The US is in political turmoil. Squabbling politicians have shut down the government. And a looming fight over the debt ceiling could even see the US potentially default on its debt.

Meanwhile, the British economy seems to be going from strength to strength. Our politicians still squabble, but as they’ve handed most of the important decision-making powers on the economy to the Bank of England, it doesn’t matter.

With the UK in the ascendant and the US in chaos, my next suggestion might seem a little odd.

But now looks a great time to sell sterling against the US dollar…

The pound’s smashing summer

The pound has had a bonanza summer. From its low point in July at $1.48, it has rocketed to $1.62, where it sits now, as I write.

This has been a move that many, myself included, did not see coming. I thought the rally would peter out in the low $1.50s. But I was stopped out of my short position so, thanks to some decent risk management, I live to trade another day.

So why do I like the idea of going short again now?

First of all, I like the risk. I know I can be wrong about this trade without having to take too big a hit.

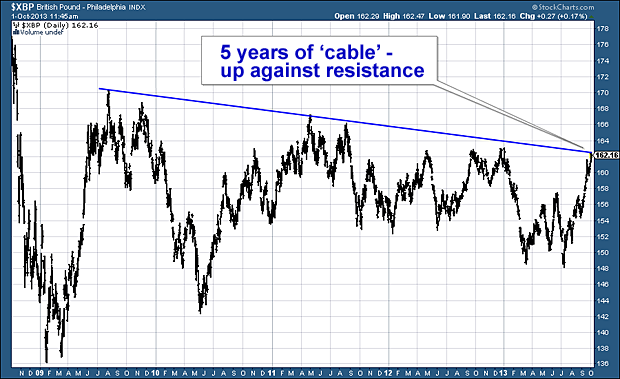

I see $1.63 as a fairly pivotal level for the sterling-dollar exchange rate. This has marked the high of the past two years. Every time sterling has tried to get through, it has failed.

Of course, one day it will get through. It might even get through on this attempt – you never know. But it is still an obvious line of resistance – which means there is an obvious place to put a stop-loss and manage my risk.

My prediction is that it won’t get through. And there’s every chance the pound could fall just as quickly as it has risen, re-visiting $1.56 and $1.54 before you know it. But I don’t know that for sure – obviously – and I’m glad to have an opportunity to take a trade where it’s going to be pretty clear at which point I’m wrong.

In this case, above $1.63, and I’m wrong. So I’m shorting as close to $1.63 as I can and my stop will be not far above, as illustrated below.

Source: StockCharts.com

Below, I have also drawn a five-year chart of sterling against the dollar. You can see there has been a gentle downtrend in place since the upheaval of 2008, with lower highs made one after the other and, since 2011, lower lows. Now cable (sterling vs dollar) has come up against that line at, you guessed it, around $1.63.

Source: StockCharts.com

If $1.63 is broken, sterling could very quickly move to $1.67 or even $1.70, hence my tight stop. I’m not expecting that move to happen, but I’m only too aware that it could – and if it does, I’m protected.

In the long run, the pound could go far lower

Longer-term I remain a sterling bear. I think we’ll see $1.56, $1.54, $1.48 and even $1.40.

We are living in a world of economies built on house prices, cheap money and hot air – but the British model seems particularly fumigated. We are getting away with it at the moment, but I suspect we won’t forever.

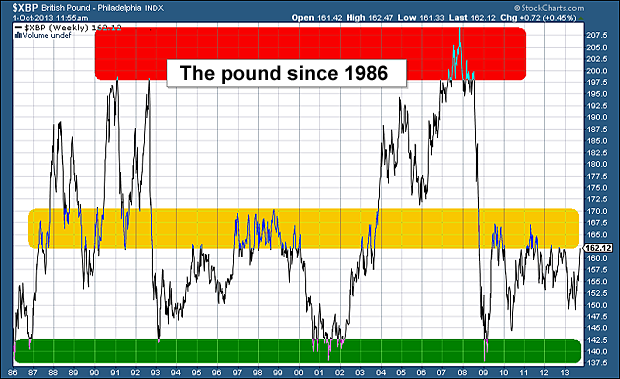

In the meantime, I keep referring to my long-term map of sterling as depicted below. This shows cable since 1986 and the range that has played out – from $2 to the pound (the red area) to just below $1.40 (the green area).

Source: StockCharts.com

We visited the red area at around two dollars to the pound in the early ‘90s and in ‘06-‘08. We visited the green area (and below) during the early and mid-‘80s, from ‘00 to ’02, and again in ‘08-‘09.

Meanwhile, that yellow band I have drawn across the middle has at times acted as support, and at other times resistance. I see it as major resistance now.

I accept that we may get to the top of that yellow band at $1.70. If we do I shall be shorting again (with a stop at $1.71). But for now I see $1.63 as a barrier. I also suspect there is a high probability it will prove a turning point.

Perhaps the US government shutdown may prove to be a load of irrelevant huff (as if you didn’t already know). And when – as it will be – it’s back to business as usual, you could easily see a rally in the dollar and a corresponding decline in sterling.

For all the volatility of cable, over time it is a fairly reliable, repetitive performer, reproducing the same patterns, returning to the same levels. So in the long run, I still think the green band beckons, not immediately, but in the coming year or three.

• Spread betting is not suitable for everyone – ensure you fully understand the risks involved and never risk more than you can afford to lose. Trades carry a high level of risk to your capital. Prices can move rapidly against you and resulting losses may be more than your original stake or deposit. The content of MoneyWeek Trader is educational only. It should not be interpreted as investment advice.

Category: Market updates