The world’s most important central banker has managed to cut interest rates, end quantitative tightening, and disappoint markets. Jerome Powell is truly a man of many talents.

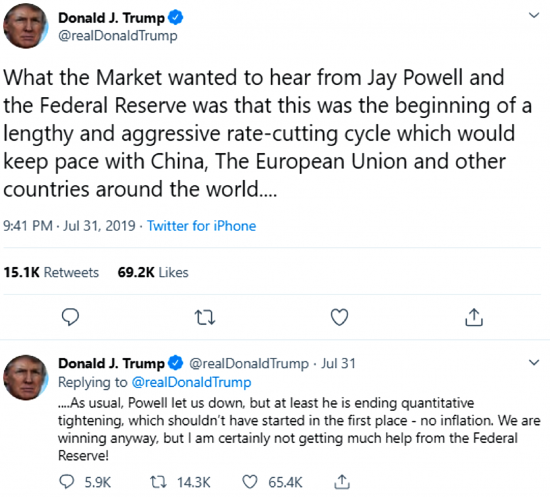

… though not nearly so multi-talented as the leader of the free world. The US president took time away from his new quest to cure cancer and stop AIDS (one-upping Joe Biden, who was “only” going to cure cancer if made president), to summarise the situation to a tee:

Powell’s decision to cut rates for the first time since the financial crisis received an almost perfectly mixed response:

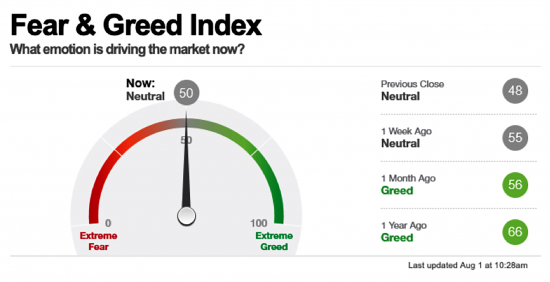

The CNN Money Fear & Greed indicator after the rate announcement. At the time of writing, it is now at 43 (fear).

The CNN Money Fear & Greed indicator after the rate announcement. At the time of writing, it is now at 43 (fear).

Though Powell mentioned hiking rates, lower for longer is the name of the game. The reach for yield is only just getting started. Mark Carney has resisted cutting rates for now, but for how long can he hold out? If further devaluation of the pound, brought about by Brexit uncertainty, continues to stoke inflation, it’s possible we’ll see a small interest rate rise, but this will be a temporary blip on an otherwise downward trajectory for rates.

Gold is now the most expensive it has ever been in pounds:

But gold isn’t the only fringe asset that’s taking off. Bitcoin, even further out in the investment bush, is back above $10k once more:

Charlie Morris’s ByteTree.com platform has recently added some new functions which provide some fascinating insights to the recent action. Number one, that the miners who held back from selling during the doldrums this week, are now aggressively dumping into the market – and making little impact on the price. Demand is strong:

Miners selling newly minted bitcoins represented by the pink bars on top. The longer the bar, the larger the selling pressure.

Miners selling newly minted bitcoins represented by the pink bars on top. The longer the bar, the larger the selling pressure.

And something strange happened on Monday. Here’s the BTC price again, but with total transactions going across the bitcoin network indicated by blue bars at the bottom. As you can see, on Monday evening, somebody sent somebody else a lot of money:

With a little look at the blockchain, more details of this transfer are revealed. That blue bar right there dear reader, represents a transfer of 385 million quid – which took place in a single transaction from one bitcoin wallet to another. Bear in mind that this could have been to anyone, anywhere on the planet – geographical constraints don’t apply to BTC as they do the banking system, it’s the internet that matters.

So how much did it cost to perform this huge wealth transfer?

310 quid.

And that is the power of BTC.

We’ve long argued that the recent bull run in bitcoin was brought about by wealthy Chinese getting their cash out of the country, and that once lower interest rates arrive, that investors clamouring for any kind of return would push the market higher. With the announcement of further US tariffs on China, and first blood now drawn on interest rates, I believe that both of these dynamics are now in play.

The market fringes are on fire – enjoy the heat while you can.

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates