“Eureka!” cries Archimedes, rising from his bathtub.

Sculpture of Archimedes outside Manchester University. Source: flickr

Sculpture of Archimedes outside Manchester University. Source: flickr

He’d just discovered how displacement works. That the volume of water displaced when he entered the bath must be equal to the volume of his body beneath its surface.

If you put anything into water, the water will be displaced by exactly that objects volume. A seemingly simple observation, but it took a genius to figure it out.

Archimedes realisation not only contributed to the understanding of fluid mechanics and the popularisation of the term ‘Eureka’ (‘I found it’), but also as you can see above, peculiar sculptures outside universities.

Archimedes discovery of displacement doesn’t apply only to water of course. We are living through a period of intense and aggressive displacement of capital.

Just like Archimedes’ bath, the world financial market is one massive cauldron, full of liquid – the wealth of investors, savers, companies and governments. It has been the strategy of central banks since the credit crisis to displace this liquid and force it in in one direction.

This has been achieved by creating and then dropping ever larger objects into it. The liquid is pushed ever further up the sides of the cauldron into ever riskier assets, all in the hope that forcing risky investments will lead to economic growth.

A catch of course is that the more the cauldron is filled, the closer the liquid capital gets to spilling out – when the extremely risky investments don’t pay off and investors get wrecked.

But this is simply the cauldron we’re stuck in, and short of withdrawing your cash from the bank and buying physical gold (both noble endeavours which I endorse I hasten to add), we’ve just got to deal with it.

Get to higher ground

Super Mario over at the ECB announced last week that the boulders being thrown into the financial market are set to resume. €20 billion a month in freshly printed euros will be summoned from the either and then chucked into the cauldron.

The wealth within will accordingly be displaced by that amount, as investors will need to find €20 billion of something to buy, which will likely be a riskier investment (the returns on safe investments are getting crushed by the ECB’s barrage).

After buying that riskier investment, the person who sold them it will look for an even riskier investment. The person who sells them that will then look for an even riskier investment, and so on, all to the tune of €20 billion a month.

If you can buy up that final risky investment now on the cheap, and be the person who sells it to the crowd when they’re ravenous for it, you stand to make big bucks – even if the investment itself isn’t worth what the market is paying for it.

A risky strategy to be sure, and cynical as hell, but the payoffs can be huge. I know, because I’ve done it before: in the last crypto boom, as veteran readers of this letter will know already. The manic ride the crypto market had through 2017 was purely, in my view, a result of the central banks displacing investor’s wealth and forcing it into risky investments.

Back then however, institutions couldn’t buy crypto even if they wanted to, as there’s very little laws and regulations regarding the custodianship of digital assets. To continue the metaphor, it was only retail wealth which entered the crypto plumbing as the water rose.

But now that’s changed.

The levee breaks

“Whether institutions were going to adopt crypto or not was an open question about 12 months ago. I think it’s safe to say we now know the answer. We’re seeing $200-400M a week in new crypto deposits come in from institutional customers.”

– Brian Armstrong, CEO of Coinbase

Coinbase, a large crypto exchange, began a custody service for institutional investors (Coinbase Custody) in July last year. At that point the wealth displacement mechanism we’ve described had been paused. But with the boulders now careening in, wealth will once again be pushed into the riskiest investments – and this time, with much more ease.

It doesn’t really get any more risky than crypto when it comes to speculation. But provided we don’t get a major liquidity event, like a bank in the Eurozone failing, I reckon investors will be bidding up crypto once more. That quote from Brian Armstrong would suggest that this has already begun, and this time the ‘big money’ is arriving to the party.

I’ve said before that this year feels awfully like 2016 with the performance of gold, bonds, and crypto. While it was 2017 when things really went nuts for that market, ’16 was still a winner.

