In the early 1900s, a radical new idea was born, blossoming in ivory towers and high society.

War, it became popular to believe, had been made obsolete.

This strange idea, to be proved so awfully incorrect, was thanks to the expansion in international trade in the late 1800s – a period of what would now be referred to as “globalisation”.

This boom in trade had turned national economies outward. No longer were industries meeting domestic demand, supplying goods and services to citizens in their native countries. They were now meeting international demand – supplying goods and services to the global market.

This turned national economies into links in global supply chains, as industrialists spread their operations internationally to pursue greater efficiency and profit. The economies of developed countries had thus become highly intertwined.

For one to declare war on another would significantly damage itself, and so, the believers in this new idea claimed, major conflicts could no longer occur. No country would cut its nose to spite its face.

Markets had triumphed over politics. Trade had conquered conflict…

This was all total nonsense of course. Anybody who’d invested believing it would have wrecked their portfolio. The First World War promptly arrived and global economic order collapsed, as governments accepted the economic hit and printed money to fill the cracks.

Political risk returns

Just as in the early 1900s, we have lived through an era of globalisation. And just as then, it’s become popular to believe that conflict between nations cannot last – the US and China in this case – as it’s in the interests of both to remain peacefully interdependent. Believers will be similarly proved wrong, and similarly financially destroyed if they’re investors.

But it’s not just geopolitical risk that has returned following many years of absence. The boom of globalisation over the last several decades has also coincided with, and been fuelled by, the rise of political centrism.

As you will of course have noticed, centrism is no longer in vogue. And while some expect this to be a temporary blip, it is very much here to stay – which has similar importance for investors.

Just earlier today Tim Price over at The Price Report was telling me how in his fund he’s been reluctant to maintain his allocation to a certain investment – despite it paying big dividends.

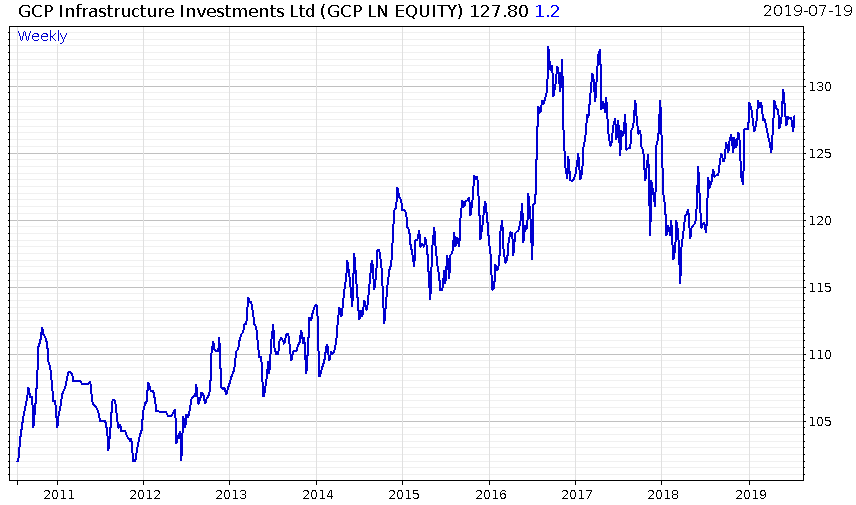

That investment is the GCP Infrastructure fund, which invests in loans for the development of schools, hospitals and roads in the UK. As you can see below, it’s performed well in recent years:

This chart hides the funds true value however, which is its almost 6% yield – massive by today’s standards.

In times past, when private infrastructure companies have fallen into receivership, the government has stepped in to pay the debts, giving the impression that the Her Majesty’s Treasury will bailout the projects if they go awry. A government-backed 6% yield is heavily attractive in this climate – and yet Tim is reluctant to invest new contributions to his fund into this investment, citing “Corbyn risk”.

In the event of a Corbyn government, the risk of a “restructuring” (see: default) on debts to infrastructure investors will be significantly higher, which is why he’s standing clear.

It’s highly unlikely Tim is the only one to be doing this – and yet this isn’t yet readily apparent in market data. The long-term effects of this will be interesting, as this change is so nuanced (what future British infrastructure won’t be built as a result of investors avoiding the sector today?). Though investor psychology is changing, the impacts – for the moment – are still nuanced.

But the further you travel from a fork in the road, the starker your decision becomes. Though we’ve only just begun deviating from globalisation and centrism, it’ll become ever clearer over time just how significant this change in direction is.

More to come,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates