For the last couple of weeks, Nickolai Hubble has been furtively sneaking into the studio, not telling anybody what he’s in there for.

Such behaviour is in some regards, to be expected; Nickolai has a reputation for being the office’s resident reclusive German anarchist.

But there was a twist – turned out that he was in the studio recording videos in preparation for his debut on social media.

I’ll let you be the judge of his efforts. Like what you see? Give him a follow on your preferred data mining platform: Facebook or Twitter.

I’ll leave you with a recent note he wrote on the prospects for investing in Brexit Britain. I’m just off to film some videos of my own – a couple of our editors are in town at the moment and it’s time to get a nice podcast on the go.

I’m thinking to make more video-based content for Capital & Conflict, specifically more interviews and in a discussion-based format. If this is something you’d like, or you have any recommendations for specific subjects you’d like to see discussed, let me know: [email protected].

And with that, I’ll leave you in hands of our resident, reclusive, German anarchist.

Are the stars aligning for Brexiteer investors?

The London Stock Exchange is one of the hardest places in the world to invest. If you want to make money by holding stocks…

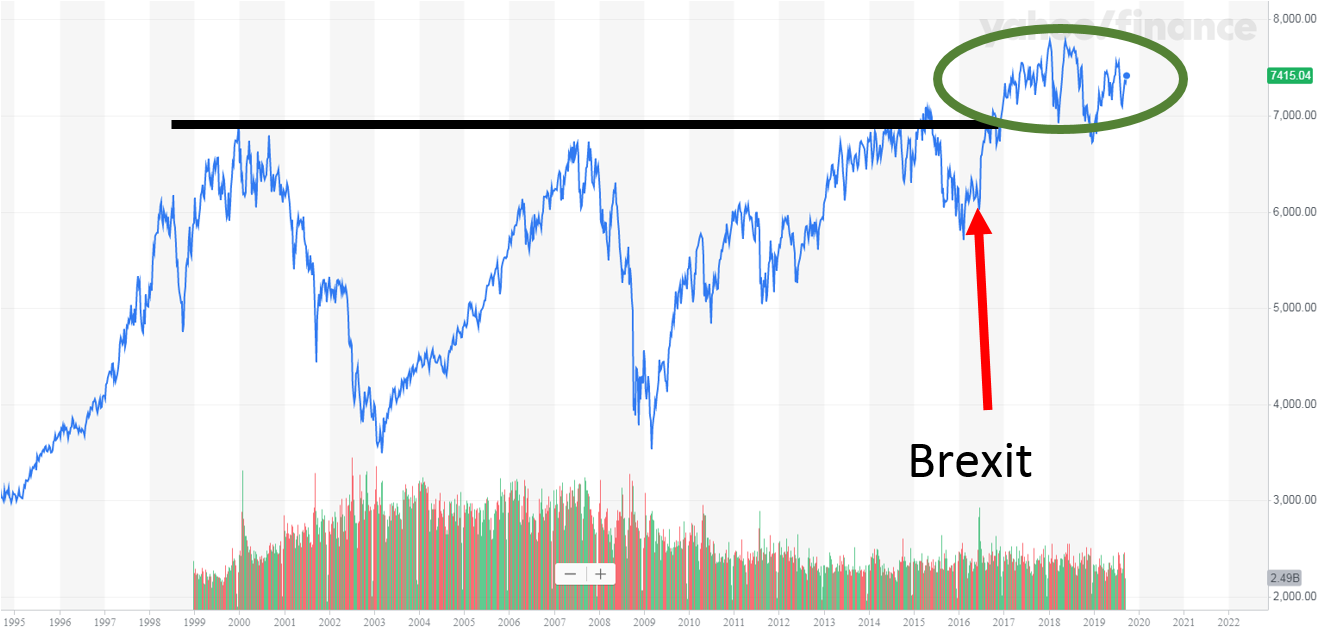

It took 15 years for the FTSE 100 to top its 1999 level. And only Britain’s Brexit Boom seems to be capable of sustaining it above that level.

It’s all got to do with the currency. We have our very own, unlike many countries in Europe. This keeps our economy on an even keel. The moving exchange rate is like the lead weight at the bottom of that keel, constantly trying to keep us level.

But this sacrifices investment returns for British investors. Because every time the British economy booms, the pound just rises instead of stocks.

Why does a rising pound weigh on stocks? It takes a two-part explanation to understand. The peculiar nature of the companies on the UK stockmarket. And how they’re affected by the pound.

Because Britain is an international financial centre, a lot of multinational corporations list their shares here. They’re about as British as the new captain of the Japanese rugby team is Japanese. Lappies Labuschagne-san just plays in the country.

Now it might sound rather good to be able to invest in global companies without having to mess about on foreign stock exchanges. British investors get global exposure from their home market, which reduces costs and inconvenience.

But here’s the key for London Stock Exchange listed multinational companies, and “Japanese” rugby players for that matter: money. Specifically, the currency and the exchange rate.

The FTSE 100’s companies convert their various international earnings into pounds. That’s how their profits are measured for their shares in London.

If a big FTSE 100 corporation earns exactly the same amount of dollars, euros and yen, but the pound goes up, then their profits measured in pounds are less. And so their stock, measured in pounds, languishes.

Foreign investors still book the gains – the exchange rate move benefits them. But British investors are stuck, getting robbed by the pound’s rise. Unless they go on holiday a lot, which I suppose retirees do…

My point is, the performance of the UK economy and its stockmarket index is often inversely related.

The Brexit referendum illustrated all this nicely, in reverse. The pound tumbled on fears for the UK economy and so the FTSE 100 stocks rose. That’s bizarre to most countries. But it makes sense here. UK-listed companies’ foreign but remitted earnings became worth more in the local currency. Which is good for their shares.

The stockmarket went up, not despite Brexit, but because of it. Because of Brexit’s effect on the pound.

Ironically, enough, I expect precisely the opposite to happen next because of Brexit. Brexit will drag down, or at least slow down, the FTSE 100. Brexit is about to rob UK investors of stockmarket gains.

This isn’t what Brexiteers want to hear. And it sounds like the opposite conclusion to my promising headline. But bear with me.

How will Brexit, which pushed up UK stocks in 2016, end up weighing on them? It’s all to do with the pound, of course. That is the key to understanding the FTSE 100’s move, because the companies in that stockmarket index are so exposed to foreign revenues.

The local UK economy plays a secondary part for most of the stocks in the FTSE 100. So even the most passionate Brexiteer shouldn’t be declaring that the UK stockmarket will outperform after Brexit.

Only certain parts of it will. More on which in a moment.

First, we need to figure out, what will Brexit’s effect on the pound be? The referendum result led to a plunge. So surely a Brexit would too?

That’s where the Brexiteer believers should start arguing otherwise, as they do.

I think almost all Brexit related outcomes will see the pound rise in coming years – the time horizon of an investor. That’s why I moved to the UK.

If Brexit is cancelled, thwarted or made meaningless, then the pound should surge. Staying in the EU, as far as economic policy and trade is concerned, would cut uncertainty. It would reverse the pound’s plunge. A relief rally in the currency.

If Brexit is a success, the pound should rise too as the economy improves.

A no-deal Brexit is likely to lead to a more successful economy because the British government could make laws and trade deals that benefit Britain instead of a long list of EU countries. Austria’s veto of the Mercosur trade deal over forest fires is a nice example of that. Can you imagine Gloucestershire vetoing a trade deal?

But not many people agree with me on Britain’s bright Brexit future. And so a further initial plunge in the pound may be the big buying opportunity for investors. After the initial reaction, the possibility of a Singapore in the North Sea will begin to look appealing to investors. And the pound will begin a long-term uptrend.

But a buying opportunity of what exactly? I just told you the FTSE 100 is full of foreign stocks that will underperform if the pound rises.

Well, the answer must be obvious. You buy stocks that are local economy focused. Stocks that import goods, which would become cheaper if the pound rallies. And stocks that would benefit from deregulation of EU controls. Perhaps even stocks that would benefit from our new export destinations like the US, Australia and New Zealand.

There’s an entire Brexit Boom Portfolio out there. As well as a list of stocks you need to avoid if the pound rises. I bet you own many of them. If you’d like to know more about the two, let me know on my Twitter or Facebook page.

But before you run off to rejig what’s in your broker account, there’s one almighty risk in all this. Even Bloomberg is reporting on it:

Mark Stephen has bobbed and weaved through the worst that U.K. real estate markets could throw at him since the Brexit referendum upended British life in June 2016.

Now, as the Oct. 31 deadline for a deal with the European Union approaches, Stephen said he fears he may be about to hit a wall.

It isn’t crashing out of the European Union without a transition agreement that worries him. If anything, he sees a no-deal Brexit as an opportunity to scoop up U.K. real estate on the cheap. What really has him spooked is the possibility.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates