I had lunch at the House of Commons yesterday. As you do. (I’ve always wanted to begin a Money Morning like that.)

MoneyWeek editor-in-chief Merryn Somerset Webb and I were the guests of MPs Steve Baker and Douglas Carswell, two gentlemen whose thinking (fewer taxes, simple taxes, lower taxes, for example) is pretty much in line with that of Southbank Investment Research.

After marvelling at the fact that bitcoin had touched $800 earlier in the day, the conversation quickly moved on to everyone’s favourite subject: what could derail the recovery? What threats loom over Western economies?

Oil is in a stealth bull market

We all agreed that we’re not likely to see interest rates go up until after the next election. Quantitative easing (QE) in some form or other looks like it’s pretty much here to stay. Stock markets continue their march higher. The housing market is booming.

What could possibly go wrong?

Douglas was concerned about some kind of external shock – perhaps the ‘candyfloss credit’ situation in China unravelling. But I think there is another potential external shock waiting to happen. And that’s oil.

Oil – in this case West Texas Intermediate (WTIC) – is a market I’ve been paying a lot of attention to recently. In June, with WTIC at $97 a barrel, I suggested we were getting set for a move up to $105, then $110 then possibly even $115. $112 was the high.

In September, with oil at $107, I suggested the mid-$90s beckoned. Then a few weeks ago, with oil at $96, I suggested oil had further to fall and gave $92 as a target.

But this is all short-term movement. Over the longer term, the price has been creeping higher. It’s in what I would call a stealth bull market – each year, oil is making higher lows.

In 2009, after the financial crisis, the low was $35; in 2010, it was $67 and then $70; in 2011, it was $76; in 2012, $77 and $84. So far in 2013, the low has been $86.

All but the shorter-term moving averages are rising – which is indicative of a rising trend.

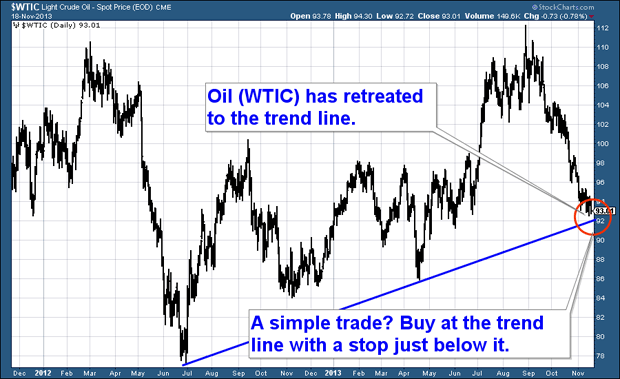

My bet that oil would fall to $92 was based on the idea that oil would simply revert to a trend line coming off the lows of the past two years. We have now almost reached said trend line (the blue line on the chart below).

Source: StockCharts.com

Now, oil could easily fall further. I have $90 or $86 as potential targets, and if they are hit, the $75 mark comes in to the frame. For the time being I’m holding on to my short – with the stop moved up so to protect my profits.

A simple, low-risk bet on oil

However, I’m really not sure which way it’s going to go next. And I can see a nice, simple trade to be had here on the long side – that is to buy WTI crude oil at around $92-93, with a stop-loss almost immediately below that trend line.

Here’s why I like this trade: it’s not because I’m confident on the future direction of the oil price, it’s because I can see exactly how to manage the risk. I can buy almost at the trend line, with a stop below it at perhaps $91. The trend line will either hold or it won’t. If it holds, it could go a lot higher, and the trade could be very profitable; if it fails, then I won’t have lost much. So the risk/reward ratio is very favourable.

But while I’m not sure on the next short-term move, in the longer run, I remain bullish on oil. Let’s take a look at the price action over a slightly longer term.

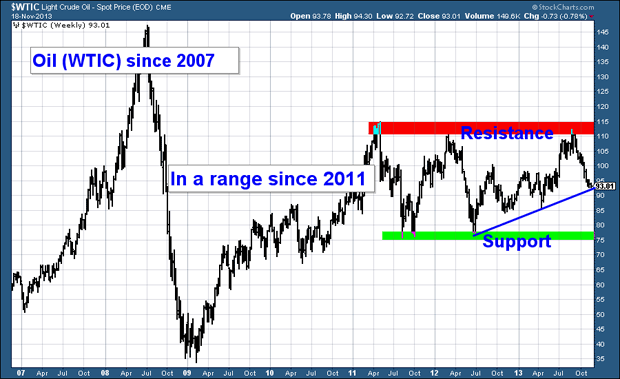

Below is a chart I posted a few weeks back. You can see the range that oil has been in since 2011, with a cap at about $115 (the red band) and a base at $75 (the green band). I have also included that rising blue trend line on which oil is now sitting.

Source: StockCharts.com

For now, we’re pretty much in the middle of the range. And that’s despite the fact that oil has had a lot of ‘bad’ news over the last year or so, from fracking to increasing efficiency. Yet for all this, the price has been gently rising. That strength is indicative of a bull market.

We’ll know for sure when oil tests either that band of resistance or the one of support. I can see oil retesting $75 just as easily as I can $115. (That’s why I like the look of the trade suggested above – I can be wrong and not take too big a hit.)

But the longer the market trades in a range like this, the bigger the break when it eventually comes. And my suspicion is that it will be to the upside.

It might take a year or two, but if oil can get above $115, I’m confident it’ll make its way back to those 2008 highs at $147 very quickly. Any eruptions beyond the usual tension in the Middle East would speed things up considerably.

The ramifications of a much higher oil price could be dramatic. The last few months have not only seen a falling oil price, but they’ve also seen a strong pound. As people have had to spend less on their energy, they’re left with more capital to spend or invest elsewhere. You have a virtuous circle.

But the pound may have made a top at $1.625 and is now in the early stages of a downtrend, while oil is at a level where it could put in a low and turn. Suddenly we’re in a vicious circle.

A higher oil price, particularly if coupled with a falling pound, means less capital left over to spend and invest. It also means inflation, in a form that is very difficult to hide. Sustained inflation will mean more pressure to raise rates. And in an economy so riddled with debt, higher debt servicing costs (as a result of higher rates) are the last thing anybody needs.

Could oil deliver the external shock that derails the recovery? I don’t know. But of all the potential threats out there, it’s got to be high on the list. Even if you don’t plan to take a bet on the oil price, it’s a market to watch.

• Dominic’s first book, Life After The State, is now available to buy at Amazon or Unbound.

Category: Market updates