Turn the page, people, turn the page. The third quarter is over. They’re only days on a calendar, but maybe the new quarter – with, perhaps, a focus on actual earnings by real businesses – will be better for investors than the past three. They haven’t been great.

The Dow Jones Industrials, for example, have closed lower each of the last three quarters. The Dow finished the June quarter down 7.6%. It’s the worst such streak since six consecutive lower quarters during the ‘Great Recession’.

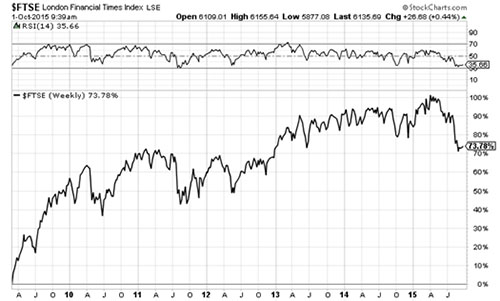

Then Bernanke with QE and the market bottomed out in the first quarter of 2009. For the FTSE, it’s been good times ever since. Except for recently, as you can see below. If you bought bang on the March 09, 2009 low at the point of maximum pessimism, you’re still up almost 74%. But the chart lacks conviction right now.

Source: www.stockcharts.com

The overnight news from China won’t help

The official Purchasing Manager’s Index numbers were released. They showed that Chinese factors are slowly contracting. The September number was 49.8. It was better than the August number of 49.7. But only just, and a reading under 50 shows contraction.

By the way, how much stock should you put in any statistical measurement like that?

Probably not that much. In general terms, we know China is over-invested in manufacturing capacity. The wave of deflation lapping at the shores of Western economies originates in Chinese factories. The world has too much stuff. And too many factories to make it.

Heilongjiang Longmay Mining Holding Group, a state-owned Chinese coal company, fired 100,000 people earlier this week. That was 40% of its work-force. China’s factories run on coal. You don’t have to be an eight-year-old to connect the dots.

And by the way, shutting coal mines is all about over-capacity, not global warming. Someone send Bank of England governor Mark Carney a note. He gave a speech to an insurance conference and warned UK investors to sell their oil and gas stocks. Mind you, he didn’t say it that directly. But he did say that “The exposure of UK investors, including insurance companies, to these shifts is potentially huge”.

By “these shifts” he talked about tougher regulations to curb climate change. He said those “shifts” could leave fossil fuel companies “stranded” with assets they can’t produce. They can’t produce them because those assets would be “literally unburnable”.

Of course, he’s wrong

A new rule doesn’t change chemistry. Hydrocarbons will remain burnable whether the Bank of England governor says so or not.

Similarly, he can’t make alternative and renewable energy cheaper or more efficient by fiat. He can only make them relatively less expensive by making cheap fossil fuels harder to produce and use. This is the strategy of the enemies of fossil fuels: make them economically scarcer to force changes in private behaviour they desire, but that would otherwise not happen.

It’s the same as with cash but with coal. And what is it with these central bankers trying to change the price and value of everything? And all because they think it’s a good idea. The hubris is astounding. But we live in the age of the central planner. And at the centre of the central planning circle is the all-powerful central banker.

In any event, the markets haven’t reacted to the Chinese data yet. But the Chinese reality remains the same. Not even the optimism of a better third quarter can change that.

But there is always Slo-Mo

Do you remember that drug from the 2012 remake of Judge Dredd? It’s a fictional drug that slows down your perception of everything, while also giving you a rip-roaring high. Your sense of time changes, giving you the impression of a long-lasting endorphin rush.

QE and Zirp and Nirp are Slo-Mo for the economy. The economy doesn’t get any better. Debt doesn’t get any lower. People just get stoned by low interest rates. And financial markets get high on cheap credit.

Meanwhile, credit-addicted banks stop lending money to the small and medium enterprises that actually create jobs and make things happen. Take China. “Commercial banks are still quite reluctant to provide credits to SMEs but hoard large chunks of money in corporate bonds issued by large names”, says Zhou Hao in today’s Financial Times.

Zhou is an economist with Commerzbank. He adds that “This reflects risk aversion and suggests that the policy easing is not sufficient to offset concerns over [China’s] economic slowdown”. You could say that equally about Japan, Europe, and the United States. The policy of easing is not sufficient to offset concerns that the world is in a deflationary depression. A Slo-Mo depression.

