It’s been an interesting week in financial markets.

FTSE: flat. Gold: up. War stocks: up. As I write, cryptocurrencies are catching a bid again.

If your portfolio is in the green today, you’re probably a cynic, or as the Americans might say, a “wing nut”.

But being a wing nut can pay. The very first time I wrote to you in Capital & Conflict (nearly a year ago now), I suggested that cynical readers may be interested in a certain investment fund. You can see its performance since then below.

The reason I recommended it was to profit from Machiavellian wars started by the government to bind society together under their rule. This might not have occurred just yet, but this cynicism has certainly earned its keep in a portfolio.

The companies within this exchange-traded fund – weapons and military equipment manufacturers – have had a great run. And with the proxy war in Syria between the US and Russia becoming more open… and our own government wanting another go at blowing up the Middle East… the future remains bright for the dogs of war.

What do you think about British involvement in Syria? I’d love to hear your thoughts: [email protected].

The perpetual, evergreen nature of the war on terror has fed the war dogs well.

Not to mention the drones of war, which are also “evergreen” in their involvement in war, according to Military Times:

Drones are a big part of how every [branch of the military] sees war in the future playing out, and from cheap scouts in the field to elaborate lasers built to shoot down hostile drones, the notion that drone war is a separable part of warfighting can largely be laid to rest. Drones are an evergreen part of war, now.

Ever since 17 September in 2001, when the first armed Predator drone flew into Afghanistan, the drone industry has continued to soar. Naturally, our tech specialist Sam Volkering has recommended the stock of a tiny company in the drone space for readers of Revolutionary Tech Investor to take advantage of the trend, which is accelerating: the US Department of Defence (DoD) has requested the US Treasury buy the military three times as many air, sea, and land drones next year as this year.

The Americans are looking to expand their smaller drone arsenal, rather than their fleet of massive Alien-esque “Global Hawks” and “Reapers”, the former of which costs more than a hundred million dollars each. What they’re after instead are smaller, more “user-friendly” models.

On the DoD’s shopping list are more than 1,500 Switchblade drones for example. These are two foot long and can be launched almost anywhere from a small tube. They’re essentially small electric guided missiles, which can be controlled until impact by a human with a remote.

They’re made by the company AeroVironment ($AVAV) – the shares have jumped on the news of the request.

But let’s zoom out a bit. Where will the money come from to purchase all these drones, and fight the evergreen “war on terror”?

The US Treasury. Where will it get the money? The US taxpayer is first up, of course. But most of the money will need to be borrowed. Which is where things get interesting.

Rome cracks

The US government is more than $20 trillion in debt. For those wondering what that actually looks like, click here.

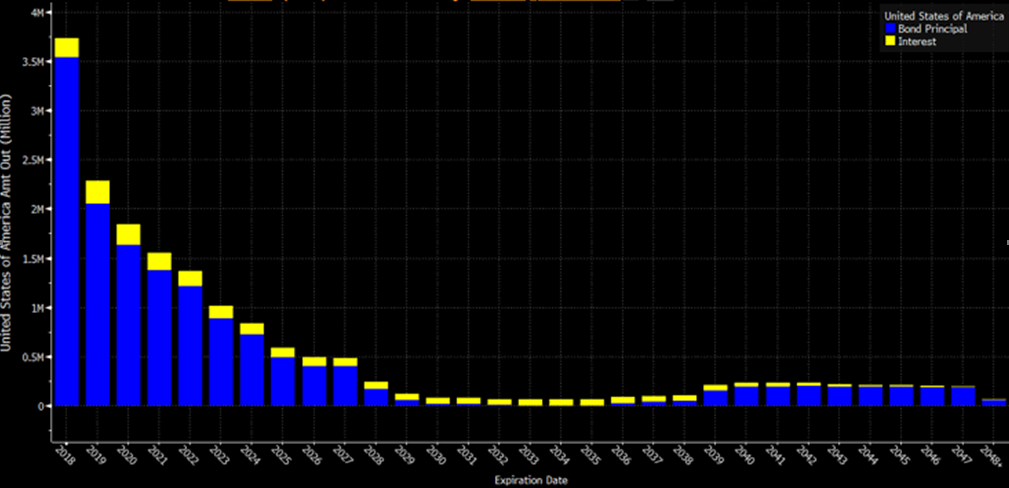

The chart below illustrates just when all this debt comes due. As you can see, the overwhelming majority of it must be paid in the next five years, with a huge chunk just in this year alone.

The US Treasury will do what it always does to deal with this year’s debt: borrow more to pay it off, and push the problem on to next year, or later.

This process of “rolling over” debt can be done quite cheaply when interest rates stay the same, or are cut. However, as the Federal Reserve has hiked rates several times, and says that it will continue to do so, this process becomes much more expensive as the US Treasury must borrow more, at higher rates of interest.

Should the Fed continue to hike rates aggressively, the costs of the rollover will accelerate higher. The Fed will create a problem for the Treasury, as more and more of the US budget will need to be directed to paying interest on their debt. $400 billion more is to have been borrowed by the end of this quarter.

When the Treasury borrows huge amounts like this, the supply of dollars dries up. The Treasury bills the government issues sucks up liquidity like a sponge, as money that was doing nothing is drawn to highly liquid instruments that yield a return – this is what is being blamed for the rise in Libor which I highlighted a couple of weeks ago.

But interestingly, this hasn’t happened this time. This is the dollar index, which measures the value of the dollar against other currencies.

Higher interest rates and an abundance of debt issuance should be strengthening the dollar. But it is weak. Despite the bullish environment for the dollar, currency markets aren’t valuing it very highly. It is of course much too soon to say that it is being abandoned, but it does make you wonder if the tide is shifting for the dollar – and the US.

The fall of the Roman Empire is often characterised by expensive foreign wars, and the constant devaluation of the currency.

With the American Special Forces deployed in 149 countries in the world in 2017, the US is running out of places to assault in the name of fighting terror. To call its war “expensive” would be an understatement, as is reflected in the number of zeroes in the US debt figures.

As for the devaluation of the currency, the dollar has gradually lost almost all of its value since the inception of the Federal Reserve System in 1913. There haven’t been many sharp and savage downturns – but Rome didn’t burn in a day.

Until next time,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Economics