The political world is delivering a steady stream of chaos this week. And it’s only Tuesday.

Keep in mind, financial markets obsess over politics. And for good reason of late. With central banks poised to prevent any sort of rout, except in populist countries like Italy, can the markets even crash?

Only if politics triggers that crash. Brexit, Italy’s rejection of the EU and euro, the trade war, China’s economic mismanagement and plenty of other political stories do present real threats to the markets.

If you’d rather opt out of a politicised market and benefit from the meddling of politicians and central bankers instead, you’re not alone. What I call Policy Profiteering is certainly a big opportunity.

Yesterday, we looked into why financial markets and thereby pensions are not very promising for the years ahead. Today, we look at the alternatives to investing in those markets.

Because…

The alternatives are real, profitable and often better than stocks

The solution to poor past returns in financial markets, and even worse prospects for the future, is simple. Invest elsewhere. But the very idea is shocking to many people.

That’s one thing we’re trying to change at Zero Hour Alert. We’re calling our suggestions Undying Wealth. The assets we profile “must be scarce, portable, valued by humanity for a considerable period of time, and impossible to default upon.”

My Capital & Conflict colleague Boaz Shoshan laid it out brilliantly in our recent Zero Hour Alert monthly issue:

I can almost guarantee you won’t be familiar with at least one of the recommendations. These are well outside of the mainstream financial industry – we’re not talking about individual stocks, bonds, or investment funds here.

But while they’re out of the ordinary, they’ve actually been around for a very long time. In fact, the youngest of these assets dates back to the Mayan civilisation in the 10th century! The other has been around for an awful lot longer.

During their lifetimes, while banks have defaulted, monetary systems changed, wars fought, and currencies died… they have endured. These are tangible assets outside the financial system, which can be loaded into the boot of a car, transferred anywhere without anybody knowing… that still have great investment prospects.

In this issue, we present undying wealth.

If you’re interested, you can subscribe here.

Diversification away from the financial system is an extremely good idea for a very long list of reasons. But what people don’t realise is that there is plenty of choice that allows you to focus on what’s important to you.

Low risk? High risk, high return? Tangible, portable, tax efficient, and consumable, there’s something for everyone.

Of course, you’ve probably heard about our favourite. But it’s been much maligned.

The worst argument against gold

It’s odd how investment professionals who agree on everything can still come up with contradictory investment advice. This is especially true for gold – the most polarising asset around. It’s as if people take a position on gold first, and then decide how their other beliefs relate to the yellow metal.

Let’s take a look at a particular argument that gold detractors like to make: gold doesn’t do well during deflationary times, and that’s what we’re in for.

To prove the point, they point out how central banks have failed to generate inflation in Japan, despite extraordinary central bank policy attempts.

The Nikkei index lost 80% of its value from 1989 to 2009 and is still down more than 40%. Property is worse thanks to leverage.

Thus, don’t invest in gold because we’re in for deflation.

Do you spot the hole in the argument? It didn’t mention the performance of gold in Japan…

Instead, the people who argue along these lines just assume that the constant deflation made gold a miserable investment.

It’s an odd oversight. Until you realise how the truth makes the argument look rather silly.

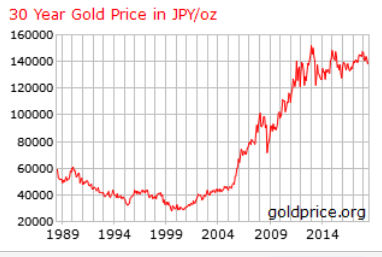

Gold priced in yen more than doubled during Japan’s deflationary period. Especially when inflationary monetary policy began.

Source: goldprice.org

Compare that to the Nikkei index and property values and you can imagine how relieved gold investors are.

While gold detractors continue to use the false Japanese example, Japanese pension funds clearly aren’t listening. The Financial Times reports that “JPMorgan surveyed 123 Japanese corporate pension funds and found that the average allocation to alternative investments reached a record 17.1 per cent in March, up from 11.4 per cent over the past five years.”

Japan’s investors are sick of low returns in mainstream assets too. And are looking elsewhere.

For more on gold’s prospects, check out the latest Gold Podcast here. Boaz and John Butler examine the manipulation of the gold price and what it’s really like inside a Swiss gold vault.

I hope today’s Capital & Conflict encourages you to open your mind to the world of investing outside the financial system.

Not only do you need to realise the reasons for sticking to financial markets are bogus, as we explored yesterday, you also need to know that the arguments against investing outside the system are often wrong too.

If you’d like to expand your investment horizon, why not go on that journey with Boaz and I in Zero Hour Alert? This week, we’ll show you how. And why you’ll wish you did. Keep an eye on your inbox.

The right way to play the stockmarket

Not that you should abandon stockmarkets altogether. It’s just that you need to adjust how you think you can profit from them.

Yesterday we also looked into how retirement savings now dominate financial markets. In fact, financial markets are practically pension funds.

That makes things interesting because the behaviour of these funds is predictable. They invest on days when money floods into the fund from salary takers across Britain, for example. And that flow moves markets. A move you can profit from in a simple, easy to understand and straightforward way.

Because you’re much smaller and nimbler than a billion-pound pension fund, you can take advantage of flows like these, to the tune of £11,420 profit a month.

Find out more here.

Until next time,

Nick Hubble

Capital & Conflict

Category: Market updates