Back in the late 80s and 90s there was a saying that rose to popularity among traders on Wall Street: “buy bonds, wear diamonds.”

The meaning behind it was simple. If you filled your portfolio with bonds, you’d make so much money you’d be wearing diamonds.

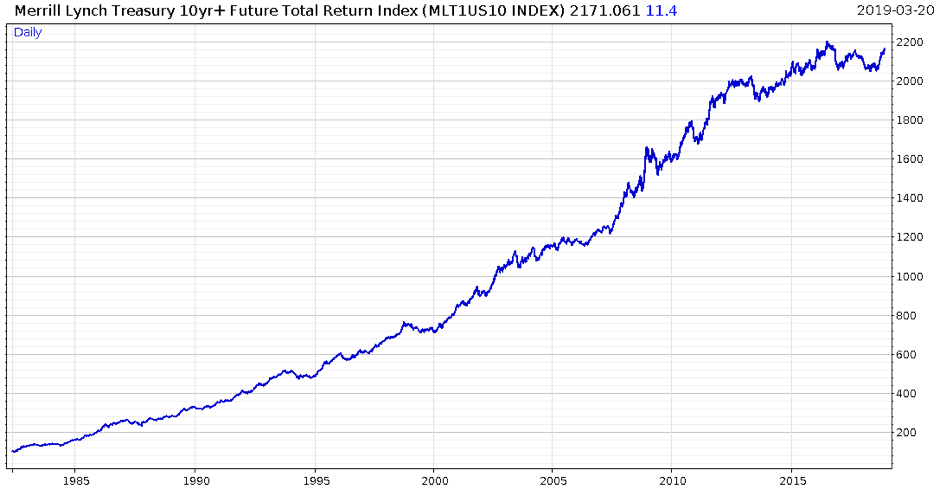

It’s certainly been a diamond age for bondholders:

This is the total return for US Treasury bond futures – ie, if you had “bought and held” US government debt futures and endlessly rolled your investment forward when the futures matured.

It’s only in recent years that the trend has come into question. But with the Federal Reserve yesterday signalling no interest rate increases for the rest of this year, and pulling back on its commitment to reducing the quantity of bonds on its balance sheet, it seems the diamond age may not be over. The trend may still have gas in it left, regardless of how seemingly overstretched the bond market may seem.

I had the pleasure of speaking to two experts on how important it is to respect market trends here in the office the other day: Robin Griffiths and Rashpal Sohan, who head up Dynamic Investment Trends Alert.

I recorded my own presentation for the Exhibition yesterday – it was a little off the cuff, but I hope you enjoy it. I used a prop some might consider unconventional, or even controversial, but at the very least I reckon it’ll be memorable. In fact, I doubt you’ve ever seen an investment presentation quite like it…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates