How do rich families get rich, and stay rich?

That’s the question I’ve been asking myself for the last few weeks. As part of it, I’ve conducted a pretty exhaustive study of pretty much every way a private investor like you can approach the markets. I’ve looked at how family offices operate. And I’ve tried to figure out what sets wealth families apart from wealthy people.

I think it comes down to three very simple things.

Secret #1: find something that works and stick to it

You’d be surprised how many people – once you start talking to them about it – don’t have any real plan for their money or their investments.

They dabble. A tech stock here. A few dividend paying giants there. A fund they liked the look of. There’s no real coherence to their approach or their portfolio.

I think that’s the wrong way of looking at things. The very best investors find something that works, then stick assiduously to it with the vast bulk of their money.

And when it comes to “what works”, there’s one approach that stands head and shoulders above everything else.

Which approaches to investing are worth focusing on, and passing on to your family? My requirements here would be: something simple, with a very long and comprehensive track record of outstanding returns.

Which brings me back to the idea I was telling you about yesterday. I consider it the only approach to investing worthy of trusting with your family wealth. That’s because its long-term track record is incredible.

I could cite any number of studies, stories or track records. I’ve been compiling them for months. You’ll see them all tomorrow. But for the sake of expediency, I’ll share two with you now.

Consider the 1970 study from the State University of New York.

Over 13 years, academics there took this idea and applied it to pick stocks. They bought 645 different stocks over that time period (far more than you’d need own, this was an academic study after all).

The results were emphatic.

Those stocks generated an average annual return of 29.4%… smashing the market by six and a half times.

I don’t know about you, but that’s the kind of performance that suggests this could be worth passing on to your family – a kind of intellectual centrepiece of family wealth.

Here’s another example. In 1985, behavioural finance expert James Montier decided to find out whether this approach was still the best way of regularly making money from stocks – or if it had become “outdated”.

Between 1985 and 2007 – a 22-year period – the average annual return of the stockmarket overall was 17%.

Not bad.

But this idea returned an average of 35%.

That’s an incredible long-term return.

Had you invested £10k at the start of the study… you’d have banked £7.3 million by the end of it.

In short, if you want to make money from the stockmarket and start creating real FAMILY wealth… you need to find something like this, and focus on it. Click here for a great way of doing exactly that – starting with three investments that fit this approach perfectly.

Secret #2: understand “permanent” wealth

Have you ever wondered whether the best investors, and the richest families, out there are… doing something you’re not? That perhaps they have access to information, knowledge and ideas that the rest of us don’t, which enable them to get rich and stay rich?

I think there’s some truth to that. But it’s not a case of trading inside information, having access to private deals or anything like that. (Maybe for some people that’s the case. But having spent a long time looking into this, I don’t think that’s the most important thing here.)

No, the real secret the richest families all understand is this:

There are two types of capital in the world. They’re both of vital importance. In fact, you cannot have one without the other.

The first, obviously, is financial capital. You have to start with something. But it may not be a lot. It could be £10k. It could be millions. The amount doesn’t matter.

The second kind of capital is different, and more important. It’s what makes your financial wealth grow and keep growing for a long time.

I’m talking about intellectual capital. Ideas. Ways of thinking about money and the world that can be passed from generation to generation. This is permanent wealth. If you’re careful, it cannot be destroyed.

Don’t scoff. You’d be surprised by just how important this is. Without a clear and proven idea about how to manage money – intellectual capital that can be passed on – the chance of you building a genuine legacy of wealth are small.

Secret #3: think big

The final point I’d make to you is this.

Building wealth not just for you, but for your family, is an ambitious goal. It’s also a worthy one. But it takes time. You need to think not just in terms of this year or next, but in terms of generations.

That’s because true wealth takes time to build. To explain, let me share an excerpt from our interactive report on family wealth:

Let me tell you the story of two investors just like you.

Their story starts on the same day. By chance, they both happen to become fathers for the first time on the same day, at the same hospital.

On that day, they both vow to start building wealth not just for them… but for their whole family.

They both start with £10,000. But they take very different approaches.

One invests just like everyone else. He dabbles here and there: the odd small cap, the odd index tracker, the latest hot trend.

He doesn’t make any big mistakes.

But there’s no clear, coherent idea behind his decisions.

He’s just making it up as he goes along. And he gets… what you’d expect him to get. Average decision making leads to average returns.

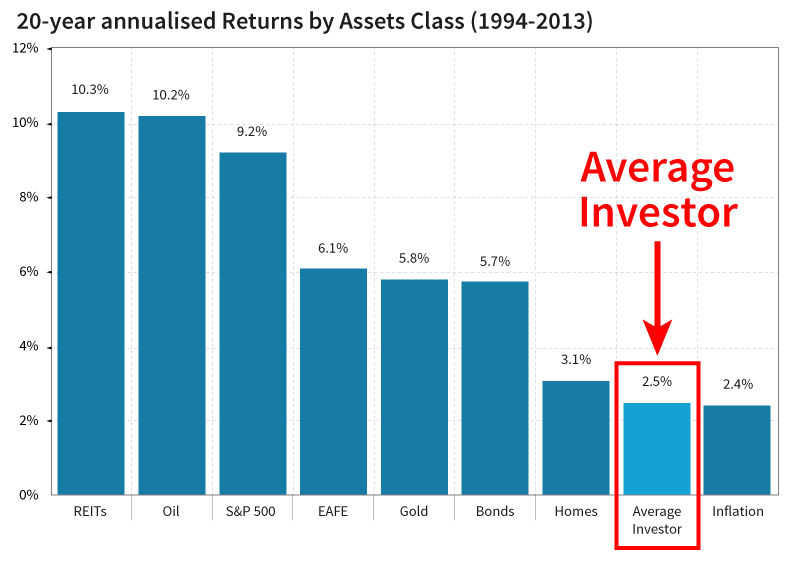

Which – it may surprise you to find out – is just 2.5% per year.

You read that right:

The average investor makes just 2.5% per year.

That’s according to a study from JP Morgan, using data over 20 years, between 1994 and 2013.

The chart above proves just how poor that return is. It’s just 0.1% above inflation!

Just sitting in bonds… gold… or a stockmarket tracker would all be better decisions.

But that’s not what our average investor does.

When his daughter turns five, his £10k pot has grown a little. It’s now worth just over £11,300.

When she turns ten, it’s worth £12,800. Ten years of wealth building has added just £2,800.

By the time his daughter leaves school at 18, it’s grown a little more. He now has a nose over £15,500.

At 21, as she graduates, it’s £16,750.

Hardly “family wealth”, is it?

Now let’s consider our OTHER investor.

He starts at the same time, with the same amount of money.

But he doesn’t invest aimlessly.

He manages his wealth exclusively using the one proven method Ben Graham developed.

His wealth doesn’t immediately double or triple.

But over time his returns start materialising… as the slow, steady, but enormously powerful wealth-building secret he understands starts to work.

After ten years, his £10,000 has become £79,000.

As his son leaves school, he has £415,000 to his name.

On his graduation, that initial pot has grown to £772,000. He’s returned – on average – 23% per year.

Not every year. Not “like clockwork”. This doesn’t work like that. It’s still possible to have down years. But if you’re patient, disciplined and trust in the secret, long-term annual returns like this ARE possible.

Just imagine you were in that position.

Well, now you can be:

Have a great weekend,

Nick O’Connor

Associate Publisher, Capital & Conflict

Category: Economics