Incidentally, that’s the term Bill Bonner used in his 2001 book Financial Reckoning Day. Bill was in London on Tuesday and Wednesday this week and dropped in to talk with Nick and me on the podcast. We talked about Japan, the future of QE (it’s not what you think), and the underappreciated benefits (and necessity) of human suffering.

From the Department of Paranoia and Conspiracies

CNBC reports that Glencore debt with a maturity of five years or more is trading at seventy cents on the dollar in bond markets. Traders are treating Glencore bonds like junk. Run Glencore shares though! The stock is up nearly 40% in the last three trading days after trading below 70p earlier this week. It’s trading near 97p as I write.

Glencore’s management could take the company private (again) if investors don’t see value in the shares, according to a note published by Citi earlier this week. That got me to thinking. And since I’m paranoid, it led me to a hypothesis which I’d like to submit for your review.

What if all this is an elaborate trade, done by design? It would have to go down as one of the greatest schemes ever. Here’s how it works:

- Float the company with an initial public offering in 2011, at the height of the commodity boom. Load up the insiders with rich options packages and shares.

- Flog the shares to the public and gradually cash out.

- In the meantime, load up the balance sheet of the publicly traded entity with debt to buy assets.

- Watch commodity prices collapse and the equity in the public traded entity dwindle.

- Take the remaining real assets and the company private again.

Glencore started out as a commodity trader. It would have been a great trade.

Realistically, you wouldn’t have known commodity prices were topping in 2011. You could have made a reasonable guess. But I admit the whole scenario suggests a degree of knowledge about the commodity cycle that only seasoned commodity traders would possess. And even though, we all know that past performance is no indication of future results.

The bottom line now is that the pessimism in the commodity complex could be reaching a climax. You may get burned by getting in early now. But if you look for solid balance sheets and under-priced assets, you’re willing to wait, and you have money you can afford to lose, it’s not exactly a bad time to be a resource speculator.

The Blood Moon and trouble in government debt ahead

Did you miss the Blood Moon the other night? I took a picture of it early in the night, slinking its way over Canary Wharf. It was before it got ‘bloody.’ The red colour, by the way, comes from the moon passing through the shadow cast by the Earth. Sunlight passing through the Earth’s atmosphere looks red as the atmosphere filters out other colours in the electromagnetic spectrum. My picture didn’t turn out too bad.

In a blog post earlier this week, analyst Toby Birch echoed some thoughts recently published by our own Tim Price. It involves the blood mood, government debt, and your UK stocks. He wrote:

[T]here is a case to be made for a flight from government paper….It is a gradual process of loss of confidence in governments themselves and by default in their flagship asset of sovereign debt. This is not a neat flight of funds overnight but an unwinding that would see money flow from public assets (government debt) to privately owned assets (stock markets, property and precious metals).

That would normally argue for a rotation out of bonds and into stocks. But it’s not as clear as it looks. The ‘transition’ will be rough and dangerous. Birch continues:

However it will likely not be a smooth transition but one where all asset classes initially decline leaving no bolt-hole. While gold may well represent the ultimate barometer of loss of faith one should never forget the power of government, particularly in the hunt for tax. Precious metals are a tiny percentage of the value of financial markets. Even a marginal switch from other investments would see their price soar. This would make it a tempting target for confiscation or at the very least restriction on their movement across borders. Any such move will be described as maintaining ‘financial stability’ when in reality it will be a failed attempt to protect the status quo.

Yes. That does sound like incipient Financial Martial Law

But in current UK conditions, you can’t remove it from the realm of possibility. According to Birch:

In spite of the oft-repeated mantra of austerity, UK debt levels have doubled since 2008. A rise in interest costs will not only crowd out the private sector but take away funds from those areas of the public sector that are desperately needed. As highlighted in Liam Halligan’s column in the Sunday Telegraph, the UK spends more on interest than it does on defence. Just as the undertones of war became tangible it leaves us in a very fragile state if bond yields rise and suck the liquidity out of markets and public finances.

And finally, about the moon:

With Shakespearean overtones of foreboding, this week also saw the rare appearance of a blood moon. Coincidence is not the same as correlation but it was interesting to note that the last time it appeared was in 1982. This marked a major trend reversal where bond markets changed tack and began their multi-decade rally. While investors in fixed income instruments have enjoyed an unprecedented bonanza, low interest rates have facilitated a spiral in debt. Should these long-term rates ascend it could trigger a scale of turmoil that makes 2008 seem tame.

You can say that again.

Category: Central Banks