Would you like the good news, or the bad news first?

Whenever I’ve asked people this in the past they’ve always picked the bad news, so I’ll start with that on this fine morning in Bloody October.

I wrote to you about the “doom loop” that exists within Italy last week (Et in Aradia ego), where the fate of Italian banks is now tied to that of Italian government debt. I focused on Unicredit, but if you look at eurozone banks as a whole you can see a trend you could almost copy with a set-square:

Banks in the eurozone have lost a third of their value since January. This is even more concerning when you consider that banks must raise equity to recapitalise themselves if they get into trouble. Equity that the market is already pricing very low. Mario Draghi’s dogs – Europe’s commercial banks – are in deep water.

The good news is that if you’ve been reading Capital & Conflict, you’ve had plenty of warning of the risks in Europe. And if you’re a reader of Zero Hour Alert, you’ve had opportunities to protect your wealth and to profit from the turmoil.

In other bad news, the Nasdaq, President Donald Trump’s favourite market index, fell yesterday by more than 4% – the largest one day since 2011. While 4% may seem low in the grand scheme of things, it’s now down 13% from its highs this year.

Source: Bloomberg

Source: Bloomberg

The Nasdaq is a very tech-heavy index, containing growth stocks like Apple, Amazon, and Google (Alphabet). With the market darlings that have ridden the tide of easy monetary policy losing favour, we’re seeing a change in the market regime away from the growth sector.

The good news, if you’re a reader of The Fleet Street Letter, is that Charlie Morris called a regime shift from growth environment to a value environment ahead of time, and has aligned his portfolios accordingly.

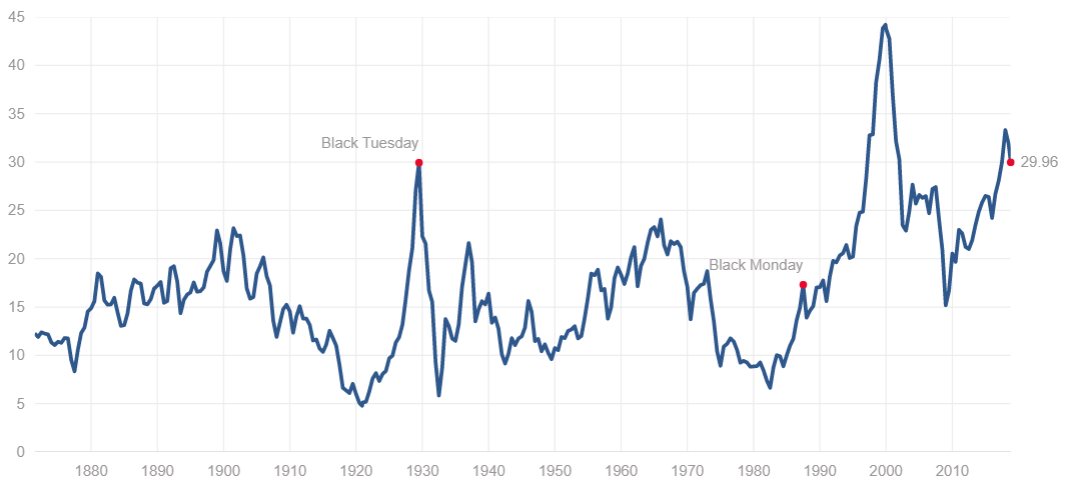

Market pundits claiming the stockmarket is already “oversold”… they’ll need to drop a lot further before we agree:

The chart above is the CAPE ratio, or cyclically adjusted price-to-earnings ratio, of the American stockmarket. CAPE shows the value of stocks relative to their average earnings, adjusted for inflation. It’s a metric my colleague Tim Price over at The Price Report has warned must revert to the mean; as it has in past, often in a brutal fashion. If we’re seeing the beginning of a mean reversion now, the market darlings ain’t seen nothing yet – that tiny dip on the right-hand side of the chart has a lot further to go.

If you’re not a subscriber to Zero Hour, The Fleet Street Letter, or The Price Report, the good news is that we’re currently offering lifetime membership to all our publications, for a one-off cost – no regular subscription fees. Click here to learn more and keep ahead of the bad news in the future.

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Category: The End of Europe