It’ll be a short note from me today. I’m currently writing this month’s editorial for The Fleet Street Letter Monthly Alert. Charlie Morris, Nickolai Hubble and I are all submitting three predictions for 2020, and how to profit if we’re right. I’ll share a little glimmer of what I’m cooking up in today’s letter before I get back to it.

As you’ll know from my recent letters, I’ve begun to flirt with the idea that 2020 will be a repeat of 2017. As you may recall, 2017 was a massively bullish year for risk assets under the “growth” category, and a bad to stagnant year for pretty much everything else. All the fear of deflation and a debt bust from 2016 were put aside: the combination of monetary stimulus (from central banks) and fiscal stimulus (Donald Trump’s tax cut) in concert seemed to be “working” as both inflation and growth had ticked up, and a raging bull was released into the stockmarket.

Fast forward to now and as we enter 2020 the European Central Bank, the Bank of Japan, and the Federal Reserve are all providing stimulus at the same time, while Trump is in election mode, making the continuation of the US stockmarkets bull run a national priority.

In short, it looks to me like a repeat of 2017 on steroids is on the way. But if I’m right… then one of my most hated investments is going to go up. Or at least, a resuscitated version of it is. While the original was slaughtered in early 2018, duplicates have since been constructed.

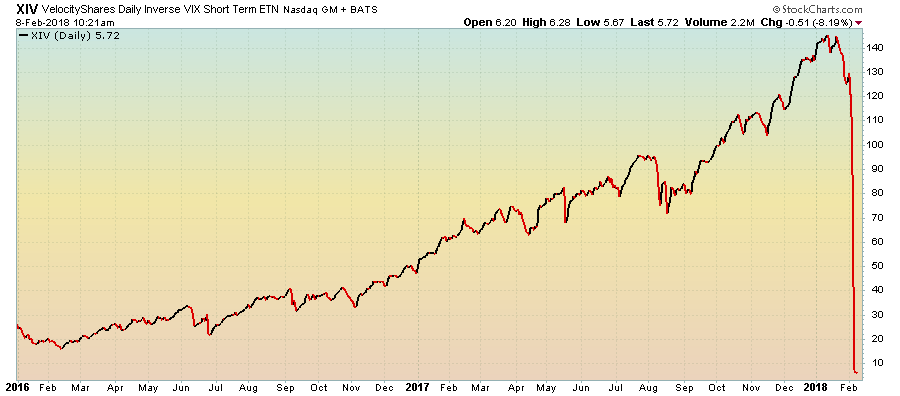

The chart of the original getting wrecked, pictured below, is framed on my wall at home. Note what a great ride it had in 2017 prior to its sudden demise:

The XIV was a derivative of a derivative of a derivative of a derivative that, through the alchemy of said derivatives, increased in value when volatility in the US stockmarket went down.

The XIV made a perpetual bet that market participants would anticipate a low level of US stockmarket volatility in the future, and accordingly not value insurance against sudden moves cheaply. Stocks take the stairs up and the elevator down, “climbing the wall of worry” gradually, and so low volatility has come to mean rising stock prices.

When volatility suddenly returned in early 2018, this triggered what was called an “acceleration event” in the product, and it was shut down. But other products which do the same thing exist, and while I was glad to witness the end of the XIV, much to my chagrin I expect its successors will do very well next year.

I called that chart “sunset on the retail volatility salesman”, as this incredibly niche and esoteric market product ended up being bought and held in large size by retail traders. There were rags to riches stories of people working in supermarkets becoming millionaires from simply buying and holding the product, and increasing their position sizes whenever it dipped in value. Selling volatility was their new trade, and it paid mighty well – right until it didn’t.

I’ve currently betting on a sharp rise in volatility before the end of the year – but once that’s peaked, 2020 may well mark “sunrise for the retail volatility salesman”. I think volatility will be crushed just as it did in 2017 as central bankers do all they can to raise asset prices and keep the “inflation and growth” show on the road. While this will all end in tears, just as it did in February 2018, those with their eye on the ball stand to make a decent buck with their speculative capital.

But “selling vol” is a harsh trade – and anybody willing to give it a try should take a long look at the near-vertical red line on the right of that chart before consider joining in. Only those that are prepared to lose 90% of their cash overnight need apply.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates