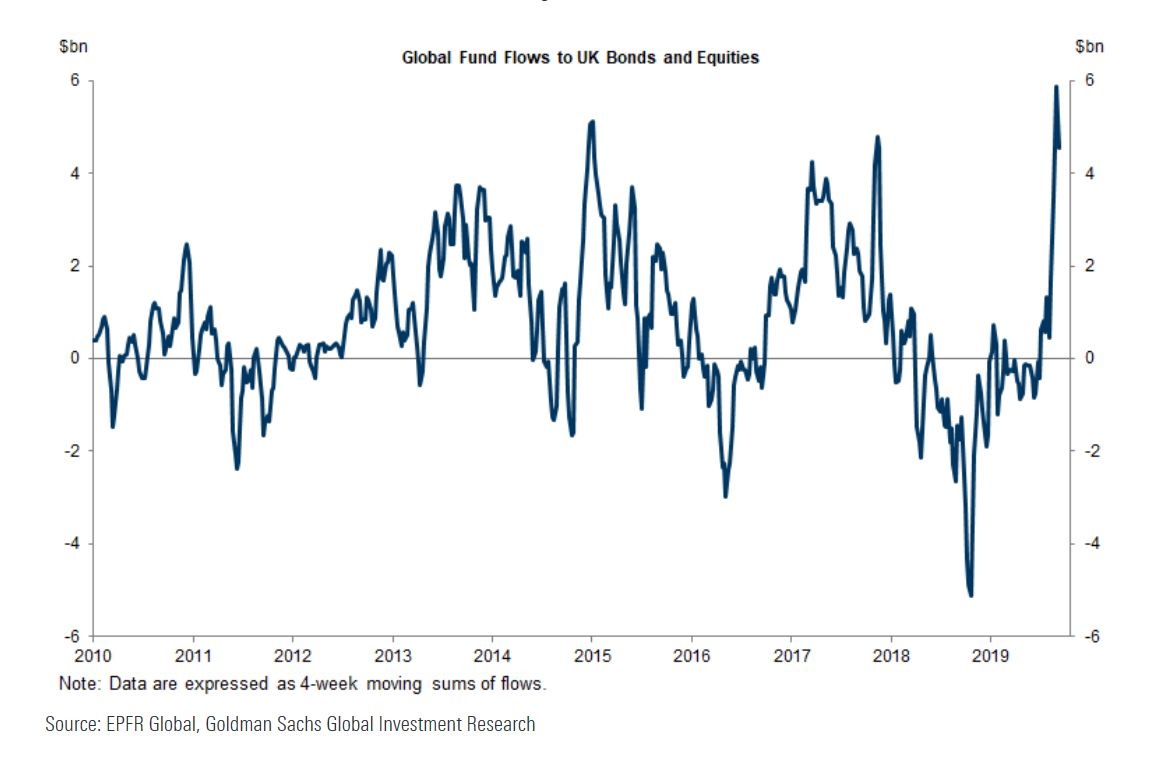

Behold: the great waves of global investment flows are returning to Britain’s drying shores.

The removal of “Corbyn risk” and BoJo’s unchallenged control over the Brexit process now has cash pouring back into the country like Caesar returning from conquest in triumph. And if we see a full return to pre-referendum levels, the celebrations are a long way from over.

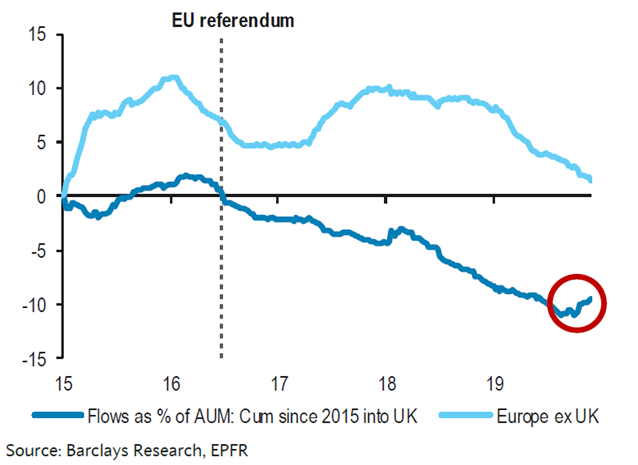

Fund managers are only just buying Britain again, and their stacks of UK assets are still way smaller than they were in 2016. Note how the dark blue line (flows into the UK) has only just begun ticking back up:

Also note how that while the flows into the UK are on the up, fund managers have been reducing their exposure to the rest of Europe all year. Their newfound optimism regarding the UK cannot be said for the rest of the continent…

But how is one to invest in BoJo’s Britain? Those who take the well-trodden path of speculating in the UK stockmarket stand to be pickpocketed by a very high-profile thief…

A tale of two FTSEs

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

– A Tale of Two Cities, Charles Dickens (1859)

You can draw a lot of comparisons between Dicken’s famous introduction and the environment we find ourselves in today.

The growing wealth divide between rich and poor, between metropolitan and rural areas…

The political divide between generations, and the growing, festering hatred smouldering between political affiliations, each side fearing an apocalyptic outcome should their opponents achieve power, while believing a paradise awaits if only they were in charge…

Technology making our lives better in areas like medicine, while at the same time allowing us to argue with anyone on the planet all day…

My colleague Nickolai Hubble interviewed me recently for our 20/20 Visions series, which you’ll see over the Christmas break. On the topic of great risks and great opportunities for 2020, I gave him one which was both: a global stockmarket melt-up. If I’m right that this occurs, this is obviously an opportunity for investors – but it is also one of the greatest risk.

Such an event, a further dramatic increase in wealth inequality stands to foment civic unrest of the likes of Hong Kong all over the developed world – and deliver any number of financial crises not through any market mechanism, but through the ballot box.

But in today’s letter however, I’d like to dwell on a more pressing grand divide for investors, not of two cities, but of two indices, or to be more specific, “a tale of two FTSEs”.

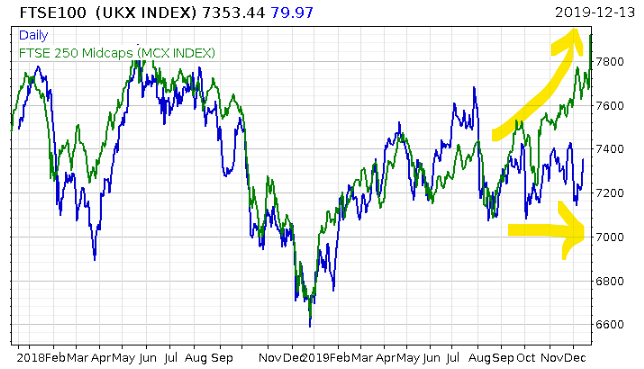

That line in blue is what everybody calls “the Footsie” – it’s the FTSE 100, the largest hundred companies by market cap. Everybody looks to it as a barometer of market and UK economic health – but it’s a misleading indicator. Indeed, those that buy the FTSE expecting it to surge following all this capital returning from abroad, may well find themselves pickpocketed in the act – by the very currency they are using to invest in it.

For those massive companies which have made it into the FTSE 100 are multinational in nature, and their earnings are in foreign currencies.

And if all those investment flows flood back into the UK, they will first flood back into our currency – the pound sterling – making it worth more relative to those other currencies. A stronger pound will make all those foreign revenues worth less, and so the FTSE 100 can suffer despite Britain’s success. We saw this in reverse after the 2016 referendum when the pound was devalued and the FTSE 100 soared.

And that’s why if you want to ride the great returning wave of capital returning to the UK, you should stick to that green line on the chart: the lesser-known FTSE 250. These are smaller British stocks more focused on the domestic UK economy, with less foreign earnings. As a result, a stronger pound has less of a dampening effect on their performance, or even increases if any imports or foreign services they buy cheaper.

As you can see from that chart, it’s already broken free of its well-known larger brother. When the press makes a great deal out of the FTSE 100 moving this way and that over the coming weeks and months, always check its lesser known relative – sterling may be stealing its thunder.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates