Now we are ready to sail for the horn

Weigh, hey, roll and go

Our boots and our clothes boys are all in the pawn

To be rollicking randy dandy-o…

Sea shanties, like financial data, can be quite hard to decipher when viewed on paper.

The above, a verse from “Randy Dandy-O”, was sung by sailors taking the dangerous voyage around the horn of South America when raising or “weighing” the anchor during the great age of sail.

The exact meaning of “to be rollicking randy dandy-o” is unclear and a subject of debate by those who enjoy a good shanty. Possible origins or variations on the last line include “to be galloping randy dandy-o”, “bollocking randy dandy-o”, or “with my rally-pin, galley-pin dandy-o”.

It’s worth noting that when shanties were first put to paper that particularly rude lyrics were altered so they could be published. The exact reason why the sailors had pawned all their clothes and boots is perhaps best left unsaid.

US banks meanwhile, have been having a lot of trouble pawning anything, which has led many to question their solvency.

I say pawning – the official term is “repo”, meaning repurchase agreements, however what happens is essentially the same. Individual X, in need of cash quickly, offers their Rolex to individual Y for less than its worth. X then buys it back once their short-term cash problem has been fixed.

Imagine X and Y are banks and instead of a Rolex it’s an asset considered to be of a high quality – a US government bond in this case – and that’s the repo market. The difference in the two prices when the bond is sold and then bought back by the original owner creates the “repo rate”.

The repo market in the US seized up last week in a big way, causing the repo rate to spike massively. At one point the reward that could be earned for an overnight loan to another bank – secured against a US government bond worth more than the loan – was an incredible 10%.

10%, supposedly risk-free, while you sleep. They don’t make interest rates like that any more. Not in the developed world, anyway.

Why would a bank refuse such a seemingly risk-free profit? They could distrust the bank asking for the loan, or at least, not trust it could pay it back the very next day, or… they’re all needing to get a quick quid at the same time.

Bankers not trusting other banks is a perilous environment – a crisis of trust, of credit between banks, is what caused the credit crisis after all.

As could be expected, the response by the Federal Reserve was as swift as it was immense.

It should be noted that before the credit crisis, the Federal Reserve operated as a “pawnbroker of last resort”, intervening in the repo market often (a practice later replaced by tactics like quantitative easing (QE)). But rarely did it intervene the way it did last week.

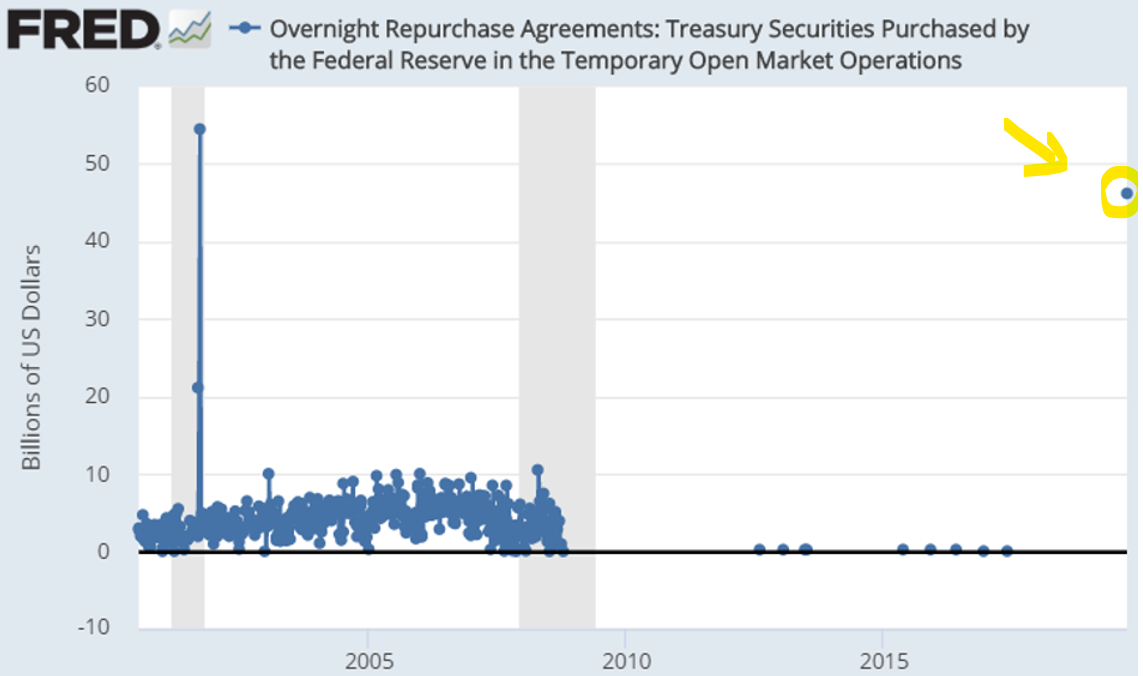

This chart below represents the value of the “Rolexes” purchased by the pawnbroker of last resort. After going to zero post-crisis, the Fed’s stack of government bonds bought to conduct repo transactions skyrocketed last week – look how high that dot is on the far right of the chart:

Source: Federal Reserve Bank of New York, accessed through the Federal Reserve Economic Data platform (FRED)

Source: Federal Reserve Bank of New York, accessed through the Federal Reserve Economic Data platform (FRED)

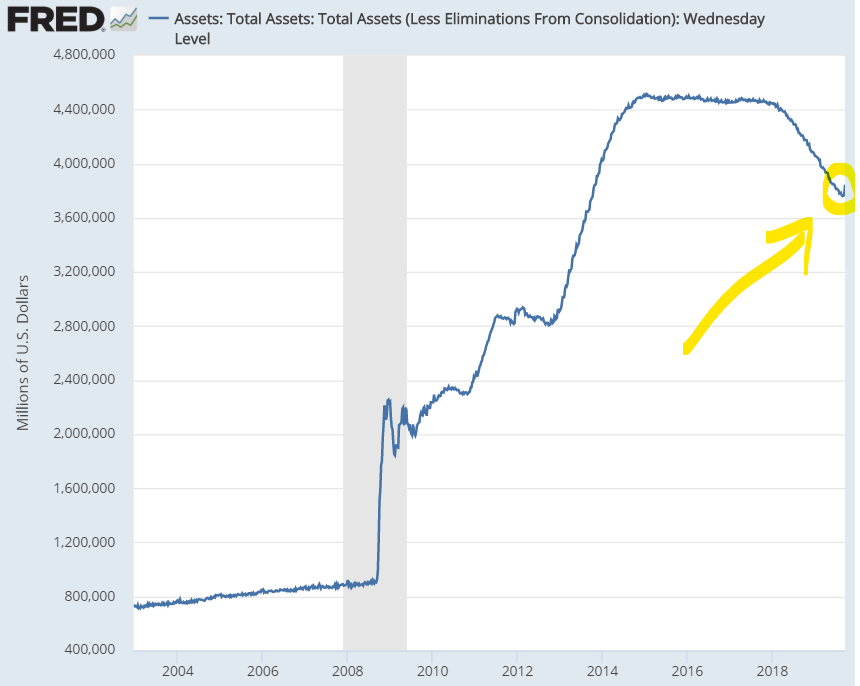

This sudden need to inject money into the banking system, has caused the pile of assets owned by the Fed, which for a little while had been declining, to once more reach for the sky.

What you see on the right of this chart of the Fed’s total assets, is the beginning of a tick worthy of Nike:

Total assets owned by the Fed. Source: Board of Governors of the Federal Reserve System, accessed through the Federal Reserve Economic Data platform (FRED)

Total assets owned by the Fed. Source: Board of Governors of the Federal Reserve System, accessed through the Federal Reserve Economic Data platform (FRED)

While during the US’s third round of QE the Fed was conjuring up $40-85 billion per month to inject into the financial system, now it’ll be doing that to the tune of $75 billion per day until at least 10 October. (Think it’ll stop then? Me neither.)

While QE and repo are different beasts it’s true, “QE 4eva” is the name of the game in order to keep the banking system “rollicking randy dandy-o” (knew I could get that in somewhere). Public money used to support private capital: a mockery of truly free markets and capitalism, where failure is propped up instead of being punished.

To my eyes, it’s likely the bank’s sudden lack of cash is a result of the US government debt machine running into overdrive. Major US banks known as primary dealers are compelled by law to bid at every US Treasury bond auction (ie, they must lend money to the US government if nobody else will – we have the same in the UK, known as GEMMs: gilt-edged market makers). With the US continuing to require ever more trillions, those banks have been lending .gov ever more cash to the point where Jerome Powell at the printing press has had to perform a back door bail-out.

It’s not known which bank(s) suddenly needed the “quick quid” to the tune of tens of billions of dollars – a secret worth a pretty penny by itself. Those “sailing for the horn” in the banking system will be rollicking randy dandy-o – and thanks to the Fed, they’ll get to keep their boots and clothes.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates