Boaz has been writing to you over the last week or so about gold.

You’re probably seeing more and more people start to turn their attention to the precious yellow metal.

It’s no big surprise.

Markets run on emotion. And you’d have to have your eyes closed not to see that anxiety is rising.

When fear and anxiety rules, gold can do tremendously well.

So, I asked Boaz if I could write to you directly today…

To take you deeper into the gold market, looking at why the forces seem to be aligning for a gold boom…

And why it looks such a stunning investment opportunity right now.

It’s not complicated. I’ve been a trader for nearly two decades.

Boiled down to its most simple form, all investing can be boiled down to this:

Buy low, sell high

That’s what it is all about, isn’t it?

That was one of the driving forces behind me calling The 2019 Gold Summit.

The summit is closed now, but I have left my Keynote Episode online for a few extra days. It will go behind the paywall on Wednesday evening. So do watch it now, if you’re keen to learn about the three big triggers I see on the horizon for a gold price surge.

In the episode, I lay out my case for gold – and share my strategy for maximising gains during a gold bull run.

It’s a strategy that worked out tremendously well in the last gold rush – in the early 2000s. And I am confident we could see an even more aggressive price move this time round.

Watch my Keynote Episode here, for free, and I’ll explain why.

But is gold really selling “cheap” right now?

Well, that is a loaded question and requires some context and explanation.

Firstly, if my conclusion was gold is expensive, then it would be schizophrenic to be screaming about what a good investment it is. In fact, that reminds me of an anecdote which helps to put this discussion in perspective.

After I left Bloomberg, where I started my career in finance, I spent some time as the director of sales at an independent research house in the West End. I’ll never forget a meeting I had with a hedge fund manager in Mayfair in early 2004. I had just been asked what I thought the best asset classes were likely to be over the coming years.

My first answer was gold, but it was the reaction I got from the investors on the other side of the table that let me know I was on to a winner. They were aghast that anyone would suggest investing in gold and the lead manager slapped his palm down on the table and said in a none-too-friendly tone, “Don’t mention that in my presence.”

As you can imagine, the meeting did not last very long afterwards and they did not become clients. Gold on the other hand went on to post ten consecutive years of positive returns which far outpaced the returns available from the stockmarket at the time.

The lesson here?

Buy when sentiment is low

After the end of every bull market, we lose a demographic of people who swear off ever investing in the asset class again. Just think about the people who have lost a ton of money over the last year in cryptocurrencies. They are unlikely to have the will or indeed the means to embark on highly speculative ventures again, anytime soon.

The people who become disillusioned with a market after a crash are usually those who were most in love with the bull market hypothesis in the first place.

In my book about how to read and time the markets, Crowd Money, I refer to these people as the jilted lovers:

People react to personal mistakes in different ways. Perhaps the healthiest way is to assess the analytical and emotional errors that caused the loss and quickly move on. However, while rationally uncomplicated, this can be an emotionally difficult process. Some people will blame the instrument for their own mistakes, taking revenge upon it rather than reforming their own character. Where once they will have ignored the flaws of the object, now they will accentuate its weaknesses and the prevailing sentiment of the crowd will be dominated by negativity.

Clear examples of revenge are evident in just about every bear market when those who profited from being short are portrayed as predators; often as sharks, wolves and vultures. Notwithstanding the fact that when bull market’s fail, crimes perpetrated during the boom years come to light as the supply of credit dries up, the deeply seated search for someone to blame is rooted in a communal desire for revenge upon those who profited from the demise of others.

Another way of thinking about that tendency is to amend an old adage, “Hell hath no fury like an investor scorned.”

It’s a little like getting an electric shock when you touch your car. I’m always a little tentative about touching it a second time. Once bitten, twice shy.

And when we are talking about people’s life savings, they can take on a very negative feeling towards an asset class even if there is a clear bullish argument.

I wanted to meet that objection head on today for you.

There is no doubt a good many people lost money during the commodity bull market and subsequent bust.

The reason I know that is because it takes time to convince people of the bull argument. And by the time the biggest sceptics have been convinced, the price has likely already rallied meaningfully.

That means the initial entry point is high and therefore the late investor is the person most at risk from a downdraft.

The plain truth is, most people get to the party too late, when the buffet table is almost empty.

Additionally, if someone has been sceptical throughout a bull market then it is only the most strident and ambitious of forecasts that is likely to sway them.

However, it is when there is clear competition to become the biggest bull that we have some evidence the bullish story is already well-known and more importantly well-owned.

We are nowhere near that condition in gold today. The asset class is unloved primarily because it has gone nowhere for three years and gold miners were recently back testing their 2011 lows.

For an investor, this is an ideal market environment to hunt for big gainers.

So…

Yes, gold is cheap!

And it could be about to get extremely expensive.

I would argue this is exactly the time people should start getting interested in gold. It is a bargain.

Now that is a controversial statement, as an asset like gold does not submit readily to conventional dividend discount models because it does pay a dividend. Therefore, we can only ever talk about gold being cheap in two ways.

The first is relative to its past price history, just as we would with any other asset.

For example, if I told you that a vintage car previously sold for £190,000 and is now selling at £130,000, we could argue it is relatively inexpensive compared to previous prices it traded at.

Of course, that would depend on the condition of the market, the inflation rate and how rare the car is. Nonetheless, it is an incontrovertible truth that £130,000 is less than £190,000 and therefore cheaper.

The second way we conclude something is cheap is the same way we make judgements about currencies. You can never say a currency is objectively expensive or cheap unless you compare it the currency you wish to convert it into.

That’s why I smile whenever I hear people in the financial media talking about how strong or weak the pound is. Over the last couple of years it has been strong when compared to the Venezuelan bolivar but it has been weak when compared to the US dollar. Gold is exactly the same.

It is only relevant to talk about whether gold is cheap if we first define what we are selling in order to buy it and what we are buying when we sell it.

That gets to the most basic argument for owning gold. It is a monetary metal.

Gold is money but it is not currency. That is an important but subtle designation because gold has been considered a store of value for millennia and that is no less true today than it was in centuries past.

The central banks of the world might have ported over to fractional reserve banking in the last few decades, but they still hold gold in reserve because it lends stability against their worst impulses.

They don’t really want you to know it. Or think about it. As you will discover in my 2019 Gold Summit presentation here, they would much prefer you to keep spending the notes in your pocket than stock up on gold.

In other words, it is far better for them if you dissipate your wealth back into the system… rather than hold on to something which preserves your wealth.

Gold is “hard money”

More importantly, gold is a source of confidence for other countries and traders that the currency is backed by something more than a promise.

That’s why we might call it “hard money” or “real money”.

At varying times in its existence gold has also been a currency. That means it has been used a medium of exchange in a wide number of countries.

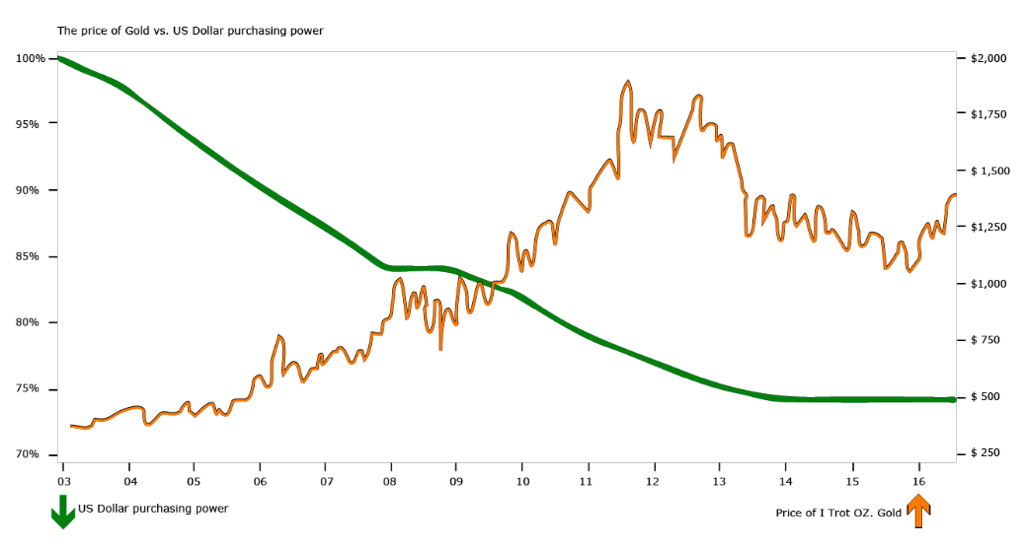

The gold standard collapsed (nearly 50 years ago) and we have seen the purchasing power of paper currencies decline considerably against hard assets like gold and property since then.