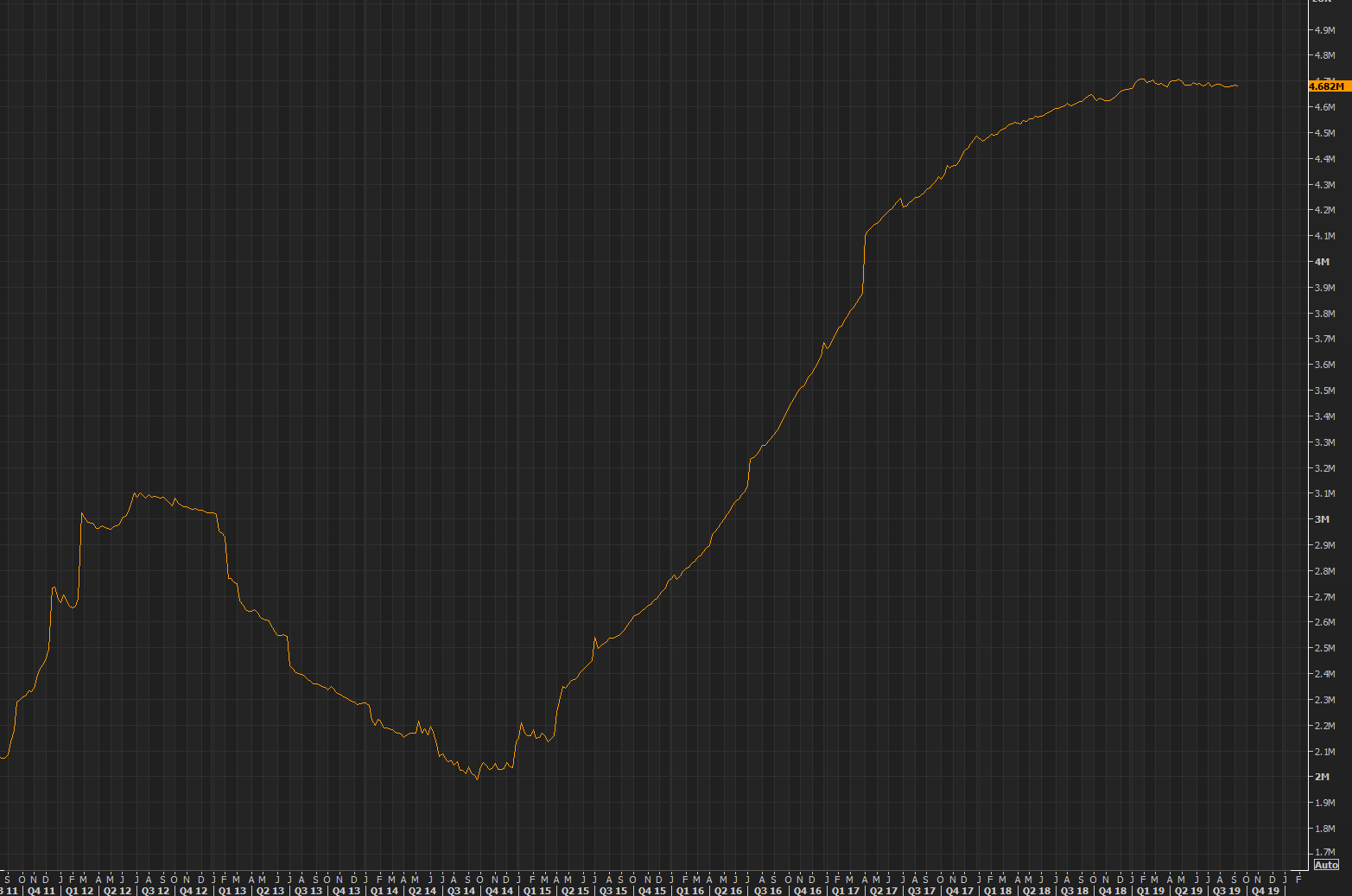

This is the level of the ECB’s balance sheet – the weight of wealth it has displaced is currently standing at almost €4.7 trillion. You’re not gonna see that number go down anytime soon. In fact, Super Mario could only pause its ascents for 9 months.

Source: Holger Zschaepitz, on Twitter

Source: Holger Zschaepitz, on Twitter

As the story goes Archimedes’ “Eureka!” moment occurred when he was trying to figure out whether or not a crown that was meant to be pure gold had actually been bulked up with silver by a corrupt goldmsmith.

The ‘crown’ in this modern reboot is the Euro, and the goldsmith debasing it is Mario Draghi. This is all going to end in tears to my eyes… but we’re in for a hell of a firework display first.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates