Today we abandon sensible investment thinking and head into the realm of the speculative punt.

We forsake the long term in favour of the short.

We ignore prudence and we bow to greed.

We are even going to sell what isn’t ours in the hope of financial gain.

In plain English, I’m looking at a shorting opportunity.

The lowdown on short selling

Let’s start with a quick explanation for those new to the game.

If you invest in something that you think is going to rise in price, you are ‘long’. But if you’re betting that something is going to fall, you are ‘short’.

That, my friends, is the long and the short of it.

Short sellers have garnered themselves a mixed reputation over the years. When they get a big bet right, they can acquire near-legendary status among investors.

George Soros famously brought the Bank of England to its knees back in 1992, placing large bets against sterling just as they were trying to prop it up so we could stay part of the European Exchange Rate Mechanism. (He might have actually done us a favour – we’d probably be part of the euro now if he hadn’t.)

John Paulson is believed to have earned some $5bn betting against US subprime mortgages in 2008.

Here in the UK we have Simon Cawkwell – aka ‘Evil Knievel’ – whose short selling exposed the fraud of Robert Maxwell’s accounts. He also made a cool seven-figure sum betting on the downfall of Northern Rock. I remember interviewing him shortly afterwards. He was a happy bunny – at a time when many others were not. And therein lies the reason short sellers are not always popular.

Despite their propensity to uncover truths that some would prefer buried, short sellers are often blamed when a company or a market goes the way of the pear. When a market capitulates, you often find that the authorities ban short selling. They banned so-called ‘naked short selling’ in the US in 2008. This August it was banned in China as a reaction to market falls there.

And there is a moral issue. When you are shorting, you are selling. But if you don’t own the stock, you can’t sell it. You have to borrow the stock from someone else. Often that person doesn’t know his stock is being lent out.

Yet those who would be rid of them ignore the enormous risks short-sellers are taking. There is, in theory, no limit to how big and valuable a company or an index or an asset can grow.

Let’s say you sell company X at 100p. If that company then goes to 1,000p, you have lost your initial stake many times over. Shorting can properly bankrupt you. It’s doubly important to get the trade right.

Sure, when it comes off, it’s great. But when it doesn’t, it can get very ugly. It’s because of the risks and the contrarian thinking involved that those who pull it off earn such respect among peers.

The main point for you and me, however, is that if you are on the short side, you have to manage your risk.

So today I’d like to tell you about a short I’ve been looking at and give you some insight into what appeals to me about it. (And I owe this idea to Dave Skarica over at Addicted To Profits, who shared a load of charts with me during a Skype call earlier in the week.)

The anatomy of a short-selling target

The company in question is Skechers (NYSE: SKX). It’s a Californian firm that sells trendy shoes, trainers and boots – you’re probably familiar with it. I don’t think the company is going to zero or anything like that – this isn’t some Enron-style exposé. It’s just a punt, as I believe the stock has got considerably ahead of itself.

Its market capitalisation stands at around $6.5bn and it trades on a price/earnings ratio of 32. Expensive, sure, but given that it’s viewed as a growth and not a value stock, that’s not as bad as it sounds – and it’s not reason enough to short it.

I have also had consultations about the products with my in-house footwear experts – my two daughters. My 13-year-old, probably the more fashion-oriented of the two, says they are, “a bit bad” – which is about as damning an indictment as I’ve ever heard. Surely if you’re going to be bad, you want to be “really bad”. My ten-year-old is a little more forthright. She says they’re “rubbish”.

My own view of the shoes, when I bought them for the feet of my daughters, was that they were pretty cool. Once again, a company’s product is not reason enough to short the company either. Actually, it has various brands targeted at various demographics, not just kids, including Skechers USA, Skechers Sport, Skechers GOrun, Skechers GOwalk.

66% of its revenue comes from the US, where the company enjoys a lot of celebrity-driven advertising. A tie-in with TV show The Voice brought it into the limelight last year.

In fact, 2014 was a great year for the company. Revenue growth was 29% (21% in the US and almost 50% internationally). And the share price has gone bananas.