I do not think we are heading back to a fixed exchange rate system – or gold standard – in my lifetime because the governments of the world have too much to lose.

And the debt mountain they have built up is so enormous that no government is ever going to give up the ability to print its way out of trouble.

However, that is exactly why gold will gain in value against the majority of currencies over the long term.

The simple fact of the matter is central banks are serial bubble blowers, they just can’t seem to help themselves. That means the boom and bust of markets will never be excised and every time the market runs into trouble, the first and last resort is to print more money.

There is an inexhaustible supply of currency, which is why the price of assets that cannot simply be lent into existence represent a value proposition that has nothing to do with dividends.

In fact, the primary allure of dividends is not so much that they offer a real-time return but that they have the potential to rise in line with the inflation rate. That store of value argument in stocks is dependent on the success or otherwise of the business, the macro environment and the willingness of management to fund the dividend programme.

Gold holds the exact opposite qualities.

Gold is a store of value precisely because its ability to hold its value is not dependent on any of those things.

This isn’t a particularly popular view right now because inflation is not a problem from the perspective of central bankers. However, for everyday people who have seen their living standards decline steadily for years, inflation is everywhere. The cost of just about everything is rising, without a commensurate move in wage growth.

That’s why I am still amazed by how surprised the anointed elite are at the rise of protest movements that are variously described as populist, anti-immigrant, nationalistic, xenophobic, etc.

They all share one common characteristic: a complete dissatisfaction with the status quo. Some countries are veering towards the extreme left and others are veering towards the extreme right…

But the solution they are demanding is the same. People want more money and, so far, that means bigger government deficits.

As I’d like to show you in my summit presentation. I believe the rise of populist politicians could be a huge gold price catalyst in 2019 – and beyond.

Just as we saw with Gordon Brown’s deficit spending in the 2000s, eventually the bills have to be paid and when that happens the currency goes through the floor – and the country experiences even greater contraction in standards of living.

It’s not popular. People don’t want to think about a scenario where gold goes up a lot in value because that generally means everything else is not looking great and standards of living are deteriorating.

Time to get into gold…

Perhaps you can already see that pressure is building up under gold right now.

As a trader, I find this situation simply irresistible.

And I’d like to share – for the first time ever – my personal plan to profit from what’s going on.

It would be remiss of me to simply ignore the risks from out-of-control money printing and the eventual debt problems that is going to create.

Gold is cheap based on that risk. Gold is cheap because it is so far below its previous peak, hit in 2011. Gold is cheap compared to most currencies, but the important thing is that when we look at gold in more currencies than the US dollar and pound, it is increasing in value against most of them.

From my long experience of trading gold, both during and after the bull market, gold does best when it is appreciating in most currencies.

If you’re keen to take advantage of these rare convergence of forces…

Let me show you here:

Many thanks,

Eoin Treacy

Southbank Investment Research

PS Getting into gold stocks is a speculative play, no question. But by using just a little risk capital – that is money you can afford to lose – you could make an enormous return on your stake. Even a little grub-stake like £500.

During the last gold boom, a £500 stake could have made you a fortune:

Newcrest Mining: £500 into £5,700

Goldcorp: £500 into £49,500

Kinross: £500 into £22,000

(Past performance is not a reliable indicator of future results.)

Mind-bending returns.

Obviously, you’d have to be damn lucky or a genius to get in on all three top-to-bottom returns.

It simply shows you what is possible even if you only captured half or a quarter of these moves.

Protect against disaster… and be ready to capitalise as “catastrophe cash” migrates into gold.

I can show you what to buy right now – here in my gold profit plan video.

Category: Investing in Gold