There is going to be a monster rally in oil.

After this collapse it’s inevitable.

It’s going to take everybody by surprise.

And I want to catch it.

The question I’m now asking is: has it already begun?

Did 29 January mark the low for the oil crash?

While the world and his wife have been worrying about the potentially catastrophic impact of the falling oil price, collapsing commodity prices, deflation, debt, currency wars, Greece and all the rest of it – oil has been rallying. At first quietly, and then rather more loudly.

Last week, I got a ‘buy’ signal. So I took a punt at $45 a barrel (on the West Texas Intermediate benchmark). I watched it go sideways for a couple of days, then my concern grew as it slid to $43.50.

But crude then turned up and closed the day higher than where it began. That’s a good sign.

And part of me wonders whether that will be the day that marks the low. We’ll see. For the record, it was Thursday 29 January.

A few days later, oil broke above $50. That’s an even better sign. As a nice round number, $50 is an obvious pivotal price point. Yesterday it flirted with $54 before closing at $51. From low to high, WTI has had a cool 20% rally already.

The million-dollar (if you use too much leverage) question is – will it continue?

Could oil hit new highs in 2016?

I spent last week skiing with some old chums, one of whom is now an oil trader with Trafigura (he thought I was dotty buying oil by the way).

Watching him deal with the never-ending avalanche of information he was bombarded with about global fuel supply was quite something. There was just so much to process and so many different deals to oversee.

I couldn’t handle it all. I’d be overwhelmed. And when the point came to add it all up, I’d be bound to miss something and draw the wrong conclusion.

So, for markets as big as oil, where there is just far too information for the small amount of grey matter in my head to process, I prefer to look at the price action.

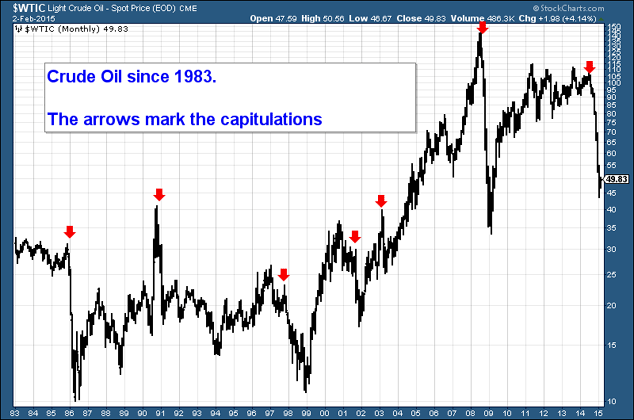

I’ve mentioned this in a previous Money Morning on oil: capitulations like the one we have just had do happen, but not very often.

We got one in 1985-86, another in 1990-91, and another in 1997-98. Then there was one in 2001, in 2003 and most recently in 2008.

Here’s the historical price of oil I posted a few weeks back. I’ve marked the capitulations with a red arrow. Look at the rebounds that followed.

Every single crash was followed by a rally, all but one of them a biggie. 1985-86 and 2008 both saw about two thirds of the falls retraced. The crash of 1990-91 only saw about a third retraced. Every other capitulation was followed a year later by oil breaking to new highs.

Now there’s a thought. Who’s talking about oil breaking to new highs in 2016? I’m not saying it’ll happen. I don’t even think it’s likely. But don’t rule it out, just because everybody else has.

A rally retracing two thirds of the falls (circa $105 to $45) would take us to the mid-$80s. To call that a probability would perhaps be too much, but it’s a distinct possibility.

How to play the oil rally

So why did I buy back in?

I took my punt at $45 for various reasons. The trend in the price seemed to have become more sideways rather than downwards. Selling volume was not so aggressive. I got a technical ‘buy’ signal, and a small ‘double bottom’ seemed to be forming. There was a deluge of bearish press.

I figured I’d fish about for a low and I put a stop in at $43 (which so nearly got taken out), just below the low of earlier that month.

So far it’s worked.

Now the eight-day moving average has turned up and the 21-day has gone flat, so there is a small upwards trend in place. I’ve moved my stop up to protect some of my gains. But I’ve also left some wiggle room in case the price retraces a little over the next few days – as I fully expect it to do.

My next target is $55 – there’s historical resistance there – where I hope to meet the 50-day moving average. If things keep on creeping up, I think $75 becomes a legitimate target later in the year – but I don’t want to run before I can walk.

The main thing is to stay around $50 and not slide back down.

By the way, the one-year moving average stands at $88. It’s currently falling, of course, but a meeting at around $75 is perfectly possible. You have to remember the mantra: monster oil capitulations are followed by monster rallies.

I’m not saying, by the way, that this is the rally. I don’t know. This could be just a small bounce before a re-test of the lows. But the strategy I am using is such that, if it is the rally, I’m there to enjoy it. And if it isn’t, well, no great loss.

So how do you play it?

Well, there’s the devil that is spreadbetting (but bear in mind that most people lose money spreadbetting, even if their ‘big picture’ overview of the market is correct). For less risk, you can buy one of the oil exchange-traded funds (ETFs).

And then – whether it’s the giants on the FTSE 100 or the tiddlers on Aim – there are a myriad of different oil producers or explorers to consider. If you decide to go for one of these, remember you’re taking on individual company risk (John will be looking at some promising options in the next issue of MoneyWeek magazine, out on Friday – if you’re not a subscriber, you can get your first four issues free here).

But whatever you decide, make sure you have a clear exit strategy in place if the market goes against you.

Dominic Frisby is the author of Life After The State and Bitcoin: the Future of Money.

Category: Market updates