I’m sorry for not getting in touch with you about this sooner. What’s going on here is really quite something.

Last week I wrote about how the price of precious metals and the cost of actually acquiring them are decoupling, becoming significantly different. It’s a dynamic the investor Grant Williams has been calling for years “the difference between the gold price, and the price of gold” which has been dramatically revealed by the corona-crisis.

However, last week I didn’t take a look into what it’s like “on the ground” for the UK gold investor. I’d just been looking at the US and the refiners in Switzerland; but here in Blighty it’s really quite extraordinary.

Major UK bullion dealers are all saying the same thing – it’s repeated all over.

Here’s the online store for Sharps Pixley, the glamorous bullion dealer based in Mayfair:

This is currently showing up at the top of the BullionByPost.co.uk:

Here’s UKBullion.com:

Here’s Gold.co.uk:

And my personal favourite bullion dealer, Bleyer Bullion:

Ross Norman, the man who runs Sharps Pixley, has said you won’t be able to get a kilo bar of gold in Europe “for love nor money”. And this shortage of bullion, clear as ever to the retail investor, has now reached acute levels at the highest levels of the gold market.

Speculation on whether the gold price is manipulated or not, and if so, by how much, is beyond the scope of this letter. But whatever the truth to the subject, yesterday there was a major shortage of physical metal at the highest levels of the gold market.

Yesterday, at the Comex in New York, where gold futures trading dictates much of what is accepted as the “gold price” (with the London bullion market driving the rest), some banks failed to deliver physical gold in exchange for a paper futures contract – breaking the contract.

The shortage is so acute that the bullion banks have had to ask the Comex to change the rules as to what form of gold is deemed valid for delivery. The Comex has standards as to the kind of bars it accepts as valid for completing delivery on a futures contract – purity, weight, etc. But due to the shortage, the banks (so far they have not been identified) have been allowed by the Comex to use gold bars from London – which do not meet those standards – to redeem gold futures contracts (specifically, Comex gold bars are 100 troy ounces – London bars are 400 troy ounces).

At least one banking executive has claimed that there is no shortage of gold in the London market, so allowing it to flow into the Comex will ease the disruption. Considering they didn’t see the shortage coming to the Comex, I’m not convinced – and that’s if this isn’t just a deception to reassure market participants and stop a run on gold…

Some on the fringe believe that this is finally the endgame of gold price suppression, and that it was inevitable that if you sell enough paper gold to keep the price down that eventually you would face the short squeeze of the century. However, at least part of the reason why gold is going down is due to coronavirus shutting down gold refiners in Switzerland, which is halting the production of gold bars and their flow into the financial system.

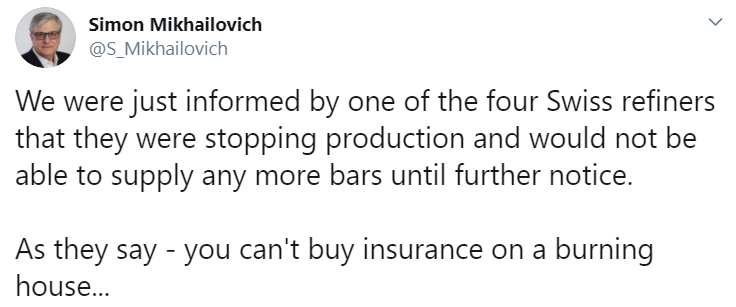

Source: Simon Mikhailovich, on Twitter

Source: Simon Mikhailovich, on Twitter

Right now, three of the big four Swiss refineries have shut down due to coronavirus fears, while the fourth is completely sold out for the next month. The shortage is spread all the way through the gold “ecosystem” – I just wonder which parts of it will break…

A subscriber wrote in with his own experience acquiring precious metal a few days ago, while the shortage was still building:

I placed an order for 200 Silver Britannia’s today. £3070 paid immediately with a 4 week wait as there are none available. There are 250 available at a small dealer at £18 but that’s it in London.

There are other non UK silver coins about but all at a serious premium and naturally subject to capital gains tax.

How this works out for silver is key. As Charlie Morris recently said “I love silver. If you call it right, it’s the trade of the gods. Best bit is that if you’re wrong, you just wait. You know it’ll come good in time.”

