Today we continue to chronicle the impending implosion of new-build property in London.

We focus on the detonator, which I suspect is somewhere in Battersea Power Station.

And we consider the strength of the builders – and the implications that their bull markets have for UK property prices in general.

The epicentre of London’s ‘artificial’ housing market

I was driving past St George’s Tower in Vauxhall the other evening. Nothing’s changed. The lights are still not on. It’s the UK’s tallest residential tower, but barely a soul is living there.

I’m not exaggerating. On a ‘lights-switched-on-in-the-evening’ basis, occupancy has to be lower than 20%.

“Oh, that’s normal”, a property-analysing fund-manager told me last night. “At One Hyde Park, even at the busiest time of year, they reckon occupancy only reaches 30%. The rest of the time it’s much lower.”

It’s something I’ve covered before – and I think it’s eventually going to lead to some kind of vacant home tax – but it’s a symptom of this almost-artificial market that is London new-build property. Many of these homes are not bought for what you might think would be their primary purpose – to be lived in. They are bought as investments, as “safety-deposit boxes in the sky”.

SW8 – Nine Elms, Vauxhall, Battersea Power Station and the surrounding area, however you want to think about it – has come to epitomise, for me at least, the problems that are looming for new build in London.

There is, as we know, a vast supply of very expensive new-build property coming to market in London. The FT put the number at 54,000 planned or under construction “in the priciest areas of the capital… close to or above the £1m mark”, while in the same areas last year, just 3,900 homes were sold for more than £1m.

This whole new-build market is very dependent on overseas investors.

But China, of course, now has its own set of problems, as do emerging markets and Asia in general. Malaysian investors bought almost a third of the 866 homes in the first phase of the Battersea Power Station project, reports Neil Callanan on Bloomberg.

Yet, as Merryn notes, the Malaysian ringgit has fallen by 30% against the pound in the last three years. Flipping the properties before the entire sum becomes payable is going to be a problem, as is raising the necessary sums to complete.

In the same piece, Callanan notes that, according to property data provider LonRes, 30% of the properties for sale in London’s Nine Elms district have now been on the market for more than a year.

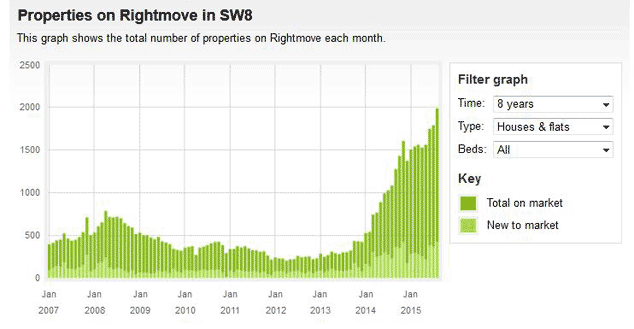

Let me add to that the table below from Rightmove (thanks to “Northshore”). It shows the total number of properties on the market in SW8 over the past eight years.

In the five to years to January 2014, the ‘normal’ number of properties on the market would be between 250 and 500, with a mean average somewhere around the 300 to 350 mark. This month we’re just shy of 2,000. That’s some rise.

Supply is not the issue. Price is.

SW8 has been marketed as prime central London when it is really Vauxhall (a place you go through, not to). And it’s the epicentre of the impending new-build implosion.

Think of the other new builds springing up across London. Some are selling well, others aren’t. But there are so many – off the top of my head, Earl’s Court, King’s Cross, around Tottenham Court Road and Soho, in Greenwich, Canary Wharf, Brentford, Stratford, Wembley and more.

If there is going to be a property crash, new build in London will be the catalyst – and it starts in SW8. Whether it’s failed football stadiums, theme parks or shopping malls, Battersea Power Station has a proven and remarkable record of failure for its investors. I suspect when all is said and done, that’s where they’ll locate the detonator.

The UK builders are still in a bull market – for now

New build in London is of course just one tiny part of a property market that is much bigger. When or if the UK housing market itself is going to top, is another matter.

You will have read that house prices rose by 2.7% last month, according to the Halifax (Nationwide reckons 0.3%). The Office for National Statistics (ONS) says house prices rose by 2% in July, a number that ties in with the Halifax.

It doesn’t matter if volumes have crashed – even if they are a leading indicator. Prices haven’t – and price is all buyers and sellers care about. And if you look at the share prices of the builders – which are, for obvious reasons, a leading indicator – then these companies are all in strong bull markets.

