Over the weekend, I sent you a note with the subject line “Stop them at Calais”. That was a briefing in which I made a direct point: the political crisis generated by the European Union is a clear and present danger to your quality of life. But more urgently: a threat to your wealth.

That note went out before Saturday night. What happened next? A group of migrants – led by British anarchists, apparently – stormed the Port of Calais and boarded the ferry Spirit of Britain. The port was briefly shut down and 35 “activists” were arrested.

The longer the Brexit debate goes on, the more migration and the viability of the EU will come into question. But what about your money? How is your portfolio connected to the politics?

Is Brexit a clear and present danger to your wealth?

Analysts at Credit Suisse had a go at answering that question in a research report. Words like “unclear” and “ambiguous” were used. But it was the analysis of stocks that caught my eye. The report said that the “immediate” impact of Brexit was “Negative for UK domestic cyclicality, Scottish exposed stocks and the FTSE 250 relative to the FTSE 100”.

What’s implied in that statement is that if it looks like Britain is ready to bolt the European Union, Credit Suisse believes investors will start to worry about Scotland bolting the United Kingdom. You’d have a “flight to bigness” on the UK indices. Investors would flee to blue chips and weather the political storm until the clouds cleared.

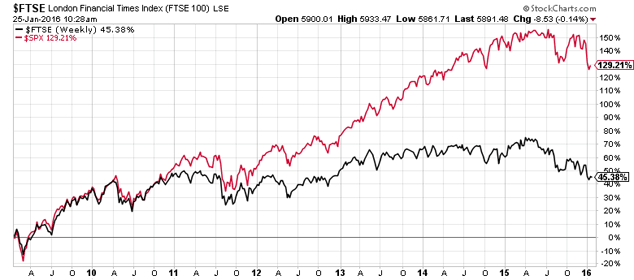

Over the “medium term” (defined as two years more), the report concludes that “An extended period of sterling weakness could start to reverse the multi-year underperformance of the FTSE 100 relative to global equities”. That’s why I included the chart above.

Sterling weakness

The FTSE has some catching up to do, at least relative to the S&P 500. If “sterling weakness” makes British exports more competitive and British assets (stocks and bonds) cheaper to foreign investors, it could do some of that catching up. So what should you do?

The answer to that is beyond the scope of my reckoning in Capital and Conflict. It’s exactly why Charlie Morris is the investment director of the new Fleet Street Letter. And it’s exactly why his first few reports to his new readers are about dealing with Brexit now, and for the rest of this year.

Category: Brexit