My, how your world can change over a few days. Addressing events in Paris over the weekend is beyond the scope of today’s Capital and Conflict. That’s not a dodge. Things have changed. We have to be thinking about how, and why, and what is likely to happen next. We are thinking about those things. And we’ll address them later this week, after more thinking and an appropriate amount of respect for those who are injured and grieving.

On a personal note, Paris and London are great cities. What they have in common unites them more than separate languages, geographies, and cultures. The world’s great cities are open, active, bustling, commercial, artistic, and international. An attack on one of them is an attack on all of us.

There will be a time to sort out the wider implications for Europe, for Britain, and even for whether enhanced ‘investigatory powers’ can prevent these events. But we’ll save all of that for later in the week. Today, we’ll focus on the mundanity of the financial world, which grinds on.

Japan still in recession

Japan’s economy shrunk at an annualised rate of 0.8% in the third quarter, according to official data. That’s two consecutive quarters of ‘negative growth’. And as we all know, when you have two consecutive quarters of ‘negative growth’, you have a recession on your hands.

No one anywhere should be surprised by this. Part of the fault lies in measuring economic health with GDP as a metric. Charlie Morris and I have discussed this in the past. It’s an antiquated notion that measures the quantity of activity, not the quality.

For example, capital investment fell by 1.3% in the quarter. Japanese business is not investing. Why would it? It’s a country in a seemingly irreversible demographic decline.

On a GDP basis, you can make up for a fall in business investment with either a rise in personal consumption or government spending. Consumption did rise by 0.5% by in the quarter. But not enough to make up for the fall in business investment. And government spending?

If you ever needed proof that government spending doesn’t create wealth, you have it in Japan. They borrow and borrow and borrow and spend and spend and spend. And what has it produced? Not a lot.

China has a seat at the table

In less than 40 years, China has gone from communist orthodoxy to having its currency included in the International Monetary Fund’s (IMF) Special Drawing Rights (SDR). Has there ever been a more rapid ascendancy from poverty-inducing central planning to a growing prosperity for over a billion people? Probably not.

IMF head Christine Lagarde said China’s yuan now meets the requirements to be a ‘freely usable’ currency. That’s one of the requirements to be included in the basket of currencies which make up the SDR. The others are the US dollar, the euro, the Japanese yen, and the British pound.

To be in the ‘basket’ is to be in the ‘club.’ The club is where the rules of the global monetary system are made. Your influence is proportionate to the size of your economy, the amount of trade you do with the world, and the number of investors and central banks who want to own your currency as a ‘reserve’ against future catastrophe. Note the pound is in the club along with the euro.

Corporations as countries

Finally, a quick follow up to something Charlie said on Thursday’s Capital and Conflict podcast. He pointed out that some companies now operate, in effect, like sovereign states. The comment came up in the context of Microsoft allowing customers to warehouse their data in European-based servers, away from the prying eyes of America’s National Security Agency.

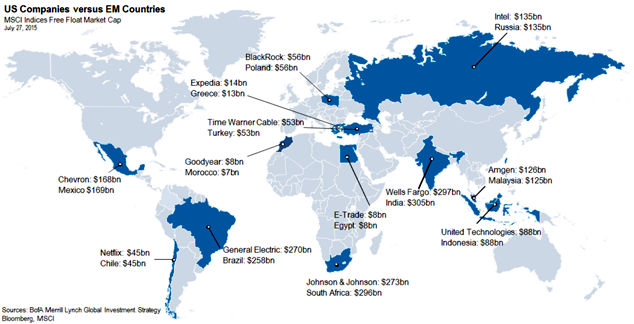

Check out the chart below. It confirms what we discussed. Netflix is larger than Poland and PayPal is larger than Chile, according to a chart reproduced below, courtesy of Bank of America/Merrill Lynch. Some of the comparisons are fanciful. Some are thought provoking.

As an investor, you can take two things away from this. The emerging market economies are probably way over-sold when analysts are suggesting a single company is worth more than an entire economy. If you’ve got thick skin and steady nerves, you’d be looking closely at emerging markets right now.

Second, these global juggernauts fall into roughly two categories. The tech companies have enjoyed soaring market valuations based on a love affair with tech. Their principle competitive advantage is software. They are to the information age what the railroad companies were to the industrial age.

But other companies, like KraftHeinz, these are truly global brands. They have the ability to produce and sell product almost anywhere in the world. They enjoy huge economies of scale. In evolutionary terms, they may be more ‘fit for purpose’ than many nation states.

You could put together a portfolio of those global ‘City States’ and come up with some strong names. Those names would provide you with geographic diversity and currency diversity. Your only big bias would be toward ‘bigness.’ But the bigness bias might be a survival strategy in today’s world.

Category: Geopolitics