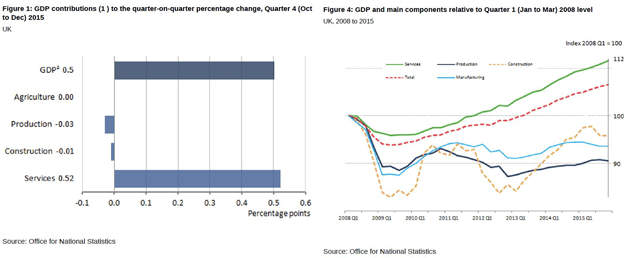

Stocks may get a further boost from the preliminary GDP figures released this morning by the Office for National Statistics (ONS). ONS says UK GDP grew by 0.5% in Q4 2015. That followed a 0.4% increase in Q3. That’s 12 consecutive quarters of growth, which isn’t bad given that the world’s in a slow motion deflationary depression.

If you break down the numbers, you’ll find Team UK is not getting an even contribution from everyone. The services sector stars. Agriculture plays a best supporting actor role. If they were top order batsmen, production and construction would be in danger of getting dropped.

This has been the case since 2008. The recovery in the UK, such as it is, is a services recovery. That’s important if you’re assessing the impact of Brexit. It’s also important when you’re talking about the current account deficit. If the service sector falls and GDP growth stalls, the pound could fall further (and faster).

‘Services’ is not code for sandwich makers at Pret A Manger. It’s the City, mostly, and the various accounting, legal, banking, and other similar support services required to the financial centre of Europe. As Lord Lamont pointed out this week, it’s not easy to replace all that in the blink of an eye (yes I’m talking to you Dublin, Frankfurt and Milan).

Category: Market updates