Well, that worked. But has it really? I’m not so sure.

The mainstream financial world has elbowed in on the bitcoin bonanza. Cboe Global Markets launched bitcoin futures on Sunday. After two days of trading, it seems to be a roaring success.

At one point, the bitcoin futures price rose so fast, the exchange had to put a halt to trading. The 26% jump doesn’t sound like much in terms of bitcoin, but it was over a short space of time.

Next Monday, the Chicago Mercantile Exchange (CME) will launch its own bitcoin futures. The CME is far more liquid than the CBOE, so it’s more of a test.

We should probably take a step back to explain what futures are. Here’s the short version, which doesn’t include olive oil futures during Aristotle’s time.

Back in colonial America’s fur trading days, trappers would try to sell their fur before going out to hunt for it. This guaranteed them a price and made the whole supply and demand equation a lot more stable for everyone. They knew their expedition would be profitable before they went on it. The supply and demand dynamics of the fur market were settled before anyone took off into the wilderness.

People stopped going broke because they couldn’t cover the cost of their expedition when the fur price crashed as everyone arrived at the market at the same time – towards the end of hunting season.

And they stopped killing animals needlessly as often because surpluses became smaller or rarer.

Then again, the more efficient system probably encouraged the industry to grow faster, so more animals died. Still, there would’ve been less waste.

The contract between the buyer and seller to exchange a set amount of something at a fixed date and price in the future was called a future… because it would settle in the future, but on terms agreed beforehand.

As always, when you’ve got a good thing going, the financial sector barges in. At first, it’s an enabling mechanism. The futures market worked thanks to willing speculators and market makers providing liquidity. Their willingness to trade meant a more transparent market, without as much price volatility. Everyone got close to the same price, encouraging fairness too.

But then people from outside the industry started speculating on the price of fur by selling futures without the intention of ever going hunting. Or buying futures to speculate on the price rising, without ever intending to use or buy the fur.

Instead, the speculators would buy and sell the fur they’d contracted for from other traders on the date it came due. They traded “on the spot” to meet their obligations in the futures market, hence the name “spot market”.

These speculators became known as bears because they often bet on the price of bear fur falling as the hunting season wore on. If it did fall, they could buy cheaply on the spot market what they had contracted to sell at a higher price on the futures market at the beginning of the season. They made money without having to go hunting.

The bull and the bear terminology we often talk about in investing actually comes from the pit fights that used to be staged between the two animals. The pessimistic sellers were the bears from the futures market, so their opponents became known as the bulls.

So a futures contract is the agreement to buy and sell something at a specified date in the future. These days, most futures settle financially, not by delivering the underlying good. So they are now just financial punts.

Even the proper users of futures just use their profits or losses in the futures market to balance out their sales and purchases in the spot market. The end result is the same as if they’d delivered on the futures contract.

Bitcoin futures hit the market

Futures contracts in bitcoin follow the historical precedents of other futures.

The CBOE offers bitcoin futures expiring in January, February and March. The reference price is the one on Gemini, one of the major bitcoin exchanges.

One contract is for one bitcoin, which gets rid of the usual confusion when it comes to contract sizes in futures markets. The contracts settle for cash, not bitcoin. So it’s a punt on the bitcoin price, not an agreement to exchange bitcoin in the future.

In other words, if you buy a February futures contract, you agree to buy one bitcoin at a specified price in February. If you sell one contract, you agree to sell one bitcoin in February.

When February comes along, you don’t actually mess about with buying and selling bitcoin, you just pay or receive the amount of money that you would’ve made or lost had you actually carried out the transaction. You settle for the difference between the pre-set futures price and the spot price at the time of expiry.

What makes the bitcoin futures different is the margin. This is the amount of money you have to deposit with the exchange or broker as a sort of collateral. If you refuse to pay up, or go broke, they at least get some of their money off you.

The usual margins for futures trading are small. But the CBOE requires 44% margins when it comes to bitcoin futures. So you have to front up 44% of the value of your futures position.

This means you can’t gain much leverage to the bitcoin price by buying futures. It costs too much in terms of the margin that remains in limbo until the contract expires.

You’ll probably never bother with bitcoin futures. But that doesn’t mean you should ignore all this. For example, the futures market creates a curve of expected bitcoin prices in the future. That’s because people buy and sell the futures to match their price expectations for bitcoin. It become a predictor of bitcoin price action.

The March 2018 contract traded at $18,830 while the bitcoin price in the spot market was just below $17,300. That implies the price will rise by March.

And there are other reasons to keep an eye on all this…

Is the future of bitcoin at risk?

The problematic aspect to all this is that bitcoin futures are likely purely speculative. A gold mining company might use gold futures to secure a price for its production – a benefit in a world with a volatile gold price. The same goes for agricultural goods, other metals, and even weather events.

Futures are supposed to serve an economic purpose. Even though it takes plenty of speculators to make a futures exchange work, so that users have plenty of willing counterparties, it’s not good if there are just speculators in the market.

The bitcoin futures market, as far as I can tell, is purely speculative. Who needs to secure a bitcoin price, after all?

Perhaps the bitcoin whales need to. With 1,000 people owning 40% of all bitcoins, these guys might use the new futures market to escape. By selling bitcoin futures, they effectively guarantee themselves a sale price, without upsetting the fragile bitcoin market. Then they dump their bitcoin, safe in the knowledge that the futures market has them covered for the resulting crash in prices.

Another problem is whether the futures market will begin to drive the bitcoin market instead of the other way around. That’s what’s happened to the gold market, where futures speculation sets prices instead of gold market dynamics.

According to the Futures Industry Association, the banks are not happy about the rapid adoption of bitcoin futures. There wasn’t any time given to argue against it. Good old competition between the CME and CBOE did the job nicely.

As the Financial Times explains, the opposition to the bitcoin futures risk getting left behind:

“Bob Fitzsimmons, head of Wedbush Futures, a non-bank broker, said his company would back both the CBOE and CME products from day one. “We could sit for hours and have a philosophical debate about bitcoin and its legitimacy and uses, but our job is to service our customers,” he said.”

Give ‘em what they want – good and hard…

Already there’s an issue with pricing disparity. There are so many bitcoin exchanges in so many countries, all with their own prices, that the bitcoin futures market has no clear reference point. It chose the Gemini exchange, but that still leaves an enormous disparity with other exchanges.

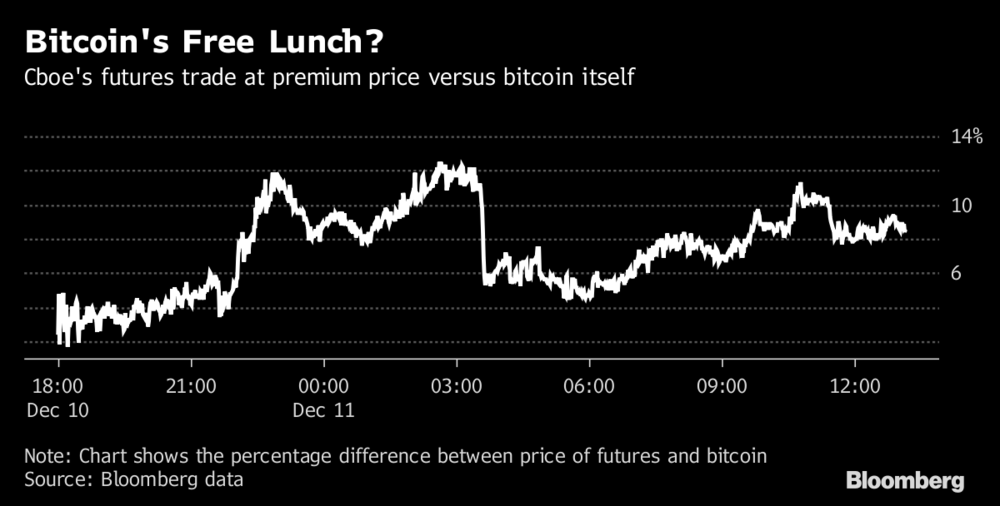

Not to mention the 13% price gap which opened up between bitcoin futures and the actual bitcoin price on Gemini.

What sort of influence bitcoin futures end up having on the bitcoin price is something we’ll have to find out the hard way. But as the financial world jumps on bitcoin’s back like the parasite that it is, you can bet there’ll be trouble.

Meanwhile, plenty of companies are turning the technology behind the cryptocurrency boom into an entirely new boom. One that could match the bitcoin bubble in terms of profits, without the bubble at its core.

Find out more here.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Bitcoin offers you a holiday in South Korea

- Are ICOs the new Stockmarket?

- Bitcoin Bashing is the Bubble

Category: Investing in Bitcoin