You’ve heard of the commodity supercycle, the Kondratiev wave and the 14-year cycle in property.

You’re familiar with the four-year presidential cycle, the ‘Halloween trade’ and ‘sell in May’.

I’ve got another cycle for you to think about today – the ‘hype cycle’…

How the hype cycle describes the rise and fall of a great story

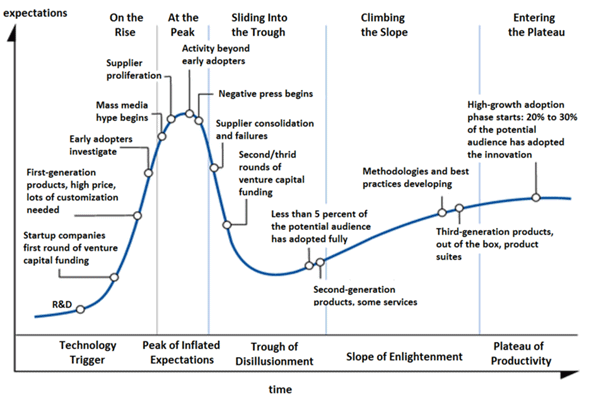

A company by the name of Gartner has branded its own graphic to describe the hype cycle in IT. It describes what happens as a technology goes from conception to maturity to widespread adoption. Here it is:

(Source: Gartner)

You can peruse it yourself, but the short version is that it shows how people get excited about a new technology, then disappointed as the reality of the difficulties of taking it to widespread usage sets in. It’s only then that it gradually climbs towards meeting its full potential.

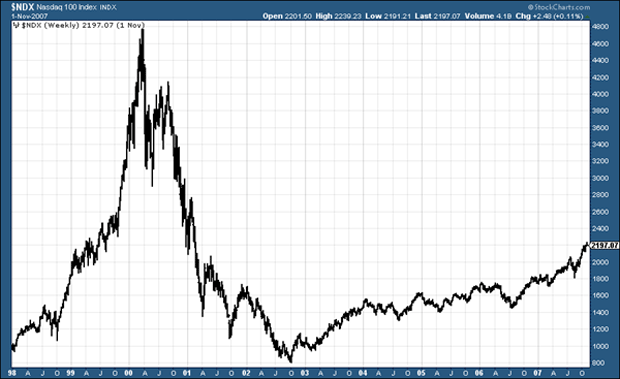

You’ll notice the arc of the chart rather resembles the chart of the US Nasdaq index in the years around the dotcom boom and bust of 2000, as the internet went from conception to maturity to widespread adoption (see chart below).

(Source: StockCharts.com)

The first phase of hype comes as the idea is born and receives some early investment and some early users.

This is the ‘technology trigger’

Excitement builds into a bubble of expectation. Here is a new technology that is going to change the world. The possibilities are endless. We’re going to cure diseases. We’re going to solve energy problems. We’re going to build houses on the moon.

Rather like the mining exploration company that hits the mother lode, at some point this bubble of expectation is punctured by the needle of reality. Forget the amazing drill results and the fantastic ore body we’ve just found – now we actually have to build this mine. That involves a great deal of time, effort and investment.

The same goes for new technology. Now we have to make this technology work on a commercial scale. That means a lot of not particularly rewarding hard work, drudgery, time and investment. Forget the ideas men – now we need the plodders and water-carriers.

During this phase, which Gartner calls the ‘trough of disillusionment’, all sorts of problems set in. This thing here doesn’t work as well as we thought it did and needs fixing. Those personnel there are no good and need replacing. Investors are not making money any more, but losing it.

Negative press creeps in – and the hype cycle reverses.

This very much describes the Nasdaq between late 2000 and late 2002 – during and after the crash.

But, eventually, the technology is made to work on a larger scale. More and more people start to use it. It starts making money. Like the Nasdaq from 2003, there is an upward ‘slope of enlightenment’.

Eventually we reach a ‘plateau of productivity’, which is where the likes of Google, Apple and Amazon are today.

Where is today’s big tech story – Bitcoin – in the hype cycle?

Of course, reality is never as defined as it is in idealised charts like the one above. But let’s take Gartner’s idealised cycle and apply it to the great tech story of the moment – investing in bitcoin.

In the space of three or four years, bitcoin went from being an understated mention on a remote mailing list, to declarations that it was not only going to become the preferred money system of the world, but that it was going to usurp the existing world order.

It caught the imagination of the left, the right and the in-between.

Computer boffins marvelled at the impossibly resilient code. Satoshi Nakamoto, bitcoin’s mysterious creator, had solved problems that had been stumping great minds for years.

Economists and libertarians marvelled at the politics of a currency without government or border.

Speculators marvelled at the colossal amount of money they were making as bitcoins rose in price.

The media went crazy for it.

There were early users – from tech savvy speculators to black markets to fugitives trying to escape capital controls.

As the excitement grew, hundreds of alternative crypto-currencies sprung up. Anyone could design and issue their own currency, and their value was appreciating by thousands of percent on a daily basis.

Banks, governments, they’re irrelevant now

Late last year, we hit the peak of this hype cycle – the peak of inflated expectations.

Now bitcoin seems to be wallowing in a ‘trough of disillusionment,’ just like the Nasdaq in 2001. The price has fallen. There have been thefts. Some of the companies involved have gone bankrupt. China and Russia have banned it.

The challenge now is for all those start-ups to make their product or service work. They have to take bitcoin from being a great idea to having a much wider ‘real world’ use. They have to find investment and get more and more people to start using the coins. In short, they have to build that mine.

But whether or not bitcoin replaces fiat money (unlikely), its technology to make and receive payments is transformative. Goldman Sachs IT analyst Roman Leal argues that in 2013 money transfer fees would have fallen by 90% if bitcoin had been used. Global transaction fees at retail point of sale, meanwhile, were $260bn on over $10trn of sales. Using bitcoin those fees fall by almost $150bn to $104bn.

Those kinds of savings are irresistible. They suggest the technology is here to stay. Bitcoin must now work its way through the ‘trough of disillusionment’ – but the ‘slope of enlightenment’ lies ahead.

It’s pretty clear to me where bitcoin is in the hype cycle

And therefore, how you should play it as an investor. It’s time to wait, do your research, find some good opportunities, and put together a shopping list – but don’t pile in yet.

I must say I like this hype cycle idea – and it doesn’t just apply to new technology. Technology, by its very nature, will of course attract excitement in a way that government bonds, say, never will. But I think a few hard honest questions about the hype cycle are worth asking every time you make an investment decision.

Whether you’re thinking in investing in a company or a commodity, ask yourself: how many other people know about this story? How early am I to the game? Is the shoeshine boy talking about it yet? How long is this story likely to last? How big could this hype get? How many other potential investors are there still to buy in?

Asking these questions and being honest with yourself about the answers will help to ensure that you are making genuinely contrarian investment decisions, rather than just following the herd. I think I’m going to add a hype meter, based on those questions, to my investor toolbox.

• Dominic Frisby is crowd-funding his latest book, Bitcoin – the Future of Money. His first book, Life After The State, is available at Amazon. An audiobook version is available here.

• Follow @dominicfrisby on Twitter.

Category: Investing in Bitcoin