You shouldn’t ignore genuine opportunities to make money.

Did you see that Microsoft sold $17 billion worth of bonds on Monday? The US tech giant is one of just two US corporates with an AAA credit rating (the other is Johnson & Johnson… with ExxonMobil having been downgraded last year thanks to the waning fortunes of petroleum). Microsoft borrowed nearly $20 billion last year to buy LinkedIn.

Borrowing before the bond bust?

There are a couple of interesting points about this. First, you have to wonder if this is a sign that interest rates really are heading up in 2017 and that further carnage in the bond market is imminent. The Federal Reserve says that it will raise rates (three times). And if it does, it raises corporate borrowing costs, which is why it makes sense for Microsoft to lock the low rates in now.

By the way, the company borrowed across a range of maturities, from three to 40 years. The interesting one, for me, is the ten-year bond. Microsoft’s ten-year bonds (issued yesterday) yield 3.3%. A ten-year US Treasury note, by contrast, yields just under 2.5% – that’s after rising from around 1.5% last year.

Here’s a pop quiz: which is the better credit risk over the next ten years? Is it Microsoft or the US government? If Donald Trump is taking a firefighter’s axe to the post-World War Two international order, then AAA-rated corporate borrowers with globalised income streams might very well be a better credit risk than a sovereign power with a $20 trillion deficit and a brewing social meltdown.

Agree? Disagree? Send your vote to [email protected].

Now back to the capital markets. Both US and European markets were off yesterday. The Dow Jones Industrial Average fell back below 20,000. It was a 122 point fall for the blue chip benchmark, which, to be fair, doesn’t really mean anything. That was a 0.61% fall on the day. A 100 point move in the Dow isn’t what it used to be.

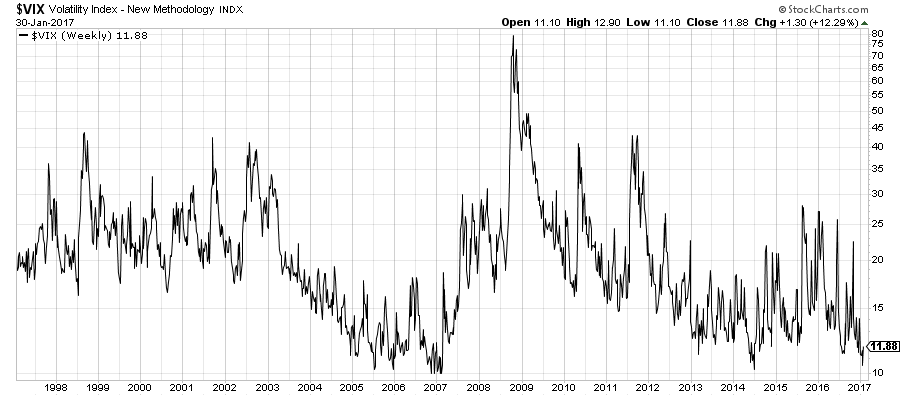

But here’s the real question in capital markets: has Trump’s erratic and fast-paced first week introduced so much uncertainty into the minds of investors that you’ll see a February sell-off? Before you answer that question please look closely at the chart below (especially if you’re a seismologist, volcanologist or a cardiovascular surgeon). What do you see? Look closely.

Source: www.stockcharts.com

The CBOE Volatility Index (VIX) hit an all-time closing low of 10.42 in January 2007. It erupted like Pompeii later in the year as the US sub-prime mortgage meltdown hit the investment banks. For the last ten years we’ve been stuck in this monetary no-man’s land of low rates and higher asset prices.

The VIX was up over 12% yesterday. It had hit an intra-day low of 10.33 before then. That was slightly above the intra-day low of 10.32 in July 2014. The obvious question: is a VIX-quake imminent?

I spoke to The Fleet Street Letter investment director Charlie Morris about it on the phone this morning. Charlie said the post-2008 VIX is different than the pre-2008 VIX. More specifically, Charlie says the VIX you see above may not be the best leading indicator of an imminent market sell-off. He said there’s another signal that’s more useful (it was complicated and I’ll have to write about it in a future issue, or have Charlie write about it in The Fleet Street Letter).

In the meantime, the market shrugged off everything Trump said he’d do about trade, immigration, China and Russia. Now that he’s actually doing those things, you may see less shrugging. And more selling.

Category: Economics