I’m currently back home for the holidays in Aberdeen (enjoying the weather of course), so over the break you won’t have to put up with my scribblings and can sample some of our best editorial instead.

To begin the week, I present Nick Hubble’s bold call that Italy would be the cause of a new sovereign debt crisis this year, well ahead of the curve.

To put this in context, this was published on 5 February, when the Italian bond market was flying high. With the benefit of hindsight, take a look at how accurate he was:

Why the European sovereign debt crisis is back

Nick Hubble, 5 February 2018

For 35 years, debt has become steadily cheaper. But it hasn’t been smooth sailing.

Each time interest rates spiked, we saw a crisis. In 1987, the US ten-year Treasury yield spiked from 7% to over 10%. Then came the famous Black Monday, when stock tumbles set records. In 2008 it was sub-prime borrowers in the US who suffered when rates rose. In 2012 it was European governments.

So, when interest rates begin their upcycle, you have to scour the world for the weakest hands. Who will snap first in a world where debt is becoming more expensive?

Is it sub-prime borrowers, who borrowed more than they can afford based on rising house prices? Perhaps companies, who borrowed too much when times were good? Or tech stock buying margin borrowers, who face margin calls from their lenders when stocks correct? Perhaps it’s the PIIGS of southern Europe?

I think it’s the PIIGS

They’re the ones who can least afford rising interest rates this time around. We’re heading back to 2012, with one crucial difference. Namely, Italy will be the centre of the crisis instead of Greece.

Italy is set for a debt crisis just like Greece’s in 2012. But it’s too big to fail, and too big to rescue too. Not a good combination for the eurozone or global financial markets.

Italy’s bad debt problem is fascinating. Even with interest rates near zero, people can’t pay their debts. And these bad debts have built up steadily, with no resolution over time. BNP Paribas reports:

Indeed, the Italian banking system had a 16.4% ratio of non-performing loans in the third quarter of 2016. Only the Greek, Cypriot and Portuguese banking systems had higher ratios at 47%, 47% and 20% respectively. However, their assets only represented respectively 1.2%, 0.3% and 1.4% of total eurozone bank assets. The figure for the Italian banking system is 13%, making it the third biggest in the eurozone, after France (27%) and Germany (25%).

The government budget and debt-to-GDP is a nightmare too. Italian debt-to-GDP is now at the levels that got Greece into trouble. And the Italians owe €35,000 per person, €6,000 more than the Greeks.

The real problem is that the debt-to-GDP ratio isn’t falling, despite the perfect conditions for it to do so. Growth in the eurozone has picked up, interest rates are extraordinarily low. Italy’s debt-to-GDP just won’t go down.

That’s largely because Italy’s GDP growth is miserable too. It was just revised down, and Bloomberg’s survey of economists expects it to slow down even more in 2018. By 2019 it’ll be less than half the GDP growth of Germany, at just 1%.

In other words, of the major economies in the EU, Italy has the worst bad debt problem, the worst sovereign debt problem, and the worst performing economy.

Imagine if the European Central Bank (ECB) raises rates on these people! Maybe you don’t have to, it’s expected to do just that.

Meanwhile, the Italian voter is matching with the British, American, French, Dutch, German, Hungarian, Austrian, Czech and others. They’ve dumped the mainstream parties and turned to… well, anyone else.

Unfortunately, these anyones have plans to worsen the budget even more. And they’re holding a gun to their own head as a means to threaten the EU into approving their crazy schemes.

That tells you they know the most important political fact. Italy is too big to fail and too big to save. Threatening self-harm is a viable strategy.

But what triggers the Italian sovereign debt crisis of 2018? Perhaps the 4 March elections? Or the EU plan to force banks to deal with sovereign debt?

I think it’s the Capital Key that’s the key.

The trigger for Europe’s fatal sovereign debt crisis

Last week we looked into the weird world of Target2 – the reason why Alan Greenspan expects the euro to eventually fail.

Well, the Bank of International Settlements (BIS), which is the only major institution to have more or less predicted the 2008 crisis, recently reversed economic wisdom about Target2.

The problem is, its new-found views suggest that Target2 is about to trigger a rerun of the 2012 European sovereign debt crisis. Only this time, it’ll be Italy that’s in trouble. And the ECB’s hands are tied.

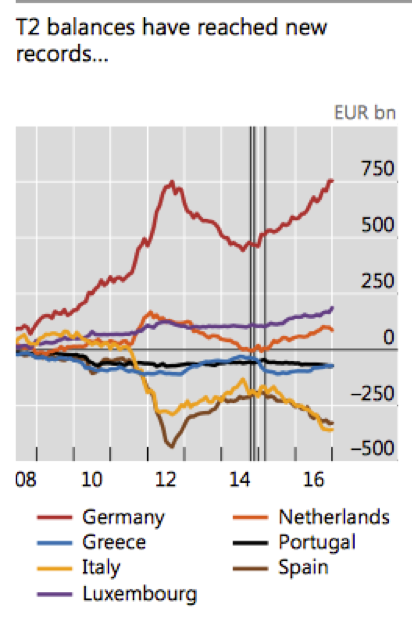

First, take a look at what happened in the run-up to the 2012 European sovereign debt crisis. Germany’s Target2 balances, in red, surged as the bond market broke. Italy’s and Spain’s obligations surged. What’s the connection between Target2 and the sovereign debt crisis?