This stood out to me in Kitco:

“If you need to borrow gold in the OTC [over-the-counter] markets right now, you are going to pay a king’s ransom” commented Ole Hanson, head of commodity strategy at Saxo Bank.

A king’s ransom, the trade of the gods… it’s enough to pique any speculator’s interest, even if you’re not a precious metals nut like me.

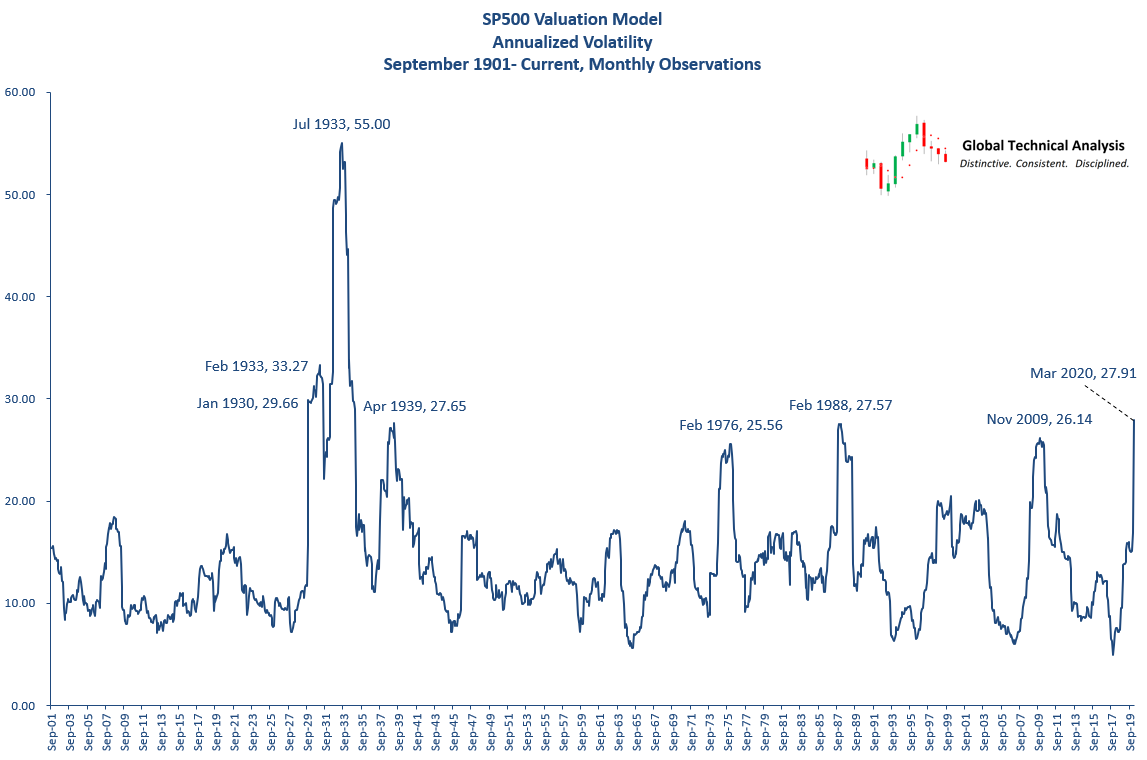

In tomorrow’s note, we’ll explore how us Brits have seen the gold price go up 8% on the month, while the Americans are down -1.5%… despite US stocks experiencing volatility the like of which hasn’t been seen since the Great Depression…

Source: J. Brett Freeze, CFA on Twitter

Source: J. Brett Freeze, CFA on Twitter

We’ll also take a look through the mailbag and see what your fellow readers have been making of all this ([email protected]). Thank you to all who’ve been writing in – I always enjoy reading your feedback, positive or negative, and suggestions as to future topics and content.

Also, if you enjoy these scribblings and you’re in the Twitter world, give me a follow: @FederalExcess. I’m thinking of posting a chart a day which hopefully reveals some kind of insight (though I can’t make any promises). This one is yesterday’s:

The last time the global stockmarket was this low was right after the Brexit vote. Déjà vu, or “just the flu”..?

The last time the global stockmarket was this low was right after the Brexit vote. Déjà vu, or “just the flu”..?

Back tomorrow!

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates