The season for “sell in May” articles is fast approaching. Before you know it, everyone will be writing one.

Today we put aside our usual contrarian stance and join the herd.

We consider the strategy, we look at the record over the years – and ask whether we should be applying it this year…

Tis the season to invest your Isa allowance

You might have noticed that I’ve been absent from these pages this last month. Have you missed me? I thought so.

This August, I’m going to the Edinburgh Festival. It’ll be the first time I’ve been since 2003. Rather unwisely – and against the advice of everyone, be they friend, foe, family or my agent – I’m taking two shows up.

One is going to be on financial matters – on the zeitgeist subject that is taxation. The other will have nothing whatsoever to do with money, except that, like most performers up there, I will return considerably less wealthy than when I set off.

Two shows take a lot of writing, so John very kindly gave me a month off my duties. I’ve vaguely reached the end of the first draft of one, but it is no more finished than Britain’s membership of the EU. The other? That’s about as incomplete as the latest Treasury forecasts about the cost of Brexit.

But this week I’m back, and I find myself with this year’s Isa (Individual Savings Account) allowance to invest. I’m planning to invest it in the most boring, low-risk, low-cost tracker fund I can find.

But me being me, rather than buying and forgetting, I’m looking at the stockmarket and thinking, “Hmm. It’s had an exceptional run these last three months. It’s due a correction. You usually get a correction at this time of year. Maybe I should wait a bit.”

So should I wait? And all you canny investors who’ve been long the stockmarket these past few months and made masses of money using leveraged, bullish bets, should you be taking money off the table?

Does “sell in May” work?

“Sell in May and go away, come back on St Leger’s Day”, runs the maxim. St Leger’s Day refers to a horse race – the St Leger Stakes – which falls this year on 10 September.

The Americans have adapted the maxim, abandoning St Leger for Labour Day, which falls on 5 September. The logic behind the phrase dated back to a golden age when the summer holidays lasted a lot longer. While those that trade the market were on their hols, action was limited and the markets went to sleep. You only wanted to be invested when they were awake.

Of course, in today’s 24/7/365 world, extended holidays are a thing of the past (unless you are writing an Edinburgh show) and so the underlying logic no longer applies.

That said, there does seem to be some kind of tradable pattern – and, if the whole thing was hocus pocus, the world wouldn’t be so obsessed with it. Probably.

Trouble is, there have been loads of studies, and they’re inconclusive. Some insist the strategy works, others that it doesn’t.

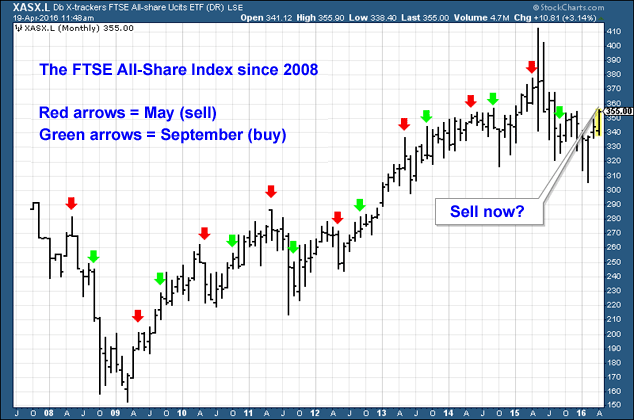

I’ll let you conduct your own ten-year analysis. On the chart below I’ve drawn the FTSE All Share index since 2008. I’ve marked the month of May with red arrows. The small horizontal tick on the left side of each bar marks the beginning of the month, the one on the right side marks the end.

The strategy could have saved you a fortune in 2008 – if you didn’t buy back in September.

In 2009, it meant you missed out on a monster rally.

In 2010, it kind of worked – the market traded sideways over the summer and you would have edged a few percent.

In 2011, it worked again, though October would have been a better time to buy.

In 2012, you lost a few percent. There was a similar story in 2013, while in 2014 you edged a few percent.

In 2015, you beat the market quite nicely, but would have probably had a heart attack in June and July.

In short, the strategy, followed to the letter, works some of the time, but it’s probably not worth the effort.

The real problem is, once you are out of the market, what strategy do you have to get back in? Waiting till September might not always be appropriate. Sometimes the better buy might come in June, July, August or even October (as was the case in 2014).

So what about this year?

This year we have the small matter of the Brexit vote, which is going to create volatility. Despite being a “Leave” supporter, my belief is that “Remain” will win. That’s a belief that’s confirmed by the bookies.

The pound is in a rotten bear market, so the forex markets are clearly not in favour of Remain, but the stockmarket doesn’t seem to mind. If Remain wins, there’ll probably be a small relief rally in both, though in the longer term Leave, in my view, will be much better for the economy.

In short, that would suggest that the risk here is in being out of the market.

But bearish thoughts keep creeping into my mind, particularly when I look across the pond. Where the American indices go, the rest of the world will follow. And given that hocus-pocus cycles are the order of the day, how about this one? In the final year of a two-term presidency, markets usually top in April-May.

Well, following the spring’s monster rally, we’re at just such a point where markets could top.

So I think I’ve decided what I’m going to do with my Isa money – and I think my decision will rather annoy you, as it’s a classic opinionless compromise. I’m going to put half to work over the next week or two, and the other half in September.

Right. Back to those Edinburgh shows.

Category: Market updates