It’s midnight on the Titanic. As it sails through the darkness, an ominous object looms on the horizon…

But it’s not an iceberg this time. It’s a massive black rock:

I am referring to BlackRock ($BLK), the world’s largest investment company with almost £5 trillion in assets under management. The trouble it’s experiencing now is a looming obstacle for the market – with potential Titanic-esque implications.

BlackRock has ridden the wave of loose monetary policy like few others. Key to its success has been its “tracker” funds: investment funds that track major market indices (the FTSE, the S&P, the Nikkei, etc) at incredibly low cost.

These “passive” funds have outperformed actively managed funds as easy monetary policy has driven share prices higher regardless of fundamentals. The rising tide of low rates and quantitative easing (QE) has floated all boats, and BlackRock attracted trillions in capital from investors who just wanted cheap exposure to the market. I believe a feedback loop operated on top of this, where passive investors blindly buying “the market” through tracker funds made the market go up, and attracted even more passive investment.

As a result, BlackRock has made billions in fees, and the share has performed very well… until this year. The sharp downtrend at the right of the chart reveals that all is not well in the world of passive investing. And if passive investing drives market performance through the feedback loop I mentioned previously, BlackRock’s woes are as stark a warning as an iceberg approaching in the darkness.

It’s worth bearing in mind that financial institutions pulled billions out of BlackRock’s products in the third quarter of this year, while retail investors poured billions into them. The shrewd heading to the lifeboats early, while those below deck were still partying, perhaps…

Passive investors have already been getting a bruising. To get an idea of just volatile stockmarkets are becoming, the S&P 500 has been over three times more volatile than bitcoin in trading over the last ten days, something that hasn’t happened for as long as bitcoin has existed. I’ll need to ask Harry Hamburg of Crypto Wire what he makes of this…

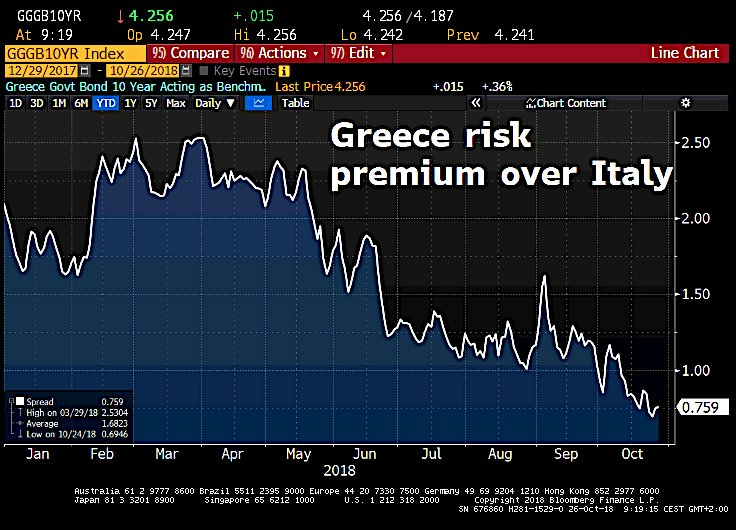

Meanwhile, markets are getting ever closer to declaring that Italian government debt is as risky, if not riskier, than that of Greece:

Now is not a time to be buying everything, at any price.

It’s a time to be shrewd, and make measured, calculated decisions. This is something we aim to help you with at Southbank Investment Research through our broad of research. And you can get all of it, for life, at a one-off cost here.

And if you’re interested in profiting from future crashes in the stockmarket, you should take a look at Southbank Investment Research’s first ever “shorting” webinar my colleague Nick Hubble will be running next week – you can sign up here, free of cost.

Until next time,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Market updates