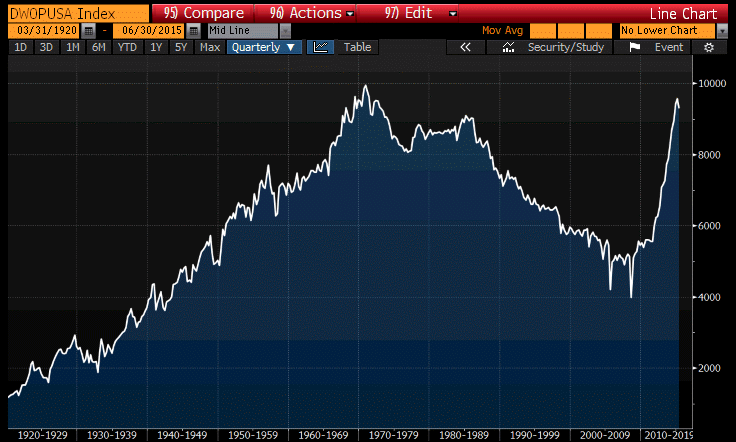

The chart below shows you how credit growth, real assets, and investment forecasting are all related. And why making money in markets is so hard.

My colleague Charlie Morris whipped up a long-term chart of daily US crude oil production going back to the days of the East Texas oil boom to now. Anyone familiar with the ‘Peak Oil’ theory will recognise Hubbert’s Peak. That’s geologist M King Hubbert’s forecast that US oil production peaked in the early 1970s.

For a long-time, Hubbert looked right. A graph of global oil production looked remarkably similar, only the peak was later, in the mid-2000s. So what happened? A technical revolution and a credit boom happened.

The high oil price signal worked. It told producers and would-be producers to go look for oil. But oil, like gold, is where you find it. Finding it can be easy. Extracting it profitably can be really hard. What changed in the last six years?

The first thing that happened was that US drillers combined hydraulic fracturing with horizontal drilling. This created a boom in natural gas.

Prices there have fallen and are still falling

But then the energy industry go to work unlocking shale oil in places like North Dakota. The technology made it possible to recover oil that wasn’t previously recoverable. You could also use it to increase the recovery rate on more traditional oil fields, pumping out dregs. Production boomed.

You could only do all that, however, if you had access to cheap finance. And that’s what Ben Bernanke and Janet Yellen made possible. It’s ironic, actually. People say things are ironic all the time. But let me explain…

The cheap credit made available through low Fed policy turned into low-cost debt financing for the energy industry. That, in turn, turned into lower energy prices for consumers and producers. The irony is that low energy prices have kept consumer price inflation from rising to the 2% target the Fed hoped to achieve by lowering rates in the first place!

That’s the delightful thing about unintended consequences and low interest rates

Central planners can’t control micro-economic behaviour. At least not until we move to a cashless society with negative interest rates.

Until the technology of micro-coercion is brought to bear on your savings and your bank account, monetary officials can’t yet force you to spend your money when you don’t want to. Nor can they force you to borrow more when you’d rather save. Nor can they decide where credit gets allocated when rates are low.

Wall Street allocated credit to the shale boom. The windfall from lower energy prices was passed on to consumers. That had the unintended consequence of keeping rates low for even longer. And that fed the boom in corporate debt (which is now blowing up in the junk bond market) and the speculation on earnings growth from Fangs and Bagels (which is now blowing up growth stock prices in the positive way that things can blow up).

What you should watch for in 2016 is when the oil market breaks

The price war between the Saudis, the Russians, the Americans, the Iranians, the Nigerians and the Venezuelans can’t last forever. The low-cost producers usually win out. And when you have state-owned oil producers in the race, they can sell at below the cost of production for as long as they like to win market share. Profit and loss is for free markets. Subsidising loss-making ventures to secure long-term national advantage is for command economies (even if they are less efficient at running a business at a profit… but that’s what happens when the profit motive is replaced by the ‘power motive’.)

But there’s always the chance that the oil-price war turns into armed conflict. That might happen when the race to the bottom in the oil market starts affecting government deficits and national income. And that could happen next year – if the supply-demand gap in oil grows and leads to a price drop in the mid-20s.

It’s all connected. It’s all complicated. Complexity plus interconnectedness increases the chance that 2016 is going to be an eventful year in the energy markets. Tomorrow, more on how benign CPI figures could blow up with higher oil prices and send inflation (and UK interest rates) much higher than anyone is expecting.

Category: Geopolitics