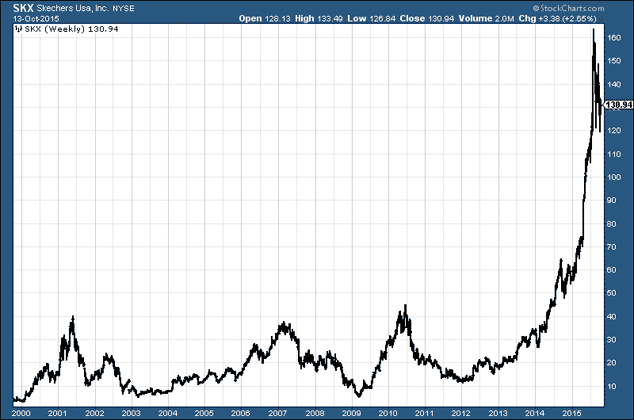

Which brings me to the price action. Here is a chart of the company since 2000.

You can see that from 2000 to 2014 it traded in the same direction as the general markets, in a range between $5 and $43. Then in mid-2014, it broke out and went parabolic. In the last two years, it’s gone from below $30 to over $160 – that’s some move.

I suspect it’s topped for now. If the broader markets get ugly (I’m still ambivalent about that), it could quite easily come back to earth.

The technical indicators that point to opportunity

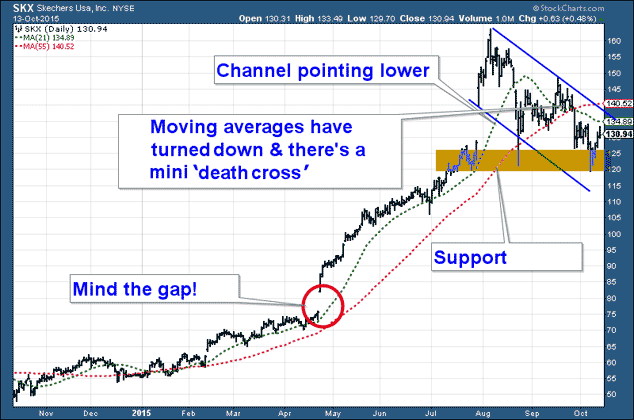

So that’s the big picture. Coming to the specifics of the trade, let’s zoom in and look at the more recent price action. Here’s a daily chart of the last year. There’s a lot to look at here. I’ll do my best to explain it all.

First, on the way up, the price ‘gapped up’ at around $75 (circled in red). Gaps have a habit of getting filled. Don’t ask me why, but they do. So based on price action alone, we have $75 as one target.

Next you can see that, since peaking at $163 in August, an orderly downtrend has taken shape. I’ve defined the channel using those blue tramlines.

This is further confirmed by the moving averages – the 21-day is dotted green, and the 55-day is dotted red. Again I use these to identify direction. On the way up, the price is above them, and they are sloping up. On the way down, as is the case now, the price is below them and they are sloping down.

The 21-day has also crossed down through the 55, known in the parlance as a ‘death cross’, which is another negative sign.

Finally, you have the brown band. This is where the price has found some support. But the more times that support is tested, the less likely it is to hold.

So I’m betting that this trend will continue and the stock will fall further. But what’s my risk?

Managing your risk in a short trade

Small investors tend to sell stocks short via a spread bets, which are high-risk in themselves. Stop-losses are a must. How would I go about deciding where to set one here?

Well, if I wanted a really tight stop loss, I could place it just above the moving averages and the upper blue tramline – at say $143.

Or if I wanted some more breathing space (and could accept the potential for extra loss), then perhaps just above the September high at $150.

My reasoning behind this is that if it gets to either of those two prices, the current trend pattern is violated, and so my trading ‘theory’ is more likely to be proved wrong.

Or I could be really loose and place my stop above the all-time highs at $163. But from my own point of view, I’d reckon that as long as this stays below $150, I’d be happy to be short.

And if this downtrend gets going, this thing could fall a long way. We’ll see what happens.

And if this downtrend gets going, this thing could fall a long way. We’ll see what happens.

Remember that the main thing when shorting (or trading at all for that matter) is to manage your risk.

Category: Market updates