Source: BIS Quarterly and FT Alphaville

Source: BIS Quarterly and FT Alphaville

German economist Hans-Werner Sinn caused a furore by labelling the Target2 imbalances a problem. He claimed the program amounted to an enormous, illegal and backdoor lending and bailout program for southern Europe. At the time, the major institutions of the eurozone explained why this was not true.

Unfortunately, with Target2 imbalances surging back to the sovereign debt crisis levels, the BIS has admitted that it was in fact a problem back in 2012:

In the period leading up to mid-2012, T2 balances grew strongly due to intra-euro area capital flight. At the time, sovereign market strains spiked and redenomination risk came to the fore in parts of the euro area. Private capital fled from Ireland, Italy, Greece, Portugal and Spain into markets perceived to be safer, such as Germany, Luxembourg and the Netherlands.

Indeed, during that period, the rise in T2 balances seemed related to concerns about sovereign risk.

FT Alphaville translates this into something a little more comprehensible:

That’s a fairly straightforward admission that had the T2 balance system not existed, and private investors pulled their money from the periphery the way they did in 2012, the flows would not have cleared without a major currency collapse. What the imbalance amounted to was Germany taking a temporal IOU from the periphery — a stealth loan by all objective measures.

It seems Sinn was right. Target2 is a backdoor bailout – the only thing that saved southern Europe from a currency collapse. While money escaped to the stable banking systems of northern Europe, those banking systems transferred it straight back to the south via Target2 to support the banking systems of southern Europe.

Sort of. This time, the Target2 imbalances are doing much the same thing, but CDS spreads are not. Credit default swaps are insurance against default. Their price signals the risk of a government defaulting, just as flood insurance is more expensive on a floodplain.

During the sovereign debt crisis of 2012, the CDS market and Target2 balances moved up and down together. When the obligations of countries under Target2 rose, the risk of their default did too. That’s because capital flight causes trouble, and Target2 was a measure of backdoor bailouts to prevent this trouble.

But this time, CDSs are not moving with Target2 imbalances. The BIS reckons this is because “the current rise seems unrelated to concerns about the sustainability of public debt in the euro area”.

So why aren’t investors worried about defaults on Italian debt, despite Target2 flows raising the alarm? The answer is simple. They’re just selling Italian debt instead.

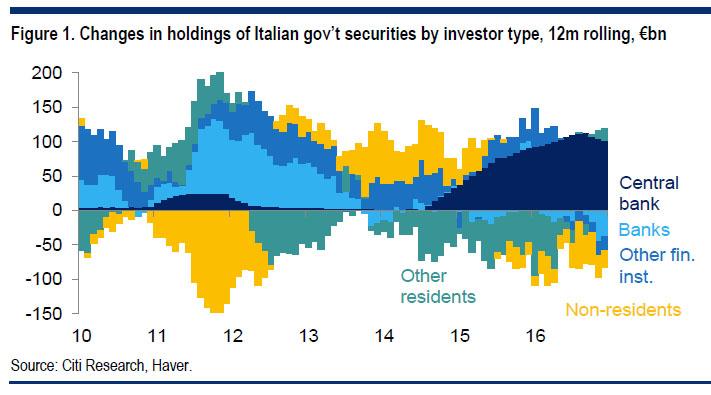

This chart from Citigroup shows that banks, financial institutors and private investors are dumping Italian government debt:

So why hasn’t the price of Italian bonds crashed, making yields surge? Because the ECB, in dark blue in the chart, has emerged to soak up the supply.

But they can’t do that indefinitely.

The Capital Key is the key

The Italian government is now living on borrowed time. Time borrowed from the ECB. Which is not allowed to favour some countries over others, and has limits on how much of each country’s debt it can buy.

These limits are known as the Capital Key. The Financial Times explained in 2017:

According to its latest monthly bond holding data for July, the ECB “overbought” Italian debt last month, deviating significantly from its capital key rules where member state debt is bought in proportion to the size of each country’s economy.

The Italian central bank, which carries out purchases on behalf of the ECB, snapped up €9.6bn of Italian debt last month – 2 percentage points over its capital key rules […]

The lesson here is that Europe’s fatal flaw is once again having an effect. Not yet in financial markets, but in the banking system’s flows and on the ECB’s balance sheet.

It’s only a matter of time before that changes though. These problems will strike all financial markets. And this time, it’s Italy that’ll be at the centre of the crisis.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: The End of Europe