Today, I want to look at what I think is going to be one of the biggest investment stories of 2015.

The return of the Nasdaq…

The internet has grown spectacularly – yet the Nasdaq hasn’t kept up

It’s amazing to think how rapidly the internet has grown over the last 15 years.

Back in 2000, Twitter, Facebook and Gmail didn’t exist. Nor did cloud computing, apps or iPads. Google, still a private company, was barely a year old. You were considered seriously groovy if you bought a Mac.

Just getting online would take you a relative eternity as you waited for your modem to dial up, listening to that familiar echo-y pinging. Just 350 million people – less than 7% of the world’s population – had some kind of internet access.

Computers were slow. Hard drive space was minuscule. Smartphones were a figment of some wacko’s imagination. My parents didn’t even have a mobile phone yet. 3G networks, 4G networks – yeah, right.

Internet cafes – remember them? – were just springing up. They’re already redundant.

Yet for all the unbelievable growth and progress we’ve seen over the last 15 years, the Nasdaq – the benchmark index for internet and tech stocks – is trading below where it was in 2000.

It’s amazing when you think about it. 4,816 was the intraday all-time high, according to my charting software.

The Nasdaq closed last week at 4,384.

Of course, the dotcom bubble was a great big bubble. But the world needs bubbles. Thanks to that bubble, cables got laid, infrastructure got built, investments were made, talent was attracted, knowledge was spread – and so on.

Even though fortunes were lost, the growth that has happened since could not have happened without the foundations all that ‘dotcom extremis’ laid down.

Many of those who lost money will feel like they were stupid or conned. Terms like ‘mass delusion’ were thrown about in the aftermath. But the underlying investment idea behind that bubble was correct – the internet really did change the world. It changed the way we do just about everything.

And here’s my point: it isn’t a bubble any more. Companies now make serious money. Just look at Apple.

Apple proved me wrong

When Steve Jobs died, I thought Apple had reached its zenith. The company was losing its vision. It was not chic any more. It was becoming too controlling and not innovative enough. It was making some (to me at least) wrong decisions (particularly with regard to Final Cut Pro, its video editing software).

And then those amazing earnings came in a fortnight ago: 74.5 million iPhones sold, $74.6bn in revenue, $18bn in profit. The most profitable company ever. And it was, mostly, off the back of those incredible iPhone sales.

It used to be that the iPod was the flagship product, then the iPad – but people don’t buy those so much any more. The iPhone is better than the original, of course, but it is not that different. But more and more people are either buying one for the first time, or (me included) buying an improved model of the one they already own.

That’s a metaphor for the whole tech sector. Some products are dying, some companies are being disrupted and made obsolete (BlackBerry, for example), but there is still huge growth and this time around there is real cashflow coming in.

There are now three billion internet users worldwide, 40% of the world’s population. The user base is growing almost as fast as government debt – 8% growth last year and the year before, 10% the year before that, 12% the year before that.

More people worldwide now own a mobile phone than own a toilet. In 2014, 4.5 billion people used a mobile; about two fifths of them – 25% of the world’s population – are using smartphones.

But it doesn’t stop even when 90% of the world is online and most have smart phones. Because new, better smartphones will be invented and people will upgrade.

The Nasdaq’s bull market can continue for a long time

You may have guessed it already – I’m incredibly bullish about tech.

Back in November, I argued that the Nasdaq would be one of the stories of 2015 – and we’re getting ever closer to that happening.

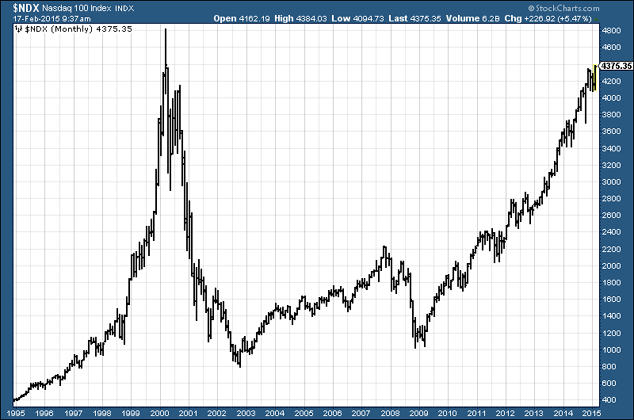

The chart below shows 20 years of the Nasdaq – all the way back to 1995. You can see the incredible bubble in 2000, then the plunge, and the long climb back (13 years!) to those old highs.

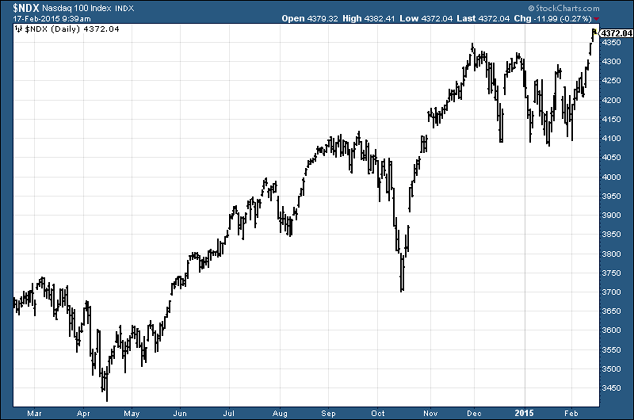

Below is the one-year chart. Since December, the index has been in a trading range – between about 4,100 and 4,300. But now the Nasdaq has broken above that, as it continues its assault on the peak – 4,800 is just 10% away.

Of course, as a major US index, the Nasdaq is subject to all the vagaries of the global geopolitical situation. But my money’s on that all-time high being tested and probably busted this year, perhaps even before May.

It might not get through straight away. There might be so much excitement we’ll see a false break above, then a correction – I’d wager that’s not an improbability. But once it breaks above there’s going to be a lot of noise and a lot of hype – and there is not going to be any overhead resistance. What was resistance – those all-time highs – will become massive support underneath.

Tech – whether it’s internet, fintech, biotech – is one of the growth stories of our age. The simplest way to play it all is to track the Nasdaq, the index most geared to tech, using one of the many exchange traded funds (ETFs) out there.

The biggest opportunities, as ever, will be in the small caps, of course. If you want to speculate in that area, Jim Mellon’s book, Fast Forward, is a good place to start. And if you’re specifically interested in technology and stocks with the potential for high returns, you should really take a look at this last-minute news alert from David Thornton. But if you’re a mug like me, the easiest way to play the boom is simply to go long the entire sector via the Nasdaq index.

Just before I go, stick this date in your diary – Friday 12 June. That’s when we’re holding this year’s MoneyWeek conference. It’s all very hush-hush at the moment, but I can tell you that we’re doing our best to bring back a speaker who was a big hit with attendees in 2013. You’ll also get to rub shoulders with like-minded investors, and get all of our contributors’ views on the biggest trends in investment and the latest hot tips.

To make sure you don’t miss out, join our priority hotlist – you’ll get first dibs on the tickets as soon as they become available, and you’ll also qualify for an early bird discount. Pop your name on the list here.

• Dominic Frisby is the author of Life After The State and Bitcoin: the Future of Money.

Category: Market updates