It’s called “good news or bad news”. I’m going to reveal news to you. And you have to guess whether it’s good or bad.

The point being that you’re guessing. I don’t know the answer either. So don’t try too hard…

The US’ trade deficit with the world shrunk 15% in March compared to February. That’s in the face of an anticipated increase. Jobs and exports performed surprisingly well.

Good news or bad?

Let’s dig a little deeper.

February, the month before, saw the biggest US trade deficit since the financial crisis. But March saw the biggest drop in the deficit in terms of dollar value, also since the financial crisis.

Is Donald Trump’s trade war working? Are imbalances rebalancing? Is it good news or bad?

Trump is far from finished with trade. His team is in China, renegotiating trade deals. The first comments from the negotiators are making their way to journalists now. And the lack of bad news was enough to make stocks jump yesterday.

So it looks like good news wins in the trade wars.

But is it really good news if Trump manages to get the US trade deficit to narrow?

Related to this is the recent surge in the US dollar against a basket of other currencies. It’s up over 3% since mid-April.

Good news or bad news?

Remember, the US dollar is still the world’s reserve currency. An American trade deficit implies the world is being flooded with US dollars. It’s like quantitative easing (QE) for global trade.

If the deficit shrinks, or the US dollar rises in value, it’ll be like quantitative tightening on trade. Not just trade with the US, but global trade.

So it could be bad news.

A spike in the US dollar also messes with countries and companies that have borrowed in the foreign currency. It makes repaying more expensive. Already, bond investors in emerging markets are trying to escape. They pulled out $1 billion from EM bond funds last week.

Stocks aren’t giving you many hints about whether all this is good or bad news. The Dow Jones Industrial Average bounced off its 200-day moving average overnight. It’s still the worst start to a calendar year since 2009. But that’s also the year the recovery began. So is it good or bad?

Let’s turn to the UK.

Round two

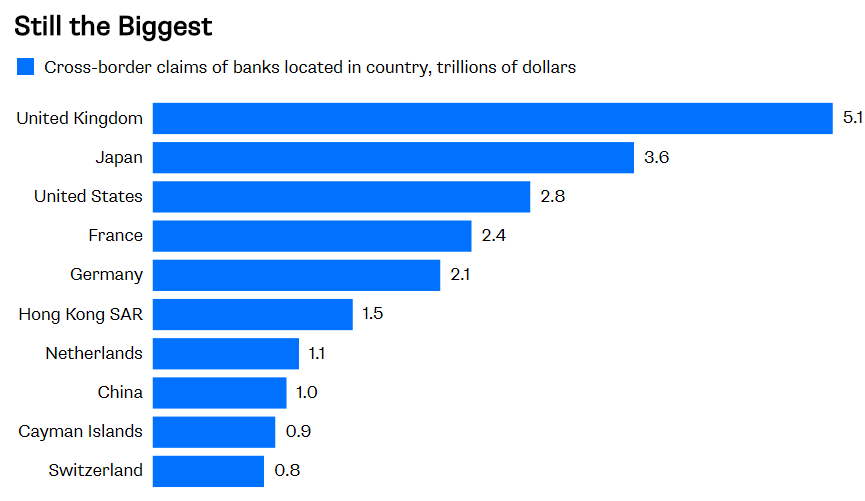

Bloomberg columnist Mark Whitehouse points out that cross-border lending by UK institutions has risen since Brexit. More recently at the fastest pace since before the financial crisis.

Good news or bad?

The trend amounts to the UK banking system being the world’s biggest international lender. And by quite a margin.

Source: Bloomberg and Bank of International Settlements

Source: Bloomberg and Bank of International Settlements

Is that good or bad? Do you want to live in a global financial centre? Do you want your key economic institutions to have vast debts owing to them?

It leaves us more than a little vulnerable if there’s any sign of trouble. A 30-year downtrend in interest rates provided an epic debt bloom that Britain profited from. But if things turn…

What about Brexit? Is it good news or bad?

With wonderful irony, Whitehouse also explains how disastrous Brexit will be for Britain when there’s an exodus of financial firms.

It makes perfect sense. Our closest competitors in the global lending market, the US and Japan, are EU members – their secret to success. And the UK rose to its position as a financial centre when it joined the EU in the 19th century. Thank God we remained in the European Monetary System in the 1970s and went on to join the euro…

Where would we be without the EU? Certainly not a financial centre…

But back to the relevant question: Is the UK’s status as the world’s lending hub good or bad? Do we want to be in this position?

The trouble is that every boom and bust around the world is felt in London’s financial markets. And thereby felt in the UK.

To be honest, it’s why I’ve decided to be here, writing this newsletter. It’s also why we’ve recently published the biggest warning in the history of Capital & Conflict’s publishing company.

Four times worse than Lehman Brothers…

Ten times worse than Greece…

And 30,000 times worse than the Asian financial crisis…

You can find out more here. You’ll also discover just how intertwined the British financial system is with the world’s welfare. And how reliant the rest of Britain is on the financial system’s welfare.

If we’re right about the world’s biggest bankruptcy, things are going to get nasty.

But back to our game of good and bad news.

Europe’s bad news

Over in Europe, inflation is slowing. Good news or bad?

Lower inflation used to be a good thing. But since 2008, central bankers have been trying to raise inflation. So the answer to this one seems obvious at first: lower inflation is bad.

Growth expectations are slowing alongside inflation. Unemployment didn’t fall from February to March, stuck at 8.5% for the eurozone. If prices stop rising because GDP is slowing, it’s bad news.

But it’s not that simple, even then.

Inflation tends to bring on tighter monetary policy – something Europe could not afford right now. So the good news is that the lower inflation has pushed back the expected interest rate increase.

But is that truly good news? The interest rate in Europe remains at 0% and QE continues. What if the economy slows now, without the ability to cut rates?

Stop playing games

The good news or bad news game is a distraction. And not just because the definition of good and bad news is subject to change.

The question is what sort of world we live in.

One where the free market is in control in the end, with authorities able to delay a reckoning at best. Then bad news really is bad, eventually.

Or are the authorities actually in control? QE to infinity actually works and debts don’t matter. Any news is good news.

It’s time to take a side. Because the latest test of financial market mayhem is about to surprise the authorities. And this time, they might not be able to prevent the fallout.

If you want to know what’s coming, you can find out here.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Opt out of the blunder from Down Under

- The pension panic is coming

- There will be a little pain in the stockmarket

Category: Economics