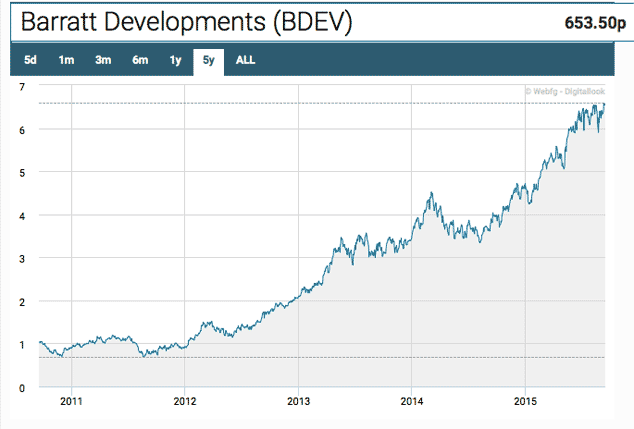

Here’s Barratt (LSE: BDEV):

That is one strong uptrend. And on a forecast yield of 3.8% and a price/earnings ratio (p/e) of 14, it’s not exactly overvalued.

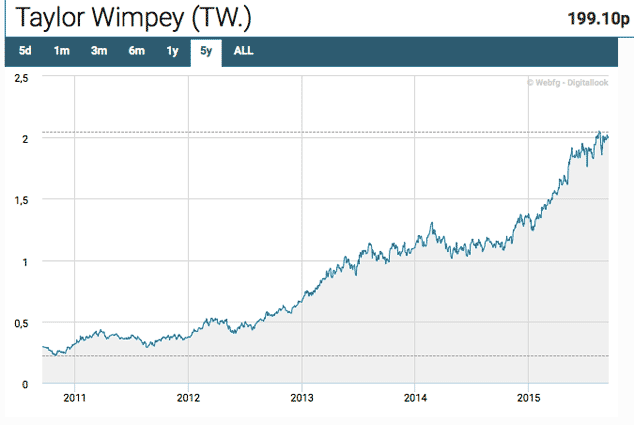

Here’s Taylor Wimpey (LSE: TW):

Again, another strong uptrend with a forecast yield of 4.8% and a forecast p/e of 13.5. Assuming forecasts are met, neither is overvalued.

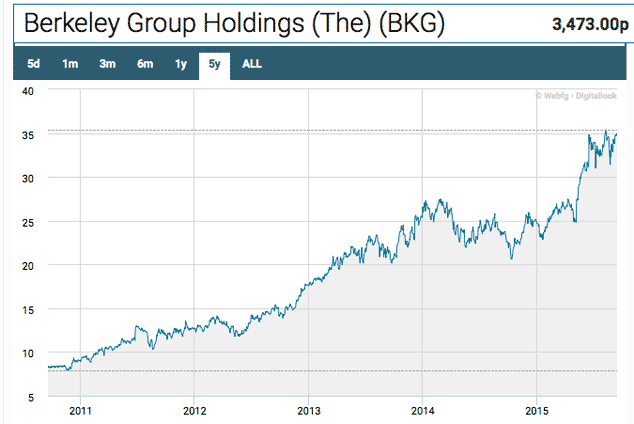

Here’s the Berkeley Group (LSE: BKG):

Another strong uptrend, though a bit more spiky. The yield is forecast to fall this year from 5.2% to 4.3%. Forecast p/e is, again, a not unreasonable 14.6%.

The big ‘but’

According to the builders, everything is fine in the state of Denmark. A price crash is not coming. But there is an “unless”.

If you look at all three of those charts you will see that a possible “double top” is forming. That theory will be invalidated as soon as any of them breaks to new highs. But as long as they remain below their summer highs, then house price bears may have a case.

There is no doubt that attitudes to housing are changing. More and more people are now starting to regard high house prices not as a good thing but as a problem.

Labour’s new shadow chancellor, John McDonnell, is an advocate of a land value tax – so that is a meme that could grow in the near future. The new Labour mayoral candidate, Sadiq Kahn, has put housing at the top of his agenda.

But the direction in prices remains up.

SW8, however, has problems – and I will continue to chronicle developments. And these problems could easily spread throughout new build in London.

But this is a market in itself. Despite tighter lending, low transaction levels and all the rest of it, UK house prices remain firm. The builders are not signalling any crash.

Unless, that is, they are putting in a top right here and now.

• Dominic Frisby is the author of Life After The State and Bitcoin: the Future of Money.

Category: